- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Did Strong Results and Cautious Outlook Just Shift Mondelez’s (MDLZ) Investment Narrative?

Reviewed by Sasha Jovanovic

- Mondelez International reported better than expected second-quarter results and maintained its guidance, but the company’s management signaled caution over U.S. demand trends and persistent cocoa market volatility.

- This mix of strong financials and prudent outlook comes after an earlier period of robust performance, setting higher expectations among market watchers.

- We'll explore how management's concerns about U.S. demand and cocoa price pressures could shape Mondelez International's investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Mondelez International Investment Narrative Recap

Shareholders in Mondelez International typically look for stable branded snacking demand, pricing power, and global expansion to support consistent returns. The latest update, with management’s caution around U.S. demand and persistent cocoa volatility, puts immediate focus on whether the company’s pricing strategies can offset cost headwinds, right now, the biggest catalyst remains pricing execution, while the biggest risk is sustained cocoa inflation and softened consumption in key markets. The net impact of the current news is material, given the weight on earnings and margin visibility.

Among recent company actions, Mondelez’s reaffirmed guidance for organic net revenue growth of over 4% stands out, directly relating to short-term catalysts. While management maintains confidence in pricing actions and revenue targets, external input costs and U.S. consumer trends remain critical watchpoints for the business’s operating momentum.

Yet, as optimism about global brand power meets the reality of raw material cost pressures, investors should stay alert to the risk that...

Read the full narrative on Mondelez International (it's free!)

Mondelez International's narrative projects $42.7 billion revenue and $4.7 billion earnings by 2028. This requires 4.8% yearly revenue growth and an earnings increase of $1.1 billion from the current earnings of $3.6 billion.

Uncover how Mondelez International's forecasts yield a $69.61 fair value, a 22% upside to its current price.

Exploring Other Perspectives

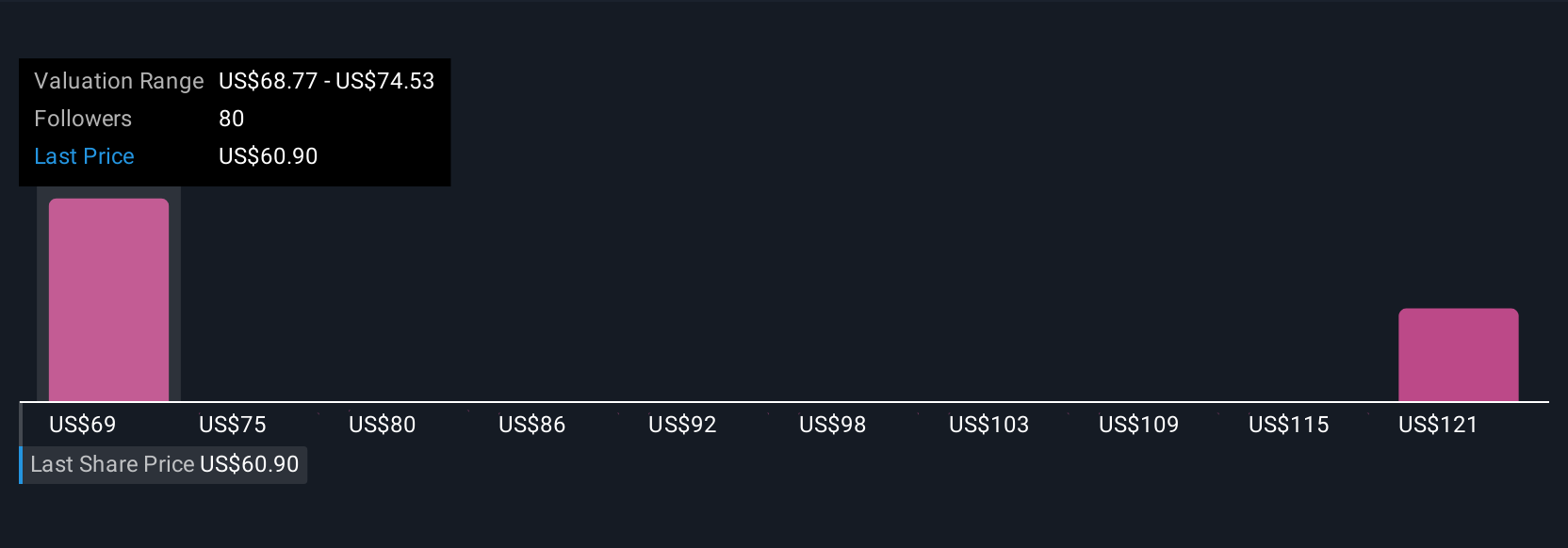

Simply Wall St Community members offered four fair value estimates for Mondelez, spanning US$69.35 to US$113.95. Their diverse views meet the present challenge posed by cocoa cost inflation, showing why it pays to compare several outlooks before making decisions.

Explore 4 other fair value estimates on Mondelez International - why the stock might be worth just $69.35!

Build Your Own Mondelez International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mondelez International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mondelez International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mondelez International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives