- United States

- /

- Food

- /

- NasdaqGS:CPB

A Fresh Look at Campbell's (CPB) Valuation as Investors Reassess the Food Producer

Reviewed by Simply Wall St

Campbell's (CPB) shares are grappling with recent performance trends, catching the attention of investors interested in staple food producers. Following a stretch of declining returns, many are taking a fresh look at where the stock stands now.

See our latest analysis for Campbell's.

Over the past year, Campbell’s share price return has trended steadily downward. A total shareholder return of -27.6% suggests that sentiment has faded even as staple stocks usually shine in uncertain times. Short-term momentum remains weak, indicating many investors are still on the sidelines while the market reassesses food producers’ growth prospects and risk factors.

If you’re searching for new opportunities beyond the food sector, now is the perfect time to expand your scope and discover fast growing stocks with high insider ownership

With shares trading well below analysts’ targets and a sizable intrinsic discount, the big question is whether Campbell’s fundamentals signal an undervalued opportunity, or if the market already reflects the company’s current and future prospects.

Most Popular Narrative: 10.9% Undervalued

Compared to Campbell's last close at $30.80, the most widely followed narrative assigns a fair value much higher, signaling a potential value gap that investors can't ignore.

Ongoing execution of expanded cost savings initiatives and supply chain optimization, including the newly raised $375 million target, should progressively improve operational efficiency, bolster net margins, and generate incremental earnings growth over the next several years.

Curious what powers this valuation? The narrative leans on ambitious cost controls, margin gains, and a future earnings target that could surprise even seasoned food stock investors. There is more behind this number than just groceries. Read on to see which forecasts really drive the “undervalued” thesis.

Result: Fair Value of $34.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and slowing demand for traditional products remain key risks that could derail this optimistic outlook.

Find out about the key risks to this Campbell's narrative.

Another View: Multiples Valuation Sends Mixed Signals

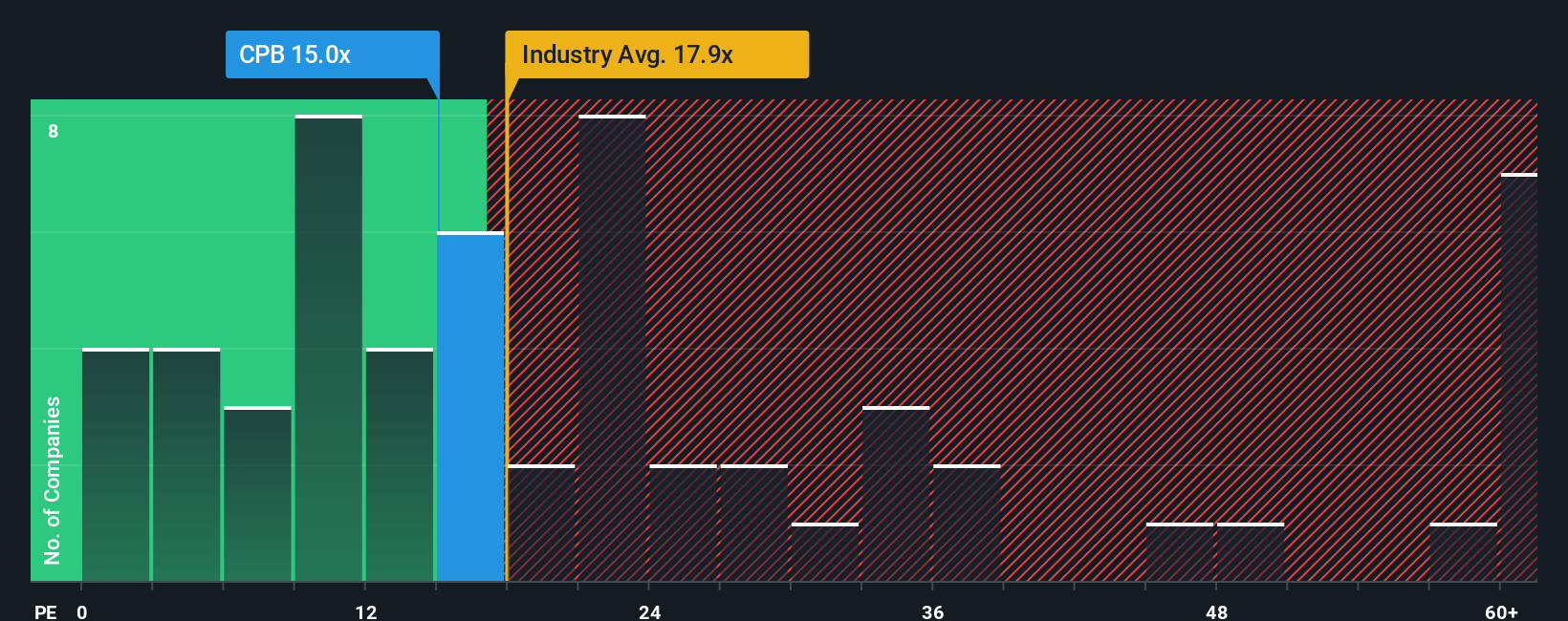

Looking at Campbell's through a price-to-earnings lens, the stock trades at 15.2 times earnings, higher than its peer group average of 13.3 but below the broader US Food sector's 19.4. While it's cheaper than the industry, the premium over peers suggests investors need to weigh both optimism and risk. Does this higher multiple signal resilience or simply leave less upside for value-focused buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Campbell's Narrative

Don't see the story the same way, or want to dig into the numbers yourself? In just a few minutes, you can craft your own view and put your research to work. Do it your way

A great starting point for your Campbell's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Use the Simply Wall Street Screener to uncover smart ideas that can fuel your investing strategy and build your edge today.

- Tap into powerful growth stories by searching for undervalued picks with robust cash flow through these 923 undervalued stocks based on cash flows.

- Benefit from reliable income by targeting options with strong yields using these 16 dividend stocks with yields > 3%.

- Advance your portfolio with potential trailblazers in artificial intelligence using these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives