- United States

- /

- Oil and Gas

- /

- NYSEAM:BRN

Here's Why Shareholders May Consider Paying Barnwell Industries, Inc.'s (NYSEMKT:BRN) CEO A Little More

Shareholders will probably not be disappointed by the robust results at Barnwell Industries, Inc. (NYSEMKT:BRN) recently and they will be keeping this in mind as they go into the AGM on 20 April 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for Barnwell Industries

Comparing Barnwell Industries, Inc.'s CEO Compensation With the industry

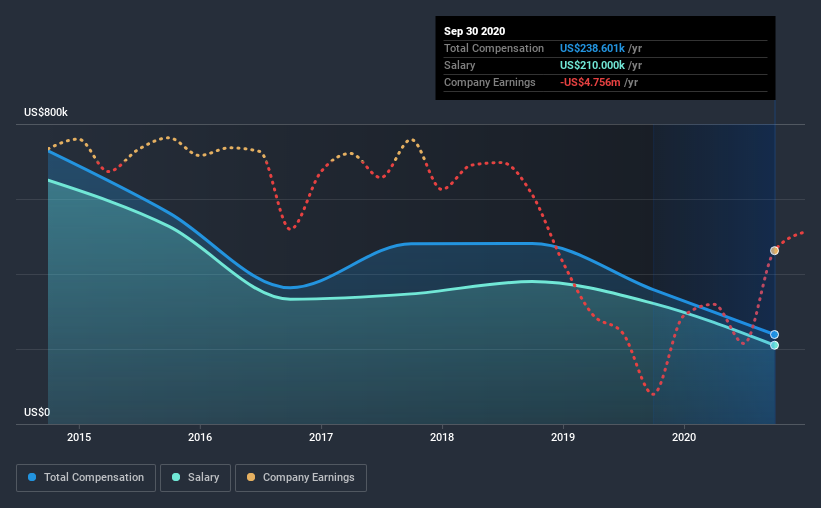

According to our data, Barnwell Industries, Inc. has a market capitalization of US$20m, and paid its CEO total annual compensation worth US$239k over the year to September 2020. Notably, that's a decrease of 33% over the year before. We note that the salary portion, which stands at US$210.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$365k. In other words, Barnwell Industries pays its CEO lower than the industry median. Moreover, Alexander Kinzler also holds US$2.3m worth of Barnwell Industries stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$210k | US$322k | 88% |

| Other | US$29k | US$37k | 12% |

| Total Compensation | US$239k | US$358k | 100% |

On an industry level, roughly 19% of total compensation represents salary and 81% is other remuneration. It's interesting to note that Barnwell Industries pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Barnwell Industries, Inc.'s Growth

Barnwell Industries, Inc. has reduced its earnings per share by 40% a year over the last three years. Its revenue is up 25% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Barnwell Industries, Inc. Been A Good Investment?

Barnwell Industries, Inc. has generated a total shareholder return of 26% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Barnwell Industries (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Barnwell Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Barnwell Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:BRN

Barnwell Industries

Acquires and develops crude oil and natural gas assets in Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success