- United States

- /

- Food

- /

- NasdaqGS:KHC

Does Kraft Heinz's (KHC) Oscar Mayer EveryBun Pack Reflect a Sustainable Shift Toward Plant-Based Innovation?

Reviewed by Simply Wall St

- In August 2025, Kraft Heinz announced the launch of the Oscar Mayer EveryBun Pack, featuring both traditional and plant-based hot dogs, and unveiled a new set of HEINZ mayonnaise-style sauces with diverse flavors in Canada.

- These product additions are aimed at appealing to plant-based consumers and Canadians' diverse flavor preferences, reflecting Kraft Heinz's response to evolving dietary trends.

- We'll assess how Kraft Heinz's expanded plant-based offerings align with analyst expectations for innovation-driven revenue growth.

Find companies with promising cash flow potential yet trading below their fair value.

Kraft Heinz Investment Narrative Recap

To be a Kraft Heinz shareholder, you need to believe the company can reignite revenue and earnings growth through product innovation while reversing weak North American retail volumes. The recent launches of plant-based hot dogs and mayonnaise-style sauces represent efforts to address dietary trends, but their impact on immediate financial catalysts, like driving core volume growth, may be limited, given overall challenges with declining North American sales and continued brand impairment risks.

Among Kraft Heinz's latest moves, the Oscar Mayer EveryBun Pack directly targets evolving consumer preferences and offers an entry into the growing plant-based segment. While innovation can support the case for recovery, this push will be tested by the company's persistent volume declines and the need for more meaningful market penetration to offset existing revenue pressures.

However, before assuming new products are the turning point for Kraft Heinz, investors should remember the ongoing threat from weak core market performance, as...

Read the full narrative on Kraft Heinz (it's free!)

Kraft Heinz is projected to generate $26.1 billion in revenue and $3.5 billion in earnings by 2028. This outlook is based on an annual revenue decline of 1.0% and a $8.8 billion increase in earnings from the current level of -$5.3 billion.

Uncover how Kraft Heinz's forecasts yield a $30.29 fair value, a 8% upside to its current price.

Exploring Other Perspectives

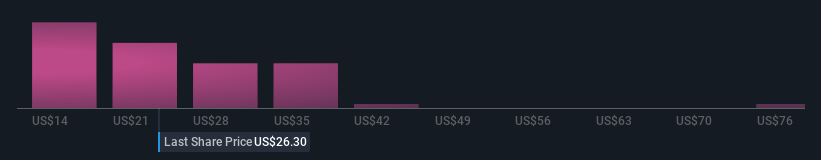

Private fair value estimates from 21 Simply Wall St Community members for Kraft Heinz vary significantly, from US$24.47 to US$81.86, reflecting a broad spectrum of opinions. With volume growth in North America still acting as a major hurdle for a turnaround, you can compare these perspectives to gauge the varied expectations for the company's progress.

Explore 21 other fair value estimates on Kraft Heinz - why the stock might be worth over 2x more than the current price!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives