- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat’s (BYND) Meme Stock Surge and Walmart Deal: Is Retail Hype Redefining Its Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Beyond Meat announced the launch of its latest Beyond Burger and Beyond Beef products at Erewhon stores, along with an expanded retail partnership making new value packs and varieties available at over 2,000 Walmart locations across the US.

- The inclusion of Beyond Meat in a popular meme stock ETF and a surge in retail investor trading activity were major catalysts for heightened interest in the stock, outpacing the impact of recent product innovation or distribution gains alone.

- We'll examine how the Walmart distribution expansion and intensified retail investor attention could alter Beyond Meat's investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Beyond Meat Investment Narrative Recap

To be a shareholder in Beyond Meat, one needs confidence in a turnaround story focused on innovation, retail channel expansion, and improving brand perceptions in the plant-based category. The Walmart distribution expansion sharply amplifies a key short-term catalyst: restoring product velocity and shelf presence at scale. However, this news alone does not mitigate the biggest risk, structural demand challenges and continued financial losses, which remain material and unresolved even amid expanding retail partnerships.

The newly announced launch of Beyond IV at Erewhon stands out as especially relevant. As the first plant-based meats to be Clean Label Project certified and made with no GMOs, cholesterol, or added antibiotics, this move aligns directly with efforts to win back health-conscious consumers and reshape negative brand narratives, offering support to the company’s growth catalysts as it attempts to broaden appeal and address ongoing demand issues.

In contrast, potential investors should be aware that simply adding more retail outlets may do little to resolve the deeper issue of persistently weak core demand and...

Read the full narrative on Beyond Meat (it's free!)

Beyond Meat's outlook projects $300.3 million in revenue and $18.6 million in earnings by 2028. This is based on a -0.1% annual revenue decline and an earnings increase of $172.2 million from current earnings of -$153.6 million.

Uncover how Beyond Meat's forecasts yield a $2.33 fair value, a 18% downside to its current price.

Exploring Other Perspectives

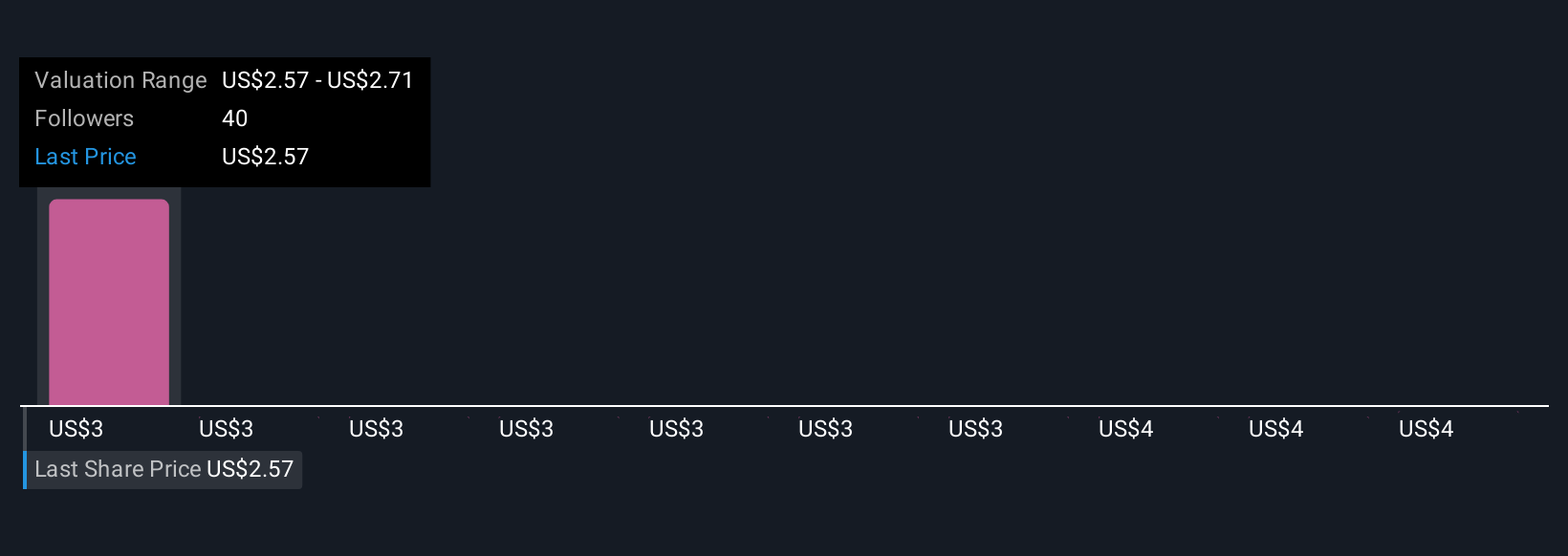

Three community members in the Simply Wall St Community estimate Beyond Meat’s fair value between US$2.33 and US$4.00. Persistent category softness and falling revenues continue to shape the outlook, inviting readers to weigh multiple viewpoints.

Explore 3 other fair value estimates on Beyond Meat - why the stock might be worth as much as 41% more than the current price!

Build Your Own Beyond Meat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Beyond Meat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beyond Meat's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives