- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy (LEU): Evaluating Valuation After HALEU Launch and Strategic Advances in U.S. Nuclear Supply Chain

Reviewed by Simply Wall St

Centrus Energy (LEU) is grabbing attention as the only U.S. company licensed to produce high-assay low-enriched uranium. The rollout of HALEU production and the recent delivery to the Department of Energy highlight its strategic role in the nuclear supply chain.

See our latest analysis for Centrus Energy.

Momentum is clearly favoring Centrus Energy, with the stock’s year-to-date share price return surging 236.2% as investors eye its unique market position and growth prospects in domestic uranium enrichment. While there was a steep pullback this month, the 205.7% total shareholder return over the past year and a remarkable 569% for the past three years suggest long-term believers have been richly rewarded.

If Centrus Energy’s recent moves have you thinking about what else is making waves in high-growth sectors, broaden your search and discover fast growing stocks with high insider ownership

The big question for investors now is whether Centrus Energy’s rapid gains still leave upside on the table, or if the market has already factored in all the company’s high-growth potential. Is this a rare buying window, or is future growth already priced in?

Most Popular Narrative: 10.7% Undervalued

Centrus Energy’s most followed narrative sets its fair value at $278.71, which stands notably above the last close price of $248.98. This difference sparks debate as investors weigh robust growth stories against compressed profitability forecasts.

The market seems to be capitalizing Centrus as a clear winner and technology leader in HALEU and domestic uranium enrichment, but execution risk remains. Contract negotiations, regulatory or permitting challenges, delays or cost overruns in commercializing next-generation enrichment, or higher-than-expected compliance or operational costs could drive down net margins and erode earnings, especially given current high expectations for margin expansion.

Want to know what bold projections drive this valuation jump? There is a striking disconnect between rapid revenue growth and surprisingly razor-thin margins. Furious debate surrounds ambitious financial targets. Peel back the curtain and uncover the key forecasts and bull-bear tensions moving this valuation.

Result: Fair Value of $278.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dilution concerns and uncertainties around Department of Energy funding could pose near-term headwinds to Centrus Energy’s bullish growth narrative.

Find out about the key risks to this Centrus Energy narrative.

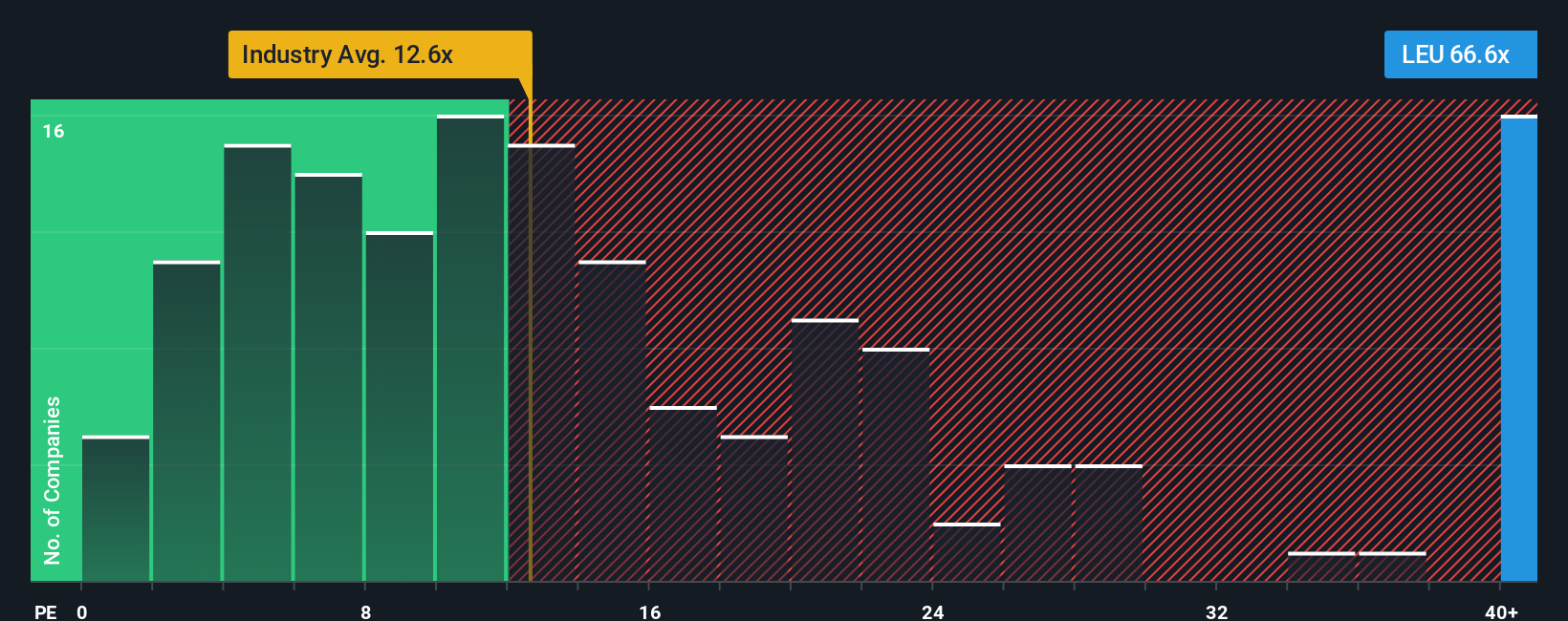

Another Perspective: High Valuation Multiples Raise Questions

While some see Centrus Energy as undervalued based on optimistic growth projections, a look at its price-to-earnings ratio raises eyebrows. The company trades at 39.9 times earnings, much higher than peers averaging 16.4 and the broader industry at 13.1. Even compared to the fair ratio of 9.8, the premium is steep. This could present a potential risk for investors if growth expectations do not materialize. Could the market’s high hopes be setting up for a future correction, or is this optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centrus Energy Narrative

If you see things differently or want to put the data to the test yourself, you can piece together your own Centrus Energy story in just a few minutes. Do it your way

A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity. Go beyond Centrus Energy and explore stocks with exceptional growth, breakthrough technology, and robust income potential using these handpicked screeners.

- Tap into strong cash flow potential by reviewing these 930 undervalued stocks based on cash flows, which could be flying under the radar right now.

- Get ahead of the AI trend and explore market-changers among these 26 AI penny stocks that are powering advancements in automation and intelligent solutions.

- Strengthen your portfolio’s income stream when you review these 14 dividend stocks with yields > 3%, offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success