- United States

- /

- Food

- /

- NasdaqCM:JVA

Should We Be Cautious About Coffee Holding Co., Inc.'s (NASDAQ:JVA) ROE Of 5.5%?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). To keep the lesson grounded in practicality, we'll use ROE to better understand Coffee Holding Co., Inc. (NASDAQ:JVA).

Coffee Holding has a ROE of 5.5%, based on the last twelve months. One way to conceptualize this, is that for each $1 of shareholders' equity it has, the company made $0.055 in profit.

See our latest analysis for Coffee Holding

How Do I Calculate ROE?

The formula for ROE is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for Coffee Holding:

5.5% = US$943k ÷ US$26m (Based on the trailing twelve months to January 2019.)

It's easy to understand the 'net profit' part of that equation, but 'shareholders' equity' requires further explanation. It is the capital paid in by shareholders, plus any retained earnings. You can calculate shareholders' equity by subtracting the company's total liabilities from its total assets.

What Does ROE Signify?

Return on Equity measures a company's profitability against the profit it has kept for the business (plus any capital injections). The 'return' is the yearly profit. That means that the higher the ROE, the more profitable the company is. So, as a general rule, a high ROE is a good thing. That means ROE can be used to compare two businesses.

Does Coffee Holding Have A Good ROE?

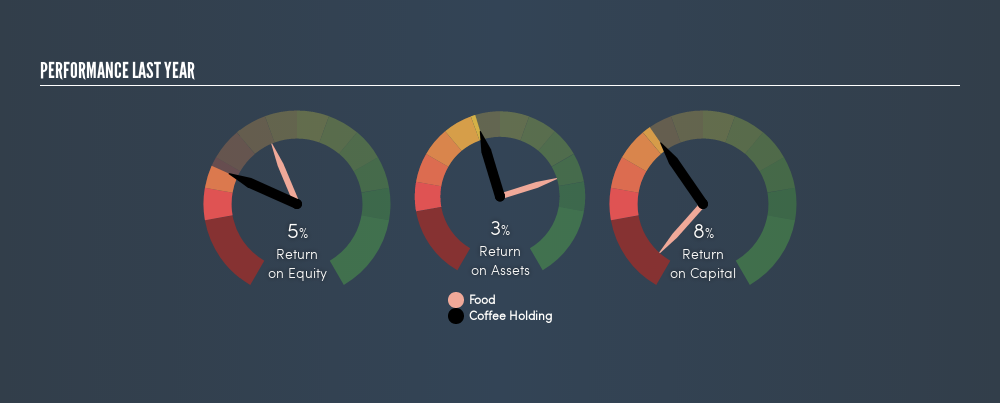

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. If you look at the image below, you can see Coffee Holding has a lower ROE than the average (12%) in the Food industry classification.

Unfortunately, that's sub-optimal. It is better when the ROE is above industry average, but a low one doesn't necessarily mean the business is overpriced. Nonetheless, it might be wise to check if insiders have been selling.

How Does Debt Impact ROE?

Most companies need money -- from somewhere -- to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining Coffee Holding's Debt And Its 5.5% Return On Equity

Coffee Holding has a debt to equity ratio of 0.22, which is far from excessive. Although the ROE isn't overly impressive, the debt load is modest, suggesting the business has potential. Conservative use of debt to boost returns is usually a good move for shareholders, though it does leave the company more exposed to interest rate rises.

The Bottom Line On ROE

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. Companies that can achieve high returns on equity without too much debt are generally of good quality. If two companies have the same ROE, then I would generally prefer the one with less debt.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to check this FREE visualization of analyst forecasts for the company.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss thisfree list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:JVA

Coffee Holding

Engages in manufacturing, roasting, packaging, marketing, and distributing roasted and blended coffees in the United States, Australia, Canada, England, and China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives