- United States

- /

- Beverage

- /

- NasdaqGS:KDP

How Investors Are Reacting To Keurig Dr Pepper's (KDP) Split Plan

Reviewed by Sasha Jovanovic

- In recent weeks, Keurig Dr Pepper secured US$7 billion in backing from private equity firms Apollo and KKR to support its planned US$18 billion acquisition of JDE Peet’s, while announcing a future split into two US-listed entities, Beverage Co. and Global Coffee Co., by the end of 2026.

- Alongside these structural changes, the company reported strong third quarter financial results, raised its full-year outlook, reinforcing its competitive positioning.

- We’ll assess how management’s increased earnings guidance could shape Keurig Dr Pepper’s investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery . The best part - they are all under $10b in market cap - there's still time to get in early.

Keurig Dr Pepper Investment Narrative Recap

To own Keurig Dr Pepper, an investor needs conviction in the company's ability to execute a complex transformation, integrating the US$18 billion JDE Peet’s acquisition and successfully splitting into two public entities by 2026. The recent US$7 billion capital injection may boost near-term confidence, but the biggest short-term catalyst remains the integration of JDE Peet’s, while ongoing coffee segment headwinds and tariff-driven cost inflation are the main risks. The announced financing and leadership changes signal readiness for transformation, yet persistent inflation in green coffee and brewing equipment poses continued pressure on coffee profitability and could temper benefits from the acquisition if not managed.

Of the recent disclosures, the revised 2025 earnings guidance stands out, as management now expects high-single-digit net sales growth, up from a previous mid-single-digit outlook. This increased forecast closely ties to optimism around new business combinations and capital structure, giving investors a focal point for tracking integration progress and synergy realization.

On the other hand, investors should be aware that if commodity-driven inflation in the coffee segment continues, particularly with new tariffs in effect…

Read the full narrative on Keurig Dr Pepper (it's free!)

Keurig Dr Pepper's outlook forecasts $24.1 billion in revenue and $3.6 billion in earnings by 2028. This is based on an anticipated 15.2% annual revenue growth rate and an increase in earnings of $2.1 billion from current earnings of $1.5 billion.

Uncover how Keurig Dr Pepper's forecasts yield a $35.44 fair value , a 33% upside to its current price.

Exploring Other Perspectives

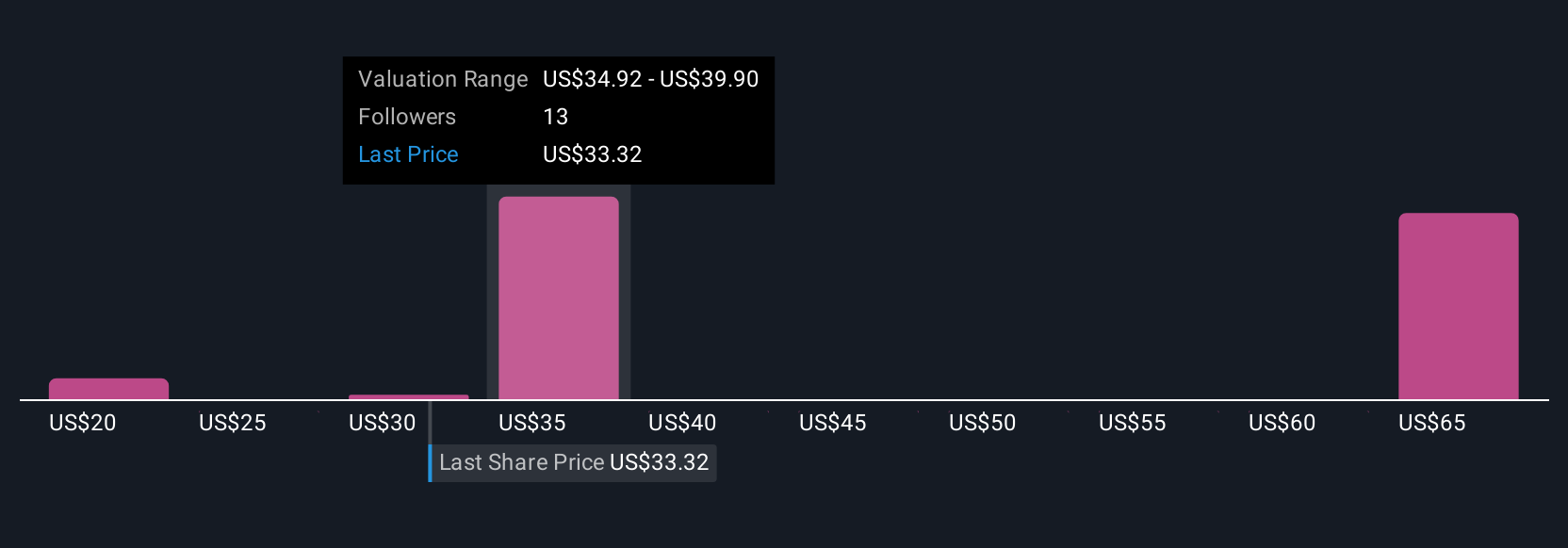

Eight independent fair value estimates from the Simply Wall St Community range widely between US$22.62 and US$64.87 per share. With such varied views, weighing them alongside the company’s raised net sales targets can help you better understand the full spectrum of outcomes.

Explore 8 other fair value estimates on Keurig Dr Pepper - why the stock might be worth over 2x more than the current price!

Build Your Own Keurig Dr Pepper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keurig Dr Pepper research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Keurig Dr Pepper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keurig Dr Pepper's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward .

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit .

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it . Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives