- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BZ

US Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a robust recovery, with major indices like the Dow and S&P 500 hitting new highs, investors are keenly watching for opportunities that align with current economic optimism. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 31.4% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Mama's Creations (NasdaqCM:MAMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mama's Creations, Inc., a company engaged in manufacturing and marketing fresh deli-prepared foods mainly in the United States, has a market capitalization of approximately $261.59 million.

Operations: The primary revenue segment for the company is food processing, generating $110.00 million.

Insider Ownership: 10.2%

Revenue Growth Forecast: 11.5% p.a.

Mama's Creations, recently added to multiple Russell Indexes, has demonstrated robust growth with a 60.7% increase in earnings over the past year and sales rising from US$93.19 million to US$103.28 million. Despite a recent dip in quarterly net income and EPS, annual figures show significant improvement. The company is expected to outpace the market with forecasted annual revenue growth at 11.5% and earnings growth at 31.23%. However, shareholder dilution has occurred over the past year, impacting value perceptions despite trading well below estimated fair value.

- Navigate through the intricacies of Mama's Creations with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Mama's Creations shares in the market.

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

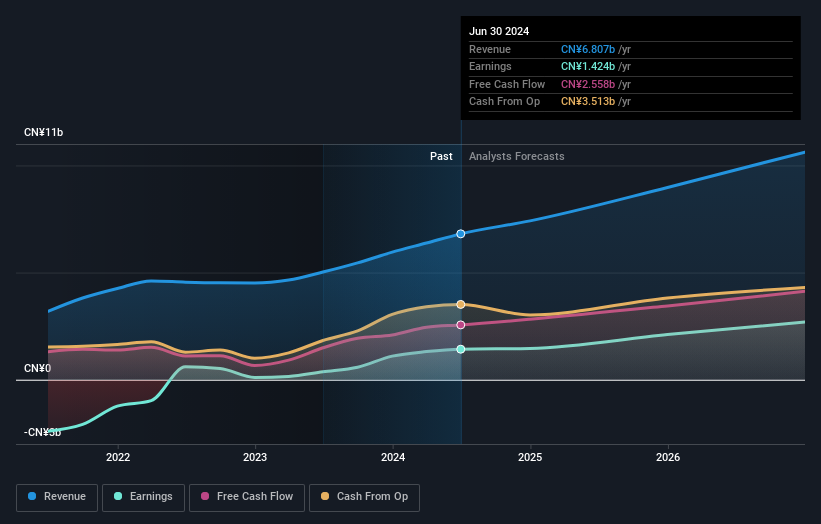

Overview: Kanzhun Limited operates an online recruitment platform in the People's Republic of China, with a market capitalization of approximately $8.36 billion.

Operations: The company generates revenue primarily through its internet information services, totaling CN¥6.38 billion.

Insider Ownership: 16.1%

Revenue Growth Forecast: 18.9% p.a.

Kanzhun, despite trading 41.8% below its estimated fair value, shows promising growth with earnings expected to increase significantly over the next three years. Annual profit is projected to outpace the US market average, with a robust 23.4% growth per year against a market trend of 14.8%. However, concerns arise as shareholder dilution occurred last year and return on equity is forecasted to be low at 18.5% in three years. Recent board changes and solid quarterly performance indicate active management and operational momentum.

- Click here and access our complete growth analysis report to understand the dynamics of Kanzhun.

- Our valuation report here indicates Kanzhun may be undervalued.

Transocean (NYSE:RIG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Transocean Ltd. operates globally, offering offshore contract drilling services for oil and gas wells, with a market capitalization of approximately $4.52 billion.

Operations: The company generates its revenue primarily through the provision of contract drilling services, amounting to $2.95 billion.

Insider Ownership: 10.7%

Revenue Growth Forecast: 13.6% p.a.

Transocean, recently added to multiple Russell indexes, is poised for notable growth with expected profitability within three years. Despite a forecasted revenue growth of 13.6% per year—surpassing the US market average—its return on equity remains low at 2.2%. The company's earnings have increased by 16.4% annually over the past five years, and it trades at a substantial discount of 65.3% below its estimated fair value, suggesting potential undervaluation despite recent shareholder dilution and extensive capital raising activities through shelf registrations and private placements.

- Delve into the full analysis future growth report here for a deeper understanding of Transocean.

- According our valuation report, there's an indication that Transocean's share price might be on the cheaper side.

Taking Advantage

- Click this link to deep-dive into the 179 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet with solid track record.