- United States

- /

- Food

- /

- NasdaqGM:FRPT

Is Freshpet’s Recent Retail Expansion Enough to Justify the Stock’s 4% Price Rise?

Reviewed by Bailey Pemberton

- Wondering if Freshpet is a hidden gem or just another overhyped story? You are not alone, especially if you are trying to figure out whether the recent price is justified.

- Freshpet's stock price has climbed 4.1% in the last week and 4.7% over the past month. However, the year-to-date and one-year returns remain deeply negative at -61.2% and -63.0% respectively.

- Investors have been reacting to increased demand in the natural pet food category and recent management changes, both of which add excitement and uncertainty. Headlines about expansion into new retail partnerships have also brought Freshpet into the spotlight, fueling debates over its long-term growth prospects.

- On our valuation checks, Freshpet scores just 2 out of 6 for being undervalued. This indicates potential risks or missed upside. Next, we will explore various ways to value Freshpet, so keep reading for a perspective that could help you move beyond the numbers.

Freshpet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Freshpet Discounted Cash Flow (DCF) Analysis

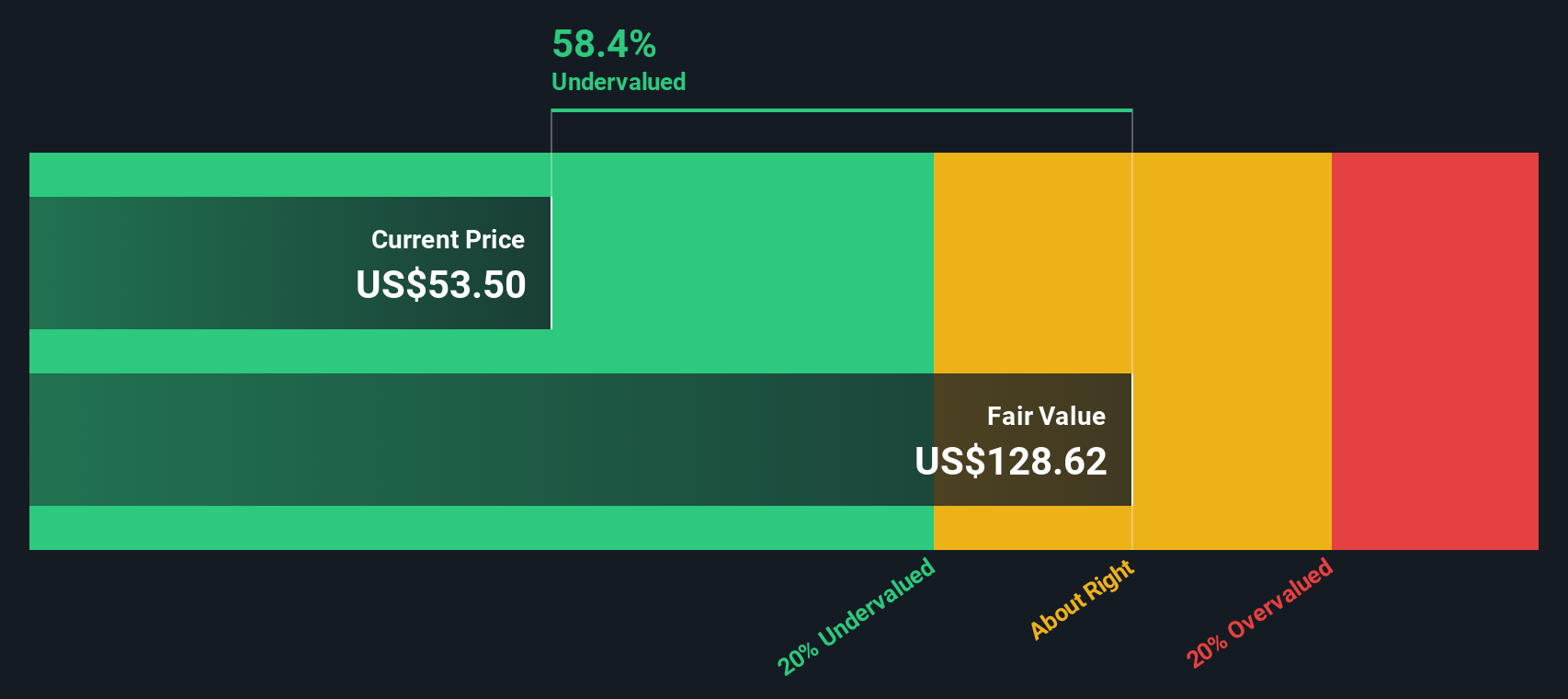

The Discounted Cash Flow (DCF) model estimates the present value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach provides an intrinsic value based on actual and forecasted Free Cash Flow (FCF), giving investors a grounded sense of what the business is worth.

For Freshpet, current Free Cash Flow stands at -$75.5 million. Analysts have made specific forecasts for the next few years, projecting FCF to rise to $35.6 million by 2026 and further to $153 million by the end of 2029. Beyond these years, estimates are extrapolated and show steady FCF growth through at least 2035. All projections are presented in US dollars, the company's reporting currency.

Factoring in these expectations, the DCF model calculates Freshpet’s fair value at $88.20 per share. Compared to the current price, this indicates the stock is trading at a 36.5% discount and suggests it is undervalued by a significant margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freshpet is undervalued by 36.5%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

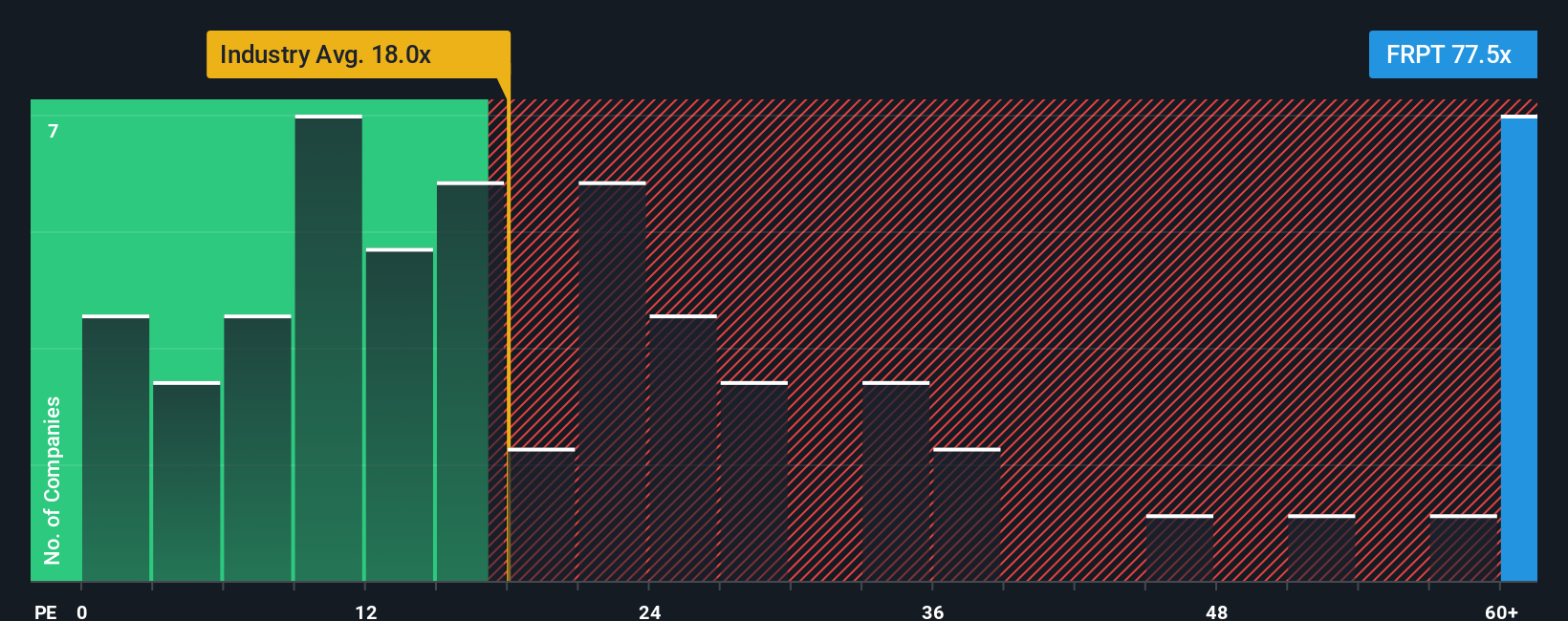

Approach 2: Freshpet Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it directly compares a company’s stock price to its earnings, giving investors a quick way to gauge how much the market is willing to pay for each dollar of profit. For growth-oriented businesses like Freshpet, the “right” PE ratio can vary significantly. Faster growth and lower risk generally justify a higher PE multiple, while slower growth or higher risk will typically call for a lower ratio.

Freshpet’s current PE ratio stands at 22.2x. For context, the average PE ratio across the Food industry is 17.7x and Freshpet’s peers average 22.1x. This means Freshpet is trading roughly in line with peers, but at a premium to the broader industry average. However, simple comparisons to industries or peers may overlook important company-specific factors, such as unique growth potential or risk profile.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Freshpet’s Fair Ratio is 16.2x, which accounts for its earnings growth, risk, profit margins, industry dynamics, and overall market capitalization. The Fair Ratio refines the valuation process by offering a tailored benchmark rooted in a fuller picture of the company’s prospects and challenges, rather than relying only on broad averages.

When comparing Freshpet’s actual PE ratio to its Fair Ratio, the valuation lands slightly above that “fair” benchmark. The difference is larger than 0.10, suggesting the stock is currently valued at a premium, which may imply limited upside unless earnings growth accelerates.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

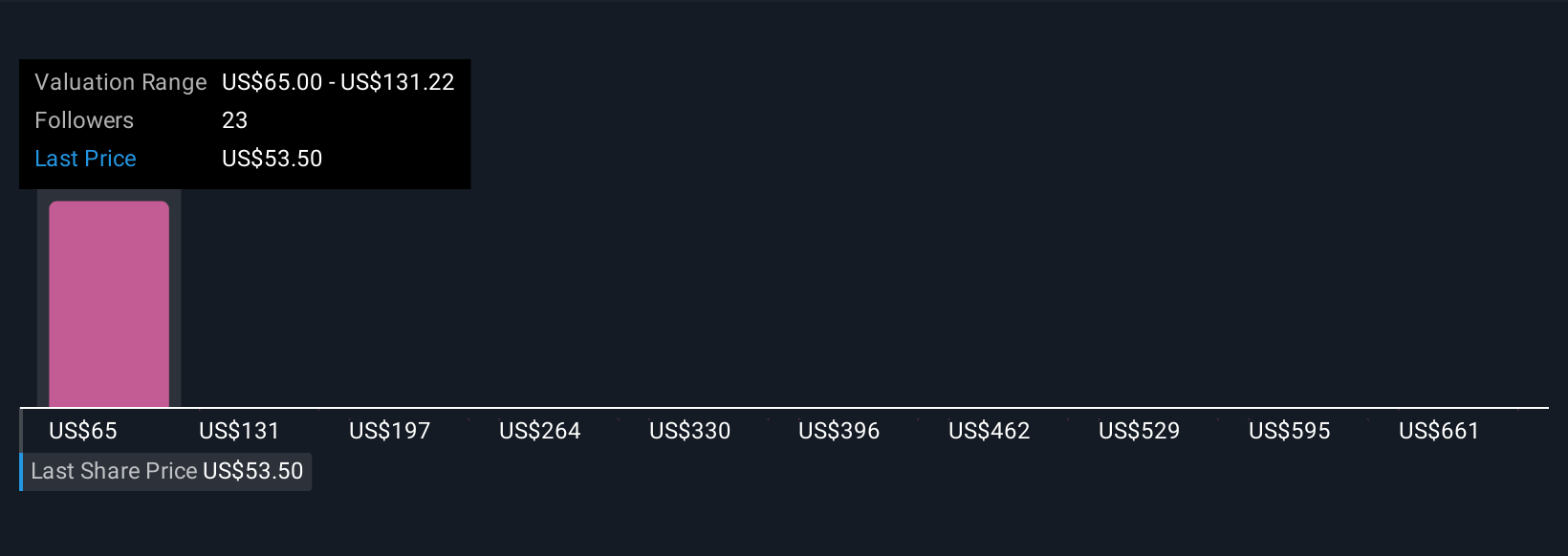

Upgrade Your Decision Making: Choose your Freshpet Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your perspective on a company, a story built around your assumptions for Freshpet's future, such as what you believe about its revenue growth, earnings, and profit margins. This story then connects to a financial forecast and an estimated fair value.

Narratives make investing easier by letting you test your outlook and see how that story translates into numbers. This tool, available on the Simply Wall St Community page, empowers millions of investors to compare their fair value directly against the current share price, helping them decide when to buy or sell with greater confidence.

The real power of Narratives lies in their dynamic updates. Anytime new information comes in, like news or earnings releases, your Narrative and fair value adjust in real time. For example, with Freshpet, some investors are bullish and set their fair value near the $116 high analyst target, believing operational improvements will drive long-term earnings. Others are more cautious, landing closer to the $48 low due to competition and slowing growth concerns. This way, you can see how different viewpoints shape investment decisions instantly.

Do you think there's more to the story for Freshpet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives