- United States

- /

- Food

- /

- NasdaqGS:KHC

Should Kraft Heinz's (KHC) Board Overhaul and Split Plan Prompt Action From Investors?

Reviewed by Sasha Jovanovic

- On October 22, 2025, The Kraft Heinz Company announced that L. Kevin Cox, Mary Lou Kelley, and Tony Palmer were appointed to its Board of Directors, bringing extensive expertise in human resources, e-commerce, and consumer packaged goods.

- This leadership refresh comes as Kraft Heinz undertakes a major transformation, including a planned split into two businesses aimed at driving growth and unlocking value.

- Now, we'll explore how the new board appointments and planned company separation could shape Kraft Heinz's future trajectory.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kraft Heinz Investment Narrative Recap

For shareholders, the core belief is that Kraft Heinz can unlock value through a successful split and drive margin improvement while mitigating ongoing declines in North America retail volumes. The board refresh adds depth in e-commerce, human resources, and global brands, but the main near-term catalyst remains the execution and outcome of the pending business separation. The biggest risk continues to be execution missteps that could lead to dis-synergies and increased costs; the latest board appointments do not materially alter this risk or its immediacy.

Among recent developments, the September announcement of Kraft Heinz’s plan to separate into two independent companies is most relevant, as it sets the stage for the new directors to influence critical decisions related to corporate structure, capital allocation, and market positioning. Their experience may help manage integration challenges and maximize the potential benefits of the planned split, but execution risks remain front and center for investors watching these changes unfold.

Yet, unlike catalysts that could offer uplift, investors should be especially alert to dis-synergies and higher costs if the split process faces...

Read the full narrative on Kraft Heinz (it's free!)

Kraft Heinz's narrative projects $26.1 billion in revenue and $3.3 billion in earnings by 2028. This requires 1.0% yearly revenue growth and a $8.6 billion increase in earnings from the current level of -$5.3 billion.

Uncover how Kraft Heinz's forecasts yield a $29.24 fair value, a 14% upside to its current price.

Exploring Other Perspectives

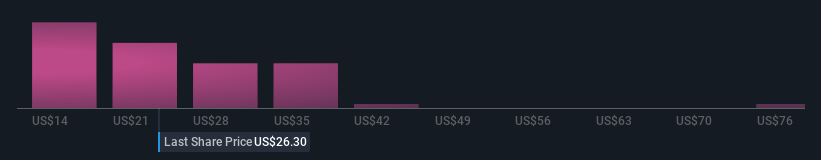

The Simply Wall St Community’s 21 fair value estimates for Kraft Heinz share price range widely, from US$23.95 to US$80.99. However, varying views on the risk of business separation disruption highlight how sharply opinions can differ among market participants.

Explore 21 other fair value estimates on Kraft Heinz - why the stock might be worth 6% less than the current price!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives