- United States

- /

- Beverage

- /

- NasdaqGS:COKE

Strong Q3 Results and Capital Returns Might Change the Case for Investing in Coca-Cola Consolidated (COKE)

Reviewed by Sasha Jovanovic

- Coca-Cola Consolidated, Inc. reported strong third-quarter 2025 results, with net sales rising to US$1.89 billion and net income reaching US$142.33 million, both up from the prior year.

- Alongside improved operating margins, the company completed a sizeable share repurchase program and continued returning significant capital to shareholders through buybacks and dividends.

- We’ll examine how the company’s earnings growth and capital return initiatives shape its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Coca-Cola Consolidated's Investment Narrative?

For me, the Coca-Cola Consolidated investment thesis often comes down to believing in its capacity for steady cash generation and disciplined capital returns, even as the company navigates shifting consumer trends and competitive pressures. The latest third-quarter results gave shareholders some reassurance: strong sales growth, healthier operating margins, and continued buybacks combined with dividends all point to a company in control of its immediate financial levers. The recent surge in share buybacks could act as a short-term catalyst by supporting share price and signaling management’s confidence. Meanwhile, the success of these actions may offset some concern around executive transitions, even though leadership changes remain a wild card in coming quarters. For now, the new financials affirm stability, with risks around margin pressure and leadership transitions still lingering under the surface.

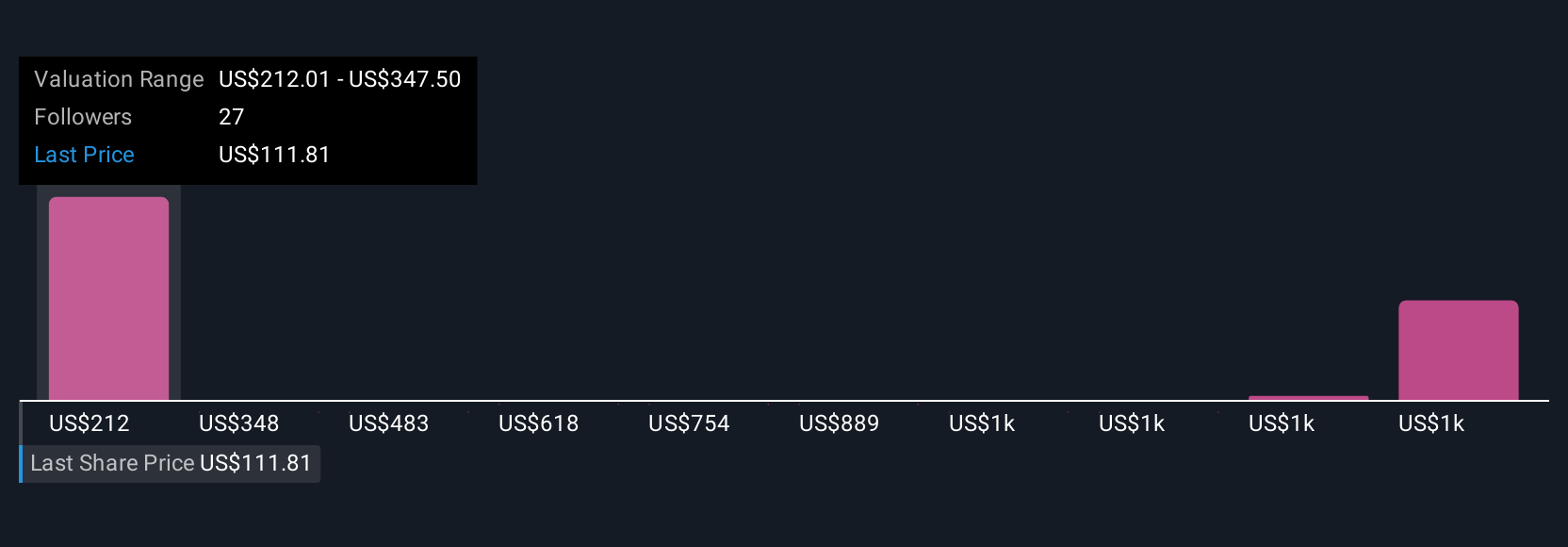

But with executive transitions on the horizon, any disruption could catch investors off guard. Coca-Cola Consolidated's shares have been on the rise but are still potentially undervalued by 24%. Find out what it's worth.Exploring Other Perspectives

Explore 8 other fair value estimates on Coca-Cola Consolidated - why the stock might be worth just $131.75!

Build Your Own Coca-Cola Consolidated Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Consolidated research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Coca-Cola Consolidated research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Consolidated's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives