- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group Holdings (NYSE:XPRO) Reports Strong Q3 Earnings with 15% Revenue Growth and Positive Guidance

Reviewed by Simply Wall St

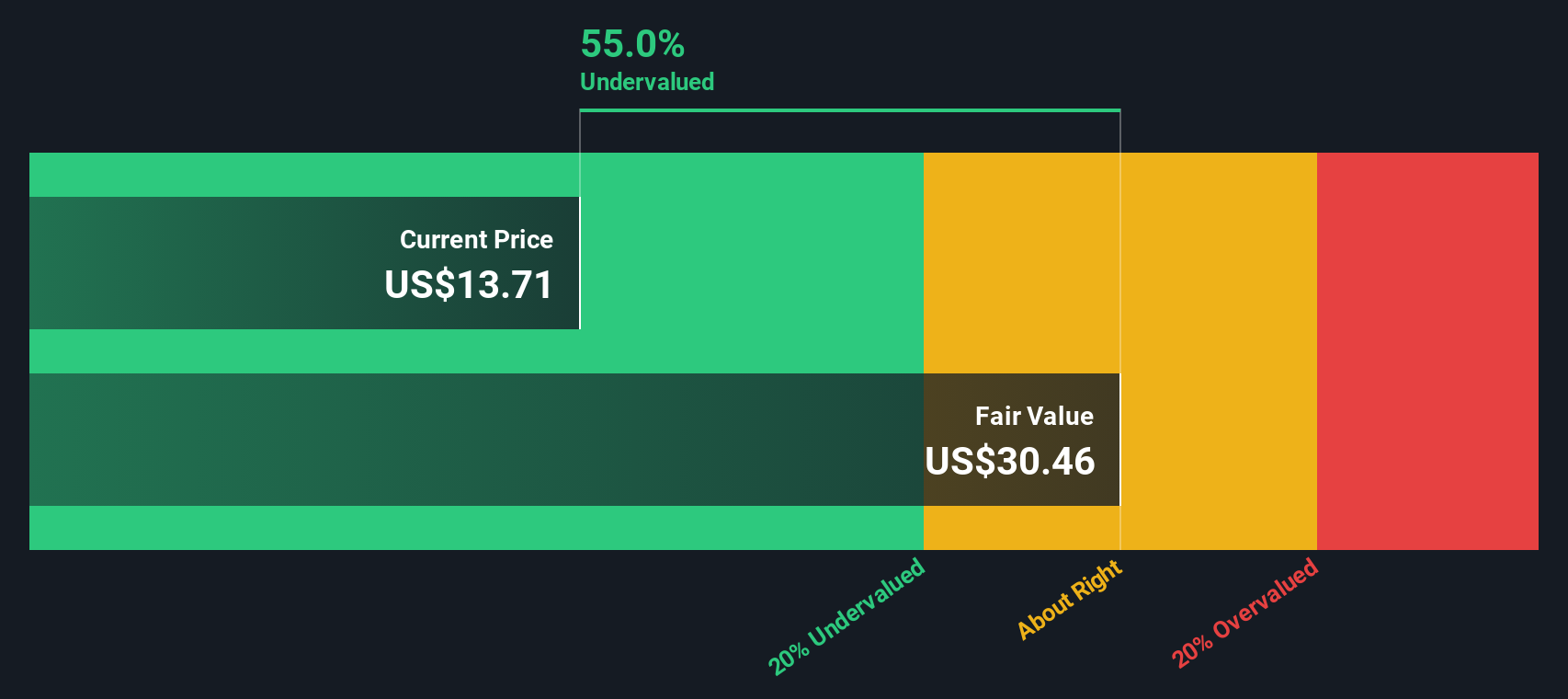

Expro Group Holdings (NYSE:XPRO) has recently reported a significant turnaround in its financial performance, with third-quarter sales reaching USD 422.83 million, a notable increase from USD 369.82 million the previous year, and a net income of USD 16.28 million compared to a net loss a year ago. The company has revised its fourth-quarter and full-year guidance, projecting revenue growth that underscores its strategic expansion in North America. Despite its high Price-To-Earnings Ratio, Expro's strong cash position and potential undervaluation present attractive investment opportunities, while challenges such as operational inefficiencies and market pressures remain areas for strategic focus.

Unlock comprehensive insights into our analysis of Expro Group Holdings stock here.

Key Assets Propelling Expro Group Holdings Forward

Expro Group Holdings has demonstrated impressive financial health, with earnings forecasted to grow at 39.9% annually, significantly outpacing the US market's 15.2% growth. This growth is underscored by a 727.9% increase in earnings over the past year, a testament to the company's strategic initiatives. The company has consistently maintained profitability over the last five years, with an average earnings growth of 51.4% per year. Michael Jardon, President and CEO, highlighted in the latest earnings call that a 15% year-over-year revenue increase was primarily driven by expanding market share in North America. Additionally, Expro's strong cash position, with more cash than total debt, reinforces its financial stability and ability to invest in future growth. The seasoned management team, with an average tenure of 3.1 years, plays a pivotal role in steering the company towards its strategic goals. Notably, Expro is trading at $12.87, significantly below the estimated fair value of $41.32, suggesting it may be undervalued despite a high SWS Price-To-Earnings Ratio.

Strategic Gaps That Could Affect Expro Group Holdings

While Expro's earnings are on a growth trajectory, the company's revenue growth forecast of 7% per year lags behind the US market's 8.8%. The high Price-To-Earnings Ratio of 91.8x, compared to the industry average of 17x, may deter potential investors. Operational inefficiencies were acknowledged by CFO Michael Jardon, noting challenges that impacted margins. Furthermore, the net profit margin remains low at 1%, with a Return on Equity of 1.1%, indicating room for improvement. Shareholder dilution, with shares outstanding growing by 6.2%, also presents a challenge. A significant one-off loss of $34.7M has impacted financial results, highlighting areas for strategic focus.

Emerging Markets Or Trends for Expro Group Holdings

Expro is poised to capitalize on several growth opportunities. Analysts have set a target price more than 20% higher than the current share price, indicating potential for stock appreciation. The company is trading at 68.8% below its estimated fair value, suggesting an attractive investment opportunity. Product innovation has been a key driver, with a 25% uptick in orders for new products, as noted by CFO Michael Jardon. Strategic alliances and long-term contracts with key clients enhance revenue visibility and position Expro to capitalize on emerging market trends.

Competitive Pressures and Market Risks Facing Expro Group Holdings

Expro faces several external threats, including economic headwinds and competitive pressures. Fluctuating oil prices present a challenge, as highlighted by CFO Michael Jardon, potentially impacting client spending. Increased competition in core markets may affect pricing power and market positioning. Additionally, supply chain disruptions have caused project delays, necessitating effective risk management strategies to maintain customer satisfaction and project timelines. These factors underscore the need for vigilance and innovation to sustain market share and growth.

Explore the current health of Expro Group Holdings and how it reflects on its financial stability and growth potential.

Conclusion

Expro Group Holdings is positioned for strong future performance, driven by its impressive earnings growth forecast of 39.9% annually, far exceeding the US market average. Challenges such as operational inefficiencies and a high Price-To-Earnings Ratio exist, but the company’s strategic initiatives and strong cash position provide a solid foundation for continued growth. The significant gap between its current trading price of $12.87 and its estimated fair value of $41.32 suggests substantial potential for stock appreciation. By capitalizing on product innovation and strategic alliances, Expro is well-equipped to navigate competitive pressures and market risks, paving the way for enhanced shareholder value.

Key Takeaways

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:XPRO

Expro Group Holdings

Engages in the provision of energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Flawless balance sheet with proven track record.