- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat (BYND) Valuation: Is the Stock Undervalued After Recent Slide?

Reviewed by Simply Wall St

Beyond Meat (BYND) shares continue to remain under pressure, recently trading at $1.85. Investors have seen the stock decline further this year. This has prompted a closer look at whether the current valuation reflects ongoing performance challenges.

See our latest analysis for Beyond Meat.

Beyond Meat's share price has dropped more than 48% over the past week, adding to a year-to-date loss of 52%. This sharp slide reflects fading momentum and persistent doubts about the company's growth prospects, with the one-year total shareholder return down a steep 70%. Despite some efforts to stabilize, ongoing volatility signals that investors remain skeptical about the path to recovery or renewed growth.

If this rapid shift has you thinking about what else is happening beyond plant-based foods, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares at new lows and the company’s valuation a fraction of its former highs, investors are asking if Beyond Meat is trading below its actual worth or if the market has fully priced in its future risks and slower growth.

Most Popular Narrative: 17.1% Undervalued

With Beyond Meat trading at $1.85, the narrative's fair value estimate points to a price 17% above the market’s current level. This creates a stark contrast between analyst expectations and the stock’s battered position.

Beyond Meat is accelerating operational efficiency efforts, including substantial cost reduction, portfolio optimization, and manufacturing investments. These initiatives are expected to improve gross margins and drive the company toward EBITDA-positive operations, which may benefit future net income and operating cash flow.

What bold transformation powers this recovery outlook? The narrative centers on turnaround strategies and key profitability shifts that could redefine Beyond Meat's path. Want to know which financial levers and consensus projections unlock this fair value? The details just might surprise you.

Result: Fair Value of $2.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent category softness or lingering brand skepticism could undermine turnaround efforts. This could challenge Beyond Meat’s bid for recovery and renewed growth.

Find out about the key risks to this Beyond Meat narrative.

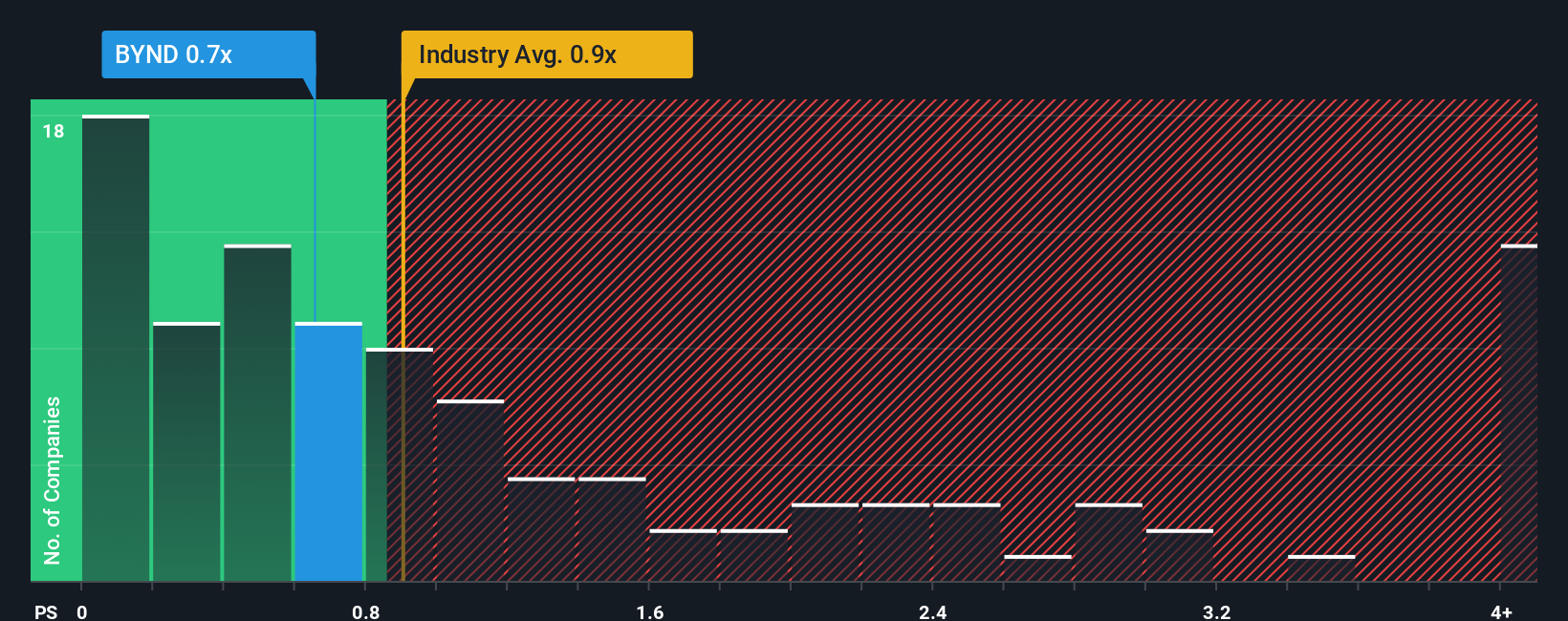

Another View: Peer and Industry Multiples Raise Caution

While the narrative hints at Beyond Meat being undervalued, a look at its price-to-sales ratio paints a far less optimistic picture. Beyond Meat trades at 2.4 times sales, which is significantly higher than both the peer average (0.5x) and the US Food industry average (0.9x), and well above its own fair ratio of 0.6x. This substantial gap means the market is currently valuing Beyond Meat's sales much higher than its peers or what regression trends suggest, flagging a valuation risk investors should consider. Could the real pressure be in the numbers, not just the narrative?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beyond Meat Narrative

If you think the real story lies elsewhere or want to dive deeper into the numbers, you can easily shape your own view in just minutes, and Do it your way.

A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Maximize your research and spot hidden gems with these powerful tools. Take the next step toward smarter investing today.

- Unlock income potential and steady performance by checking out these 21 dividend stocks with yields > 3% with yields above 3%, perfect for building a resilient portfolio.

- Capitalize on the new frontier of artificial intelligence by evaluating these 26 AI penny stocks, which are set to disrupt industries with innovative tech and growth momentum.

- Boost your chances of spotting bargains by reviewing these 848 undervalued stocks based on cash flows, which the market may be overlooking based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives