- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Will Centrus Energy’s (LEU) HALEU Edge Define Its Role in America’s Nuclear Future?

Reviewed by Sasha Jovanovic

- On November 11, 2025, Centrus Energy Corp.'s President and CEO Amir V. Vexler spoke at the Crypto & AI/Energy Infrastructure Conference in Miami, highlighting the company’s positioning within the evolving energy infrastructure landscape.

- Centrus Energy remains the only U.S.-licensed producer of high-assay, low-enriched uranium (HALEU), setting it apart as a key player in efforts to enhance domestic nuclear fuel security amid federal policy changes.

- We’ll explore how Centrus Energy’s unique HALEU capability spotlights both opportunity and risk in its evolving investment narrative post-conference.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Centrus Energy Investment Narrative Recap

To be comfortable owning shares of Centrus Energy, investors need to believe in sustained government and private sector commitment to nuclear energy and the expanding need for domestically sourced uranium, especially HALEU. The recent CEO appearance at the Crypto & AI/Energy Infrastructure Conference is unlikely to materially shift the key near-term catalyst: securing federal funding and binding commercial contracts to scale enrichment capacity and deliver on the anticipated market opportunity. The biggest risk remains the timing and certainty of government awards and commercial commitments, which are essential for growth.

Among recent announcements, Centrus' follow-on equity offering of US$196.6 million stands out in the current context. This move bolsters Centrus' cash reserves as the company works to expand domestic enrichment capacity, making it better equipped to support investment in Ohio and pursue next steps in HALEU production. However, this additional liquidity will only unlock full value if the firm secures sufficient long-term demand and government support for expansion.

Yet despite these strengths, investors should be aware that the biggest risk to Centrus right now centers on the uncertainty around government contract timing and funding, which could ...

Read the full narrative on Centrus Energy (it's free!)

Centrus Energy's narrative projects $640.9 million revenue and $70.3 million earnings by 2028. This requires 13.6% yearly revenue growth and a $34.5 million earnings decrease from $104.8 million.

Uncover how Centrus Energy's forecasts yield a $278.71 fair value, a 15% upside to its current price.

Exploring Other Perspectives

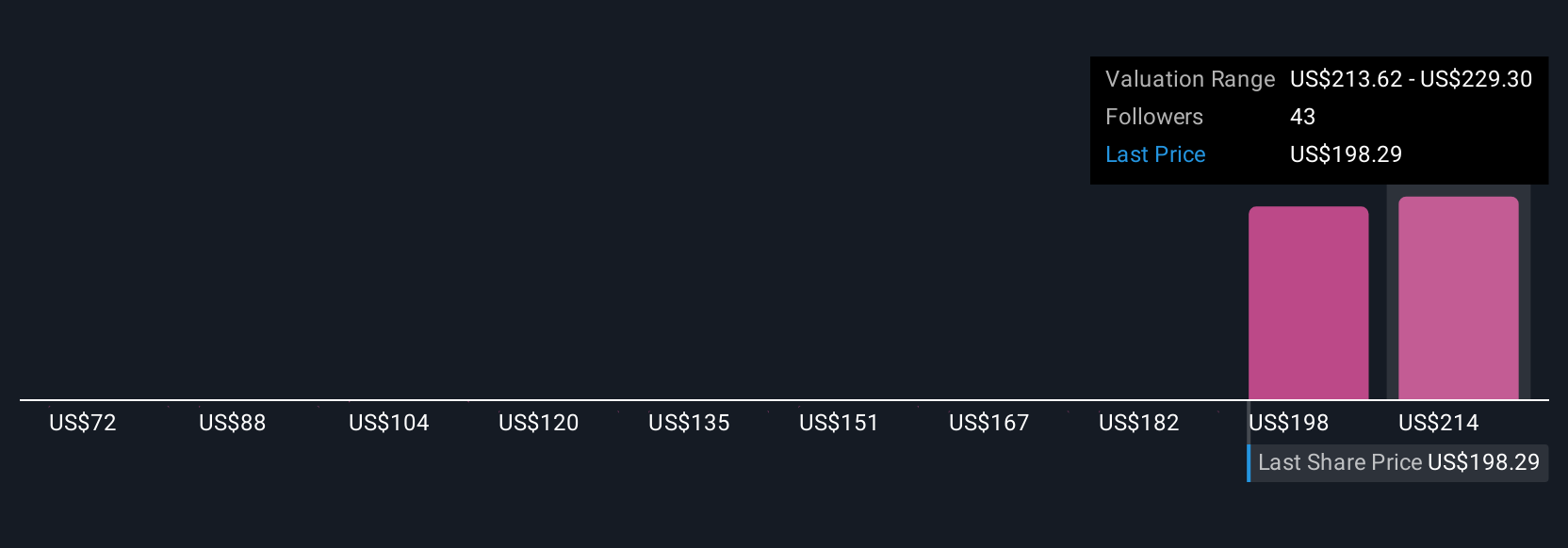

Nine individual fair value estimates from the Simply Wall St Community range from US$96.17 to US$310 per share, reflecting highly varied outlooks. When government funding decisions are pending, opinions on future growth can diverge sharply, and you can explore how these views compare.

Explore 9 other fair value estimates on Centrus Energy - why the stock might be worth as much as 28% more than the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives