- United States

- /

- Beverage

- /

- NasdaqGS:FIZZ

Does National Beverage (NASDAQ:FIZZ) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like National Beverage (NASDAQ:FIZZ), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for National Beverage

How Fast Is National Beverage Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. National Beverage boosted its trailing twelve month EPS from US$1.57 to US$1.89, in the last year. That's a 21% gain; respectable growth in the broader scheme of things.

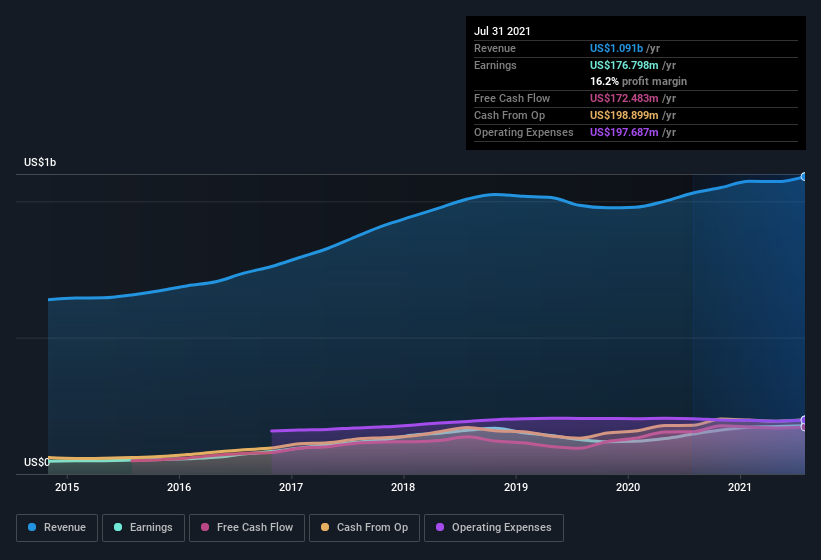

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). National Beverage shareholders can take confidence from the fact that EBIT margins are up from 18% to 21%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of National Beverage's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are National Beverage Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$5.1b company like National Beverage. But we are reassured by the fact they have invested in the company. Notably, they have an enormous stake in the company, worth US$181m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is National Beverage Worth Keeping An Eye On?

One positive for National Beverage is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of National Beverage.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Beverage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:FIZZ

National Beverage

Through its subsidiaries, develops, produces, markets, and sells a portfolio of sparkling waters, juices, energy drinks, and carbonated soft drinks in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives