- United States

- /

- Food

- /

- NasdaqGS:HAIN

Those Who Purchased Hain Celestial Group (NASDAQ:HAIN) Shares Three Years Ago Have A 52% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The Hain Celestial Group, Inc. (NASDAQ:HAIN) shareholders will doubtless be very grateful to see the share price up 33% in the last quarter. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 52% in that time. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

View our latest analysis for Hain Celestial Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

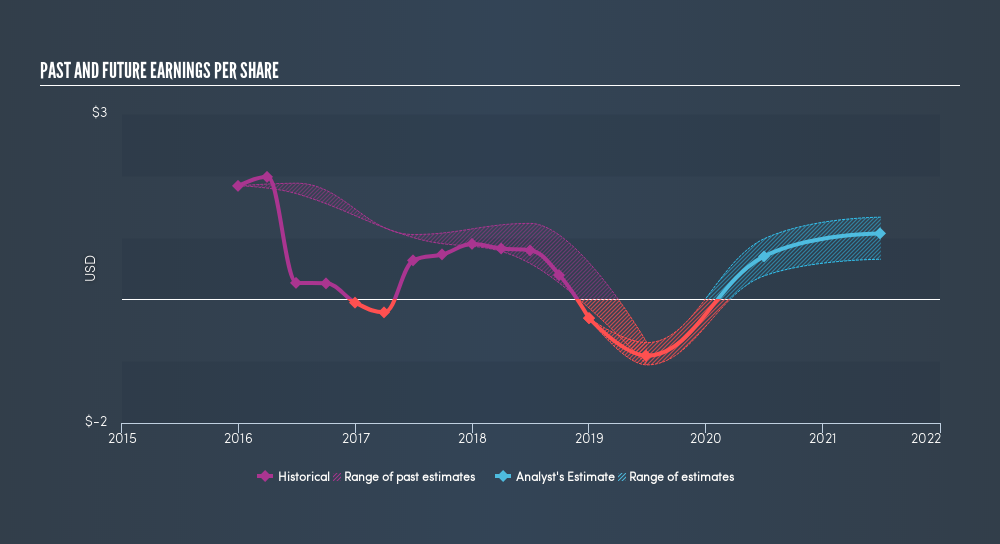

Hain Celestial Group saw its share price decline over the three years in which its EPS also dropped, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Hain Celestial Group's earnings, revenue and cash flow.

A Different Perspective

Hain Celestial Group shareholders are down 14% for the year, but the market itself is up 8.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:HAIN

Hain Celestial Group

Manufactures, markets, and sells organic and natural products in United States, United Kingdom, Europe, and internationally.

Undervalued very low.

Similar Companies

Market Insights

Community Narratives