- United States

- /

- Food

- /

- NasdaqGM:FRPT

How Investors May Respond To Freshpet (FRPT) Trimming 2025 Sales Guidance Despite Strong Q3 Results

Reviewed by Sasha Jovanovic

- Freshpet recently revised its 2025 annual guidance, stating it now expects net sales growth of approximately 13%, down from the previous range of 13% to 16%, and reported strong third-quarter results with US$288.85 million in sales and a significant increase in net income to US$101.66 million.

- The company’s shift toward the lower end of its sales guidance, alongside ongoing margin gains, may indicate evolving industry trends and operational factors impacting its growth expectations.

- With Freshpet now projecting annual net sales at the lower end of its previous estimate, we’ll examine how this guidance adjustment may influence its investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Freshpet Investment Narrative Recap

To be a shareholder in Freshpet, you must believe in the continued shift toward premium, fresh pet foods and the company’s ability to expand household penetration despite slowing growth in the overall pet category. While Freshpet’s adjustment to the lower end of its 2025 sales guidance reflects industry headwinds, it does not materially alter the most important short-term catalyst: ongoing margin expansion through operational efficiencies. However, risks around long-term category growth and consumer willingness to pay remain prominent.

The most relevant recent announcement is Freshpet’s third-quarter earnings report, which showed significant increases in both revenue and net income versus the prior year. These strong results highlight Freshpet’s recent ability to expand margins and grow market share, even as it moderates its near-term sales outlook. The interplay between cost discipline and slower category growth is front and center for investors tracking Freshpet’s progress.

In contrast, investors should pay close attention to how persistent category softness and new competitive pressures could challenge Freshpet’s revenue trajectory over the next few quarters...

Read the full narrative on Freshpet (it's free!)

Freshpet's outlook suggests $1.5 billion in revenue and $137.7 million in earnings by 2028. This scenario is based on annual revenue growth of 13.7% and an increase in earnings of $104 million from current earnings of $33.7 million.

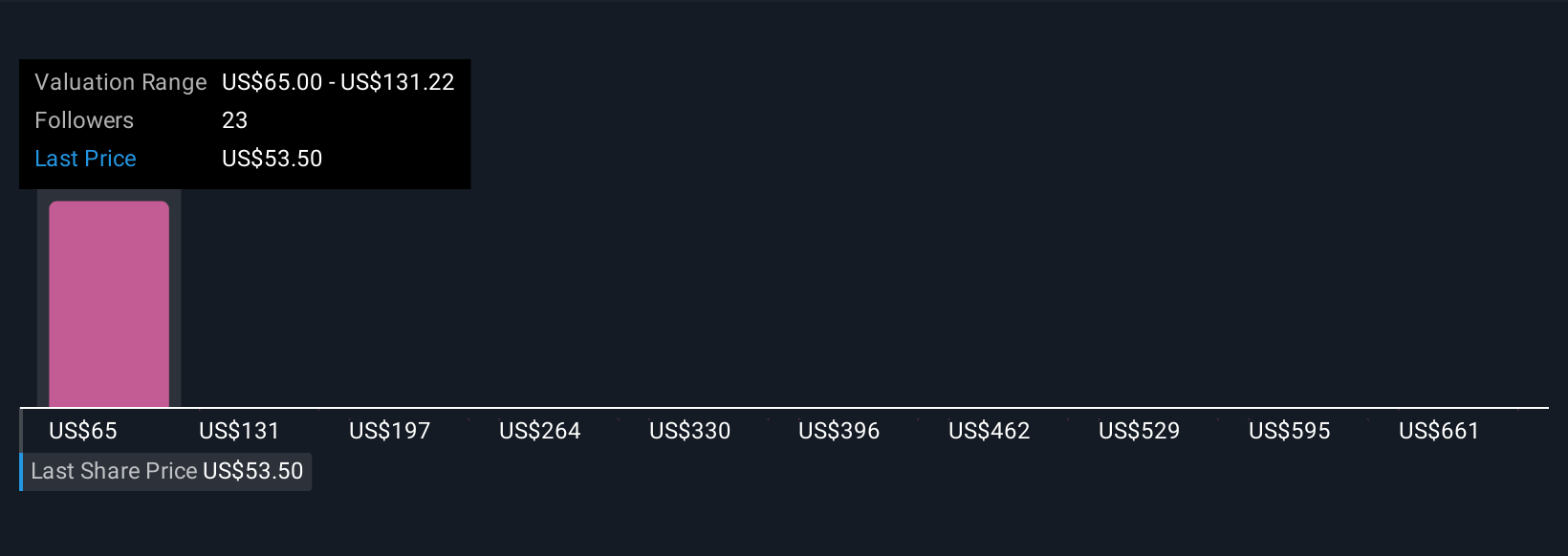

Uncover how Freshpet's forecasts yield a $76.06 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$76.06 to US$727.18 per share. With category growth now a key risk, you may want to review the wide spectrum of investor assumptions driving these opinions and explore several alternative viewpoints on Freshpet’s future.

Explore 5 other fair value estimates on Freshpet - why the stock might be worth just $76.06!

Build Your Own Freshpet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshpet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshpet's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives