- United States

- /

- Food

- /

- NasdaqGS:CPB

Does Campbell’s Recent Product Streamline Make Shares Attractive After a 32% Drop?

Reviewed by Bailey Pemberton

- Curious about whether Campbell's is a bargain or just looks cheap on the surface? Let’s break down what’s really going on with this classic name in the food aisle.

- Campbell's shares have seen a rocky ride, down 3.8% over the past month and off by 32.0% in the last year. This has sparked fresh questions about its growth prospects and risk profile.

- Recently, headlines have focused on Campbell's ongoing efforts to streamline its product lineup and respond to shifting consumer preferences, keeping the company in the spotlight. Notable news includes strategic moves to modernize its brand and announced partnerships aimed at long-term stability.

- When it comes to how undervalued the stock is, Campbell's scores a 4 out of 6 across our valuation checks. Traditional metrics are only part of the story. Ahead, we will dig into multiple valuation angles and reveal a smarter way to gauge true value by the end of our deep dive.

Find out why Campbell's's -32.0% return over the last year is lagging behind its peers.

Approach 1: Campbell's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those cash flows back to today's value. This approach provides a clear sense of what Campbell's could be worth based on its actual ability to generate cash.

For Campbell's, the latest reported Free Cash Flow stands at $670.7 million. Analyst forecasts suggest a moderate annual growth in these cash flows, projecting them to reach as high as $913.9 million by 2035. It is important to note that while analysts provide detailed estimates for the next five years, longer-term projections are carefully extrapolated using recent trends and reasonable assumptions.

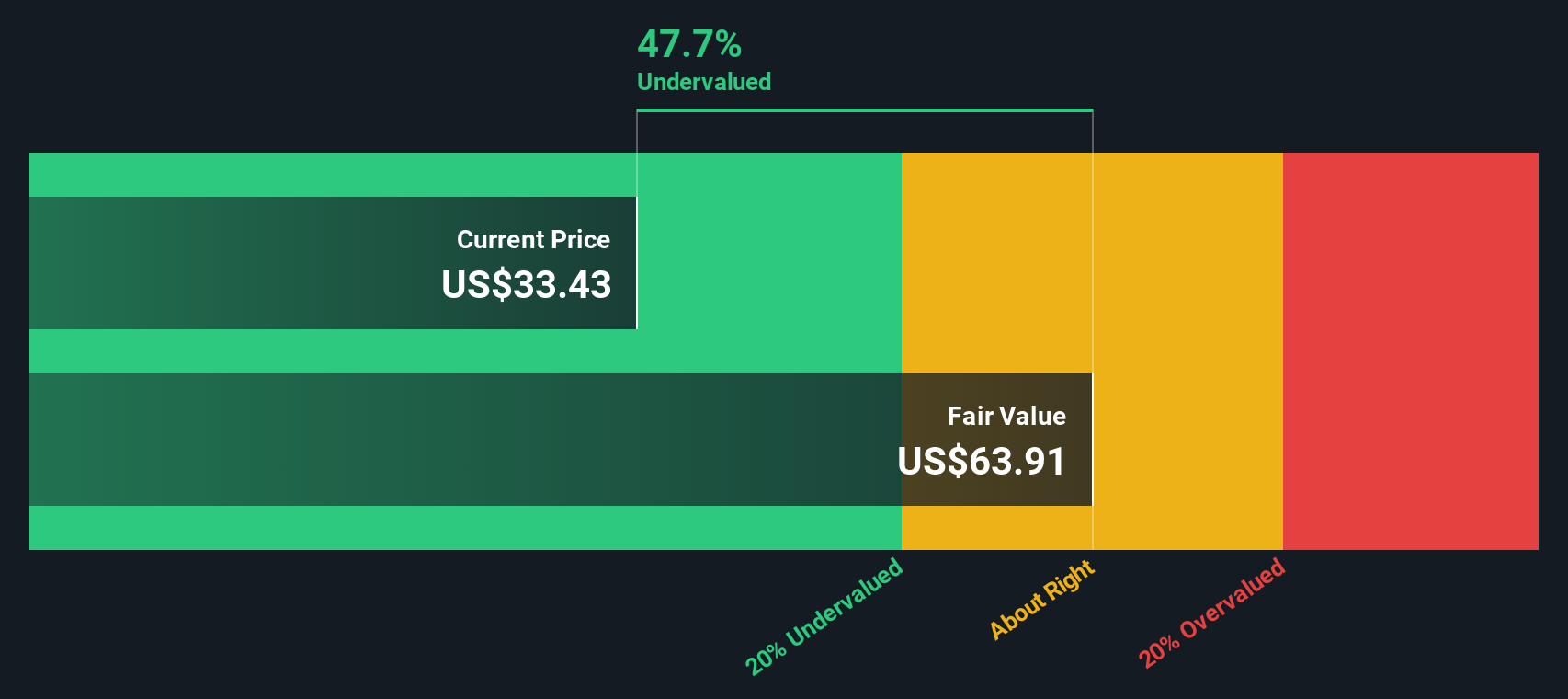

According to the DCF model used here, Campbell's fair value comes out to $63.97 per share. Compared with its current market price, this reflects a significant intrinsic discount of 52.9%, indicating the stock may be considerably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Campbell's is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Campbell's Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred metric for valuing established, profitable companies like Campbell's. This ratio offers a straightforward way to relate a company's stock price to its earnings, which is especially useful when those earnings are steady and positive year over year.

Growth expectations and risk both play an important role in what constitutes a “normal” or “fair” PE ratio for a company. Faster-growing companies or those with more stable earnings typically command higher PE ratios. On the other hand, additional risks or slower growth tend to result in lower multiples.

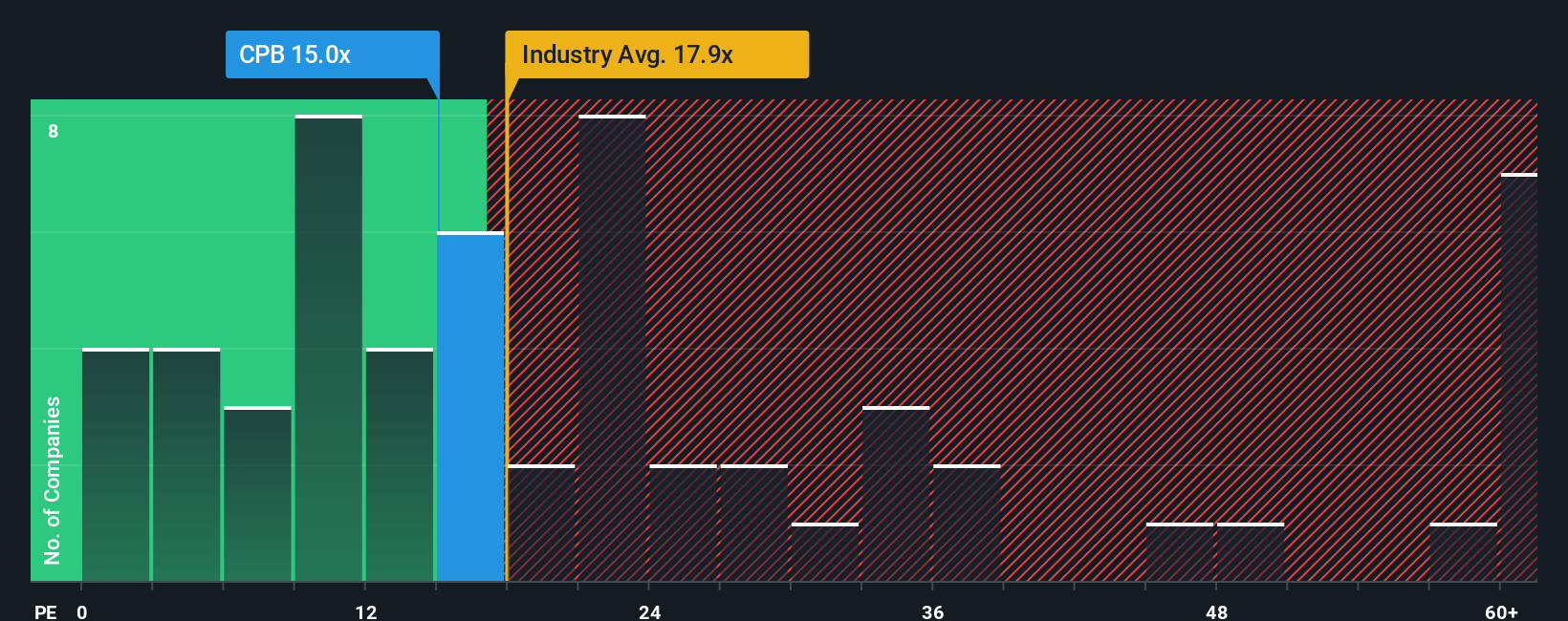

Campbell's is currently trading at a PE ratio of 14.9x. To put that in context, this is slightly above the average among similar peers, which sits at 14.1x, but below the broader food industry’s PE average of 17.8x. On the surface, Campbell’s trades at a modest discount to the typical industry peer group.

Simply Wall St's proprietary “Fair Ratio” for Campbell's is 17.9x. This number is tailored specifically for Campbell’s characteristics and outlook, taking into account its projected earnings growth, profit margins, risk profile, market cap, and industry landscape. Unlike standard peer or industry comparisons, the Fair Ratio adjusts for the nuances that may make Campbell’s more or less attractive to investors.

Given that Campbell’s current PE ratio is meaningfully below the calculated Fair Ratio, the stock appears undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Campbell's Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives, a smarter and more dynamic approach available right on Simply Wall St's Community page and used by millions of investors worldwide.

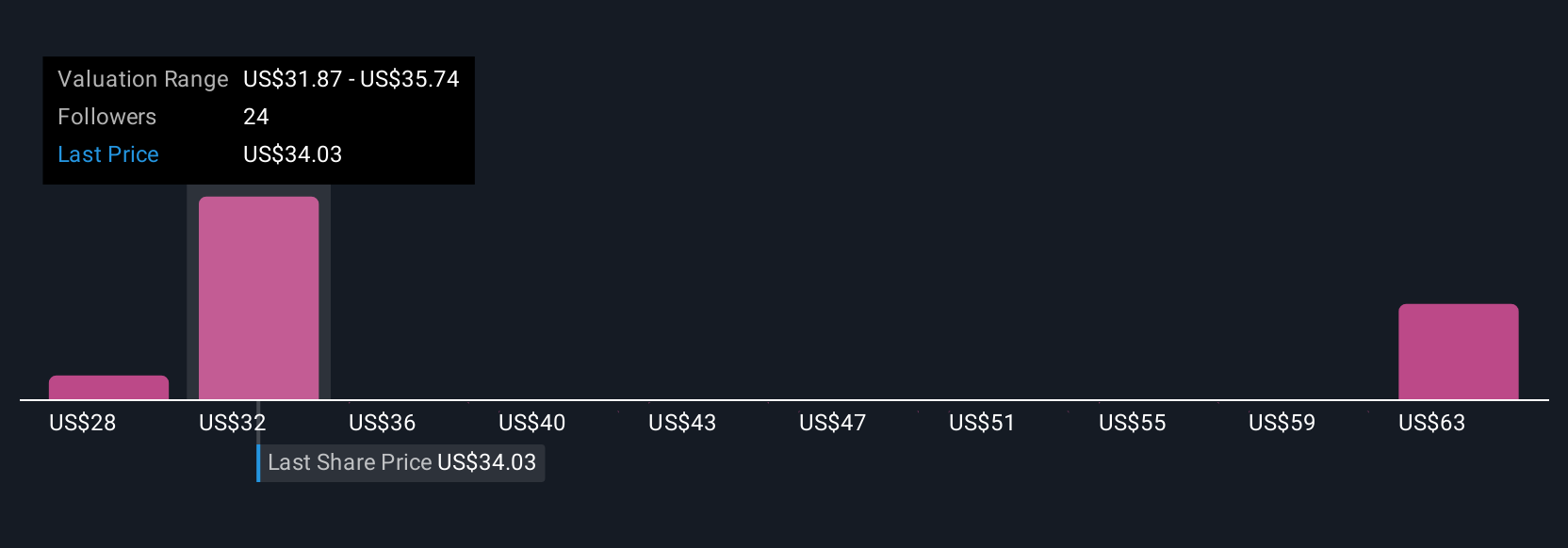

A Narrative is simply your perspective on a company’s future, combining your assumptions about Campbell’s growth, earnings, and margins into a story that connects directly to a fair value estimate. Instead of relying solely on static numbers or consensus targets, Narratives empower you to tie your view of Campbell’s evolving story—whether you think it will thrive on innovation or struggle with changing food trends—to your own financial projections and resulting fair value.

This makes the process accessible for any investor, helping you decide when to buy or sell by comparing your fair value with the current price and ensuring your outlook is always up-to-date as news, earnings, or business conditions change.

For example, one investor might believe Campbell’s premium snacks and cost savings will drive future earnings far higher. This could justify a fair value near $62. Another investor might focus on challenges from health trends and see a fair value closer to $29. Both can clearly compare their view to today's share price, update their Narrative anytime, and invest with confidence.

Do you think there's more to the story for Campbell's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives