- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC): Assessing Valuation After a Strong Share Price Surge

Reviewed by Simply Wall St

Uranium Energy (UEC) has been drawing attention lately as its stock performance outpaces many peers, especially over the past month. Investors are curious about what might be driving the steady run-up and whether it can continue.

See our latest analysis for Uranium Energy.

Uranium Energy’s share price has soared recently, notching a 16.5% gain over the last month and almost doubling so far this year. Long-term investors have seen even more impressive results, with a 1-year total shareholder return of 107.5% and an extraordinary 1,575% return over five years. This sharp upward momentum suggests changing market sentiment and growing optimism about the company’s prospects. It highlights both its growth potential and the speed with which investor perceptions can shift.

If you’re watching momentum plays like this, it’s a great time to branch out and discover fast growing stocks with high insider ownership.

After such dramatic gains, the key question arises: does Uranium Energy still have room to run, or is any potential upside already reflected in its soaring share price? Is there a buying opportunity, or is future growth already priced in?

Price-to-Book of 7.4x: Is it justified?

Uranium Energy’s shares are currently trading at a price-to-book ratio of 7.4x, placing them well above both peer and industry averages. Despite recent momentum, this steep multiple signals the stock is priced at a significant premium compared to financial benchmarks in the sector.

The price-to-book ratio compares a company’s market value to its net assets, helping investors gauge whether a stock is overvalued relative to the balance sheet. For resource companies like Uranium Energy, it is a key lens for assessing if the current valuation is supported by underlying assets rather than purely by growth expectations.

The present price-to-book of 7.4x is not only above the company’s peer average of 5.6x but also more than five times higher than the US Oil and Gas industry average of 1.3x. This stark disparity highlights how much optimism is already reflected in the price. If the market were to revert even halfway toward peer or industry multiples, it could mean considerable downside risk or stagnation until the company’s fundamentals catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.4x (OVERVALUED)

However, slowing revenue growth or continued net losses could challenge the bullish narrative and indicate that the market’s optimism may be overextended.

Find out about the key risks to this Uranium Energy narrative.

Another View: What Does the DCF Model Suggest?

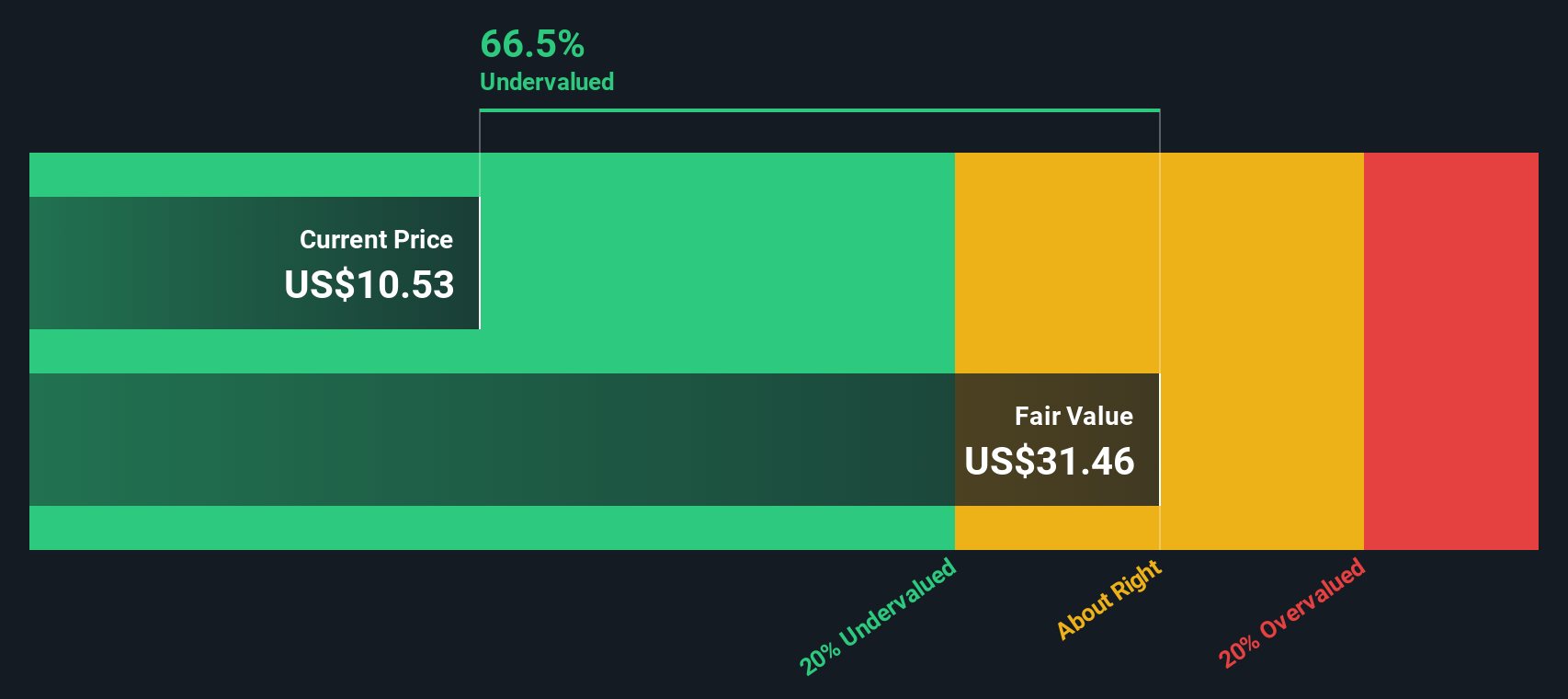

Looking beyond book value, our DCF model currently values Uranium Energy at $13.68 per share. The market is paying $15.13 per share, which indicates the stock is trading above fair value on a fundamental cash flow basis. This raises the question of how much future optimism is already built in.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you have a different perspective or want to dive deeper into the numbers, it’s easy to analyze the data and form your own view in just a few minutes. Do it your way.

A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great investors never stand still. Take action today and check out other compelling companies on Simply Wall Street that could strengthen your portfolio and boost your returns.

- Maximize income potential by evaluating these 22 dividend stocks with yields > 3% with attractive yields and proven financial stability.

- Tap into the future of healthcare by reviewing these 33 healthcare AI stocks, which is poised to disrupt the medical field with AI-powered advancements.

- Seize undervalued opportunities by comparing these 832 undervalued stocks based on cash flows, which could offer upside as the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives