- United States

- /

- Food

- /

- NasdaqGM:FRPT

Freshpet (FRPT) Valuation: Exploring Analyst Targets After Recent Share Price Weakness

Reviewed by Simply Wall St

Freshpet (FRPT) has seen its stock under pressure recently following a string of disappointing returns over the past month and three months. Investors are keeping a close eye on the company’s performance as questions about growth and profitability come into focus.

See our latest analysis for Freshpet.

After a rough year that has seen Freshpet’s share price slide more than 65% and deliver a one-year total shareholder return of -67%, recent weakness reflects fading momentum and investor caution. Some of this pressure can be tied to shifting expectations around growth and profitability, but it also highlights just how much sentiment has cooled compared to prior years.

If you're looking to expand beyond household names or rebound stories, now could be the right moment to discover fast growing stocks with high insider ownership

With shares still well below previous highs and the company showing signs of improved profitability along with significant analyst upside targets, the question remains: is Freshpet now undervalued, or is the market already factoring in its future growth prospects?

Most Popular Narrative: 35% Undervalued

With Freshpet's fair value pegged at $76.06 in the most popular narrative, and the stock closing most recently at $49.21, there is a wide gap between prevailing analyst assumptions and current market sentiment. The stage is set for a deeper look at what could justify this disconnect.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput. This has led to a significant reduction in CapEx ($100 million less over 2025-26) and enhanced gross and EBITDA margins, setting the business up for improving net earnings and cash generation.

What is driving Freshpet’s punchy fair value? Underneath it all are future earnings growth expectations and bolder profit margins than many would guess. The math behind this price is anything but ordinary. Want a peek at which financial levers analysts are truly betting on?

Result: Fair Value of $76.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing pet adoption rates and intensifying competition from major brands could quickly undermine Freshpet’s bullish thesis if category growth does not rebound.

Find out about the key risks to this Freshpet narrative.

Another View: Stretching the Limits?

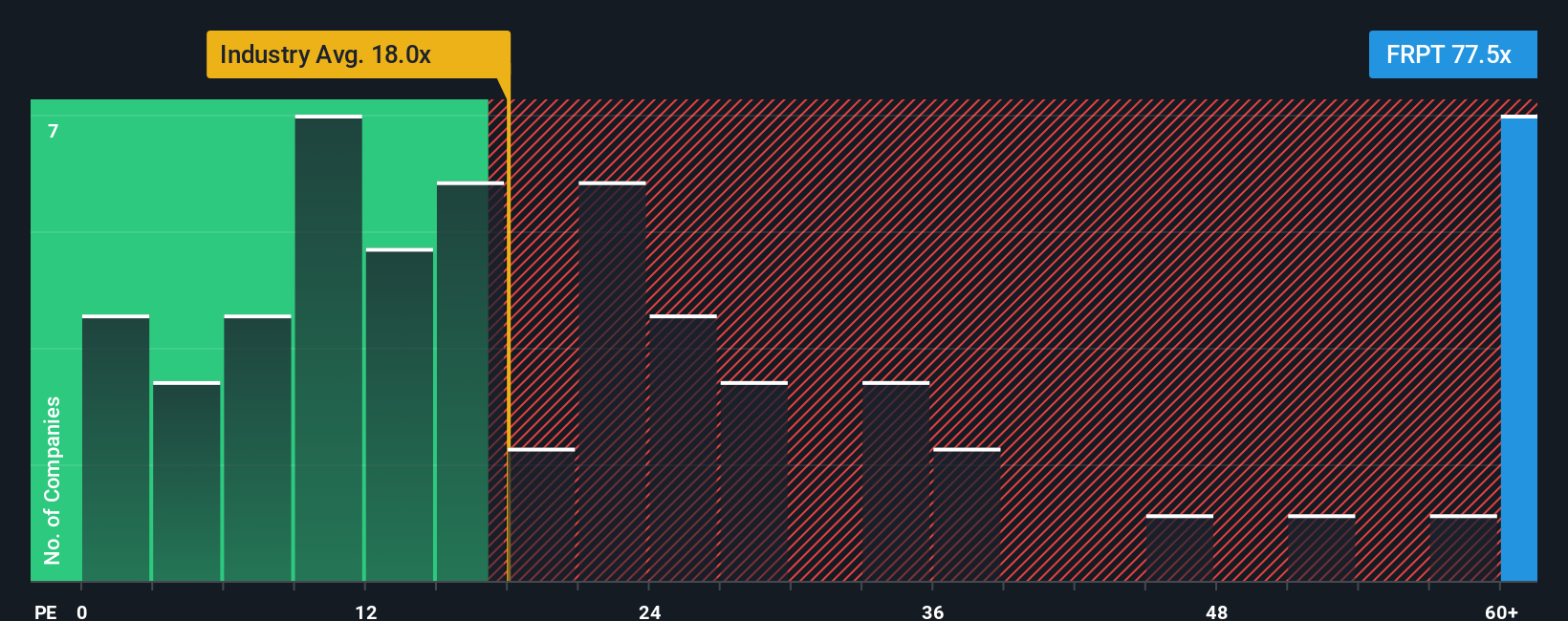

While Freshpet may look undervalued on a fair value basis, a closer look at its price-to-earnings ratio tells a different story. The company’s ratio sits at 71.3x, dramatically higher than the peer average of 21.8x and the fair ratio of 28.2x. This hefty premium signals investor optimism but also heightens valuation risk. Could the market reprice if Freshpet stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

If you want to challenge the consensus or build a case from your own research, it's easy to dive in and craft your personal perspective in just a few minutes. Do it your way

A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. Use the Simply Wall Street Screener to easily find stocks that match your strategy and put your portfolio ahead of the curve.

- Tap into fast-rising companies shaping tomorrow’s AI landscape with these 27 AI penny stocks, which are breaking boundaries in artificial intelligence innovation.

- Capture steady growth potential by checking out these 20 dividend stocks with yields > 3%, ideal for those seeking strong yields and resilient business models for consistent returns.

- Stay at the forefront of technology and invest in the next leap by reviewing these 28 quantum computing stocks, driving advancements in quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives