- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group Holdings (NYSE:XPRO): Assessing Valuation After RCIS Automation Milestone and Industry Collaboration

Reviewed by Kshitija Bhandaru

Expro Group Holdings (NYSE:XPRO) has completed its first full deployment of the Remote Clamp Installation System, bringing automation to offshore well completion and driving stronger safety and efficiency. This milestone demonstrates commercial traction and suggests the potential for broader adoption in the future.

See our latest analysis for Expro Group Holdings.

Momentum around Expro’s automation breakthrough comes as the share price has edged higher in recent months, even as the 1-year total shareholder return sits slightly below flat. Although short-term share price gains have been modest, the efficiency boost from RCIS and partnership with BP suggest that sentiment could be shifting as operational results start to materialize.

If news of Expro’s technology wins got your attention, it might be a great moment to discover other companies where insiders back fast growth. Check out fast growing stocks with high insider ownership.

Yet with shares down over the past year despite a breakthrough in automation, the question remains: is Expro being overlooked, or is the market already factoring in the company’s future growth?

Most Popular Narrative: 2.3% Undervalued

Expro’s most popular narrative places fair value just above the last close, suggesting that the market may be overlooking operational tailwinds and recent upgrades. Here’s what stands out for analysts driving this valuation:

Accelerated development and deployment of advanced digital and automation technologies, such as remote operations and AI-driven tools, are enhancing operational efficiency and margin expansion. This is creating potential for further net margin and earnings improvements as adoption grows.

Something significant is developing behind this valuation. The narrative’s positive fair value relies on a few ambitious forecasts for margins and profit growth. What key financial levers are analysts focusing on to support this price? Discover the numbers behind Expro’s pricing story right now.

Result: Fair Value of $12.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fresh uncertainty could arise if regulatory shifts or energy transition goals reduce offshore oilfield demand and put pressure on Expro’s future margins.

Find out about the key risks to this Expro Group Holdings narrative.

Another View: What Do Profit Multiples Reveal?

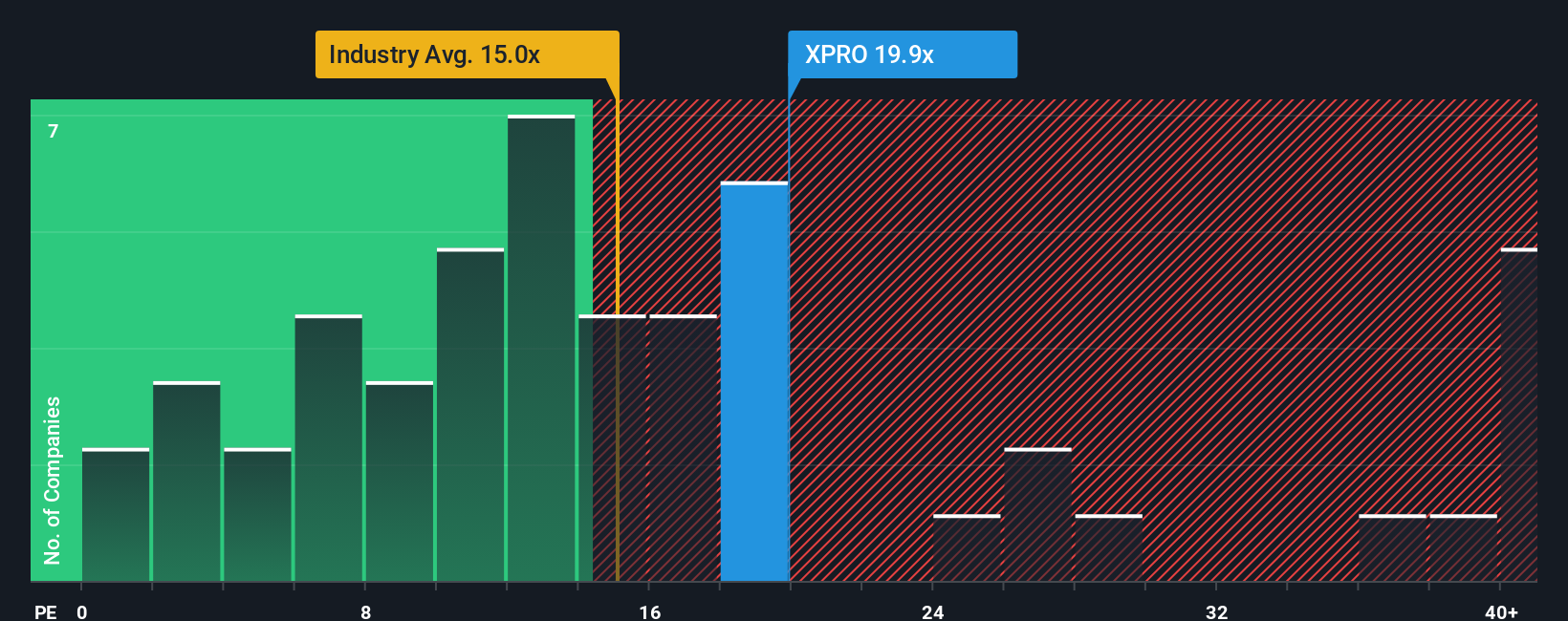

Looking at Expro’s valuation through its price-to-earnings ratio changes the story. The company trades at 20.3x earnings, which is noticeably higher than the US Energy Services industry average of 14.8x and its peer average of 20x. Compared to the fair ratio of 13.9x, this premium suggests the current share price leaves little room for missteps or slower-than-expected growth. Does this signal caution for investors, or is the market simply betting big on Expro’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expro Group Holdings Narrative

If you see things differently or have your own perspective, you can explore the data yourself and build a narrative in just minutes. Do it your way.

A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the chance to power up your investing strategy with stock screens that reveal bold opportunities you might otherwise miss. These tools can help you spot potential winners in areas where trends are just warming up.

- Capture growth by tracking breakout performers in artificial intelligence using these 24 AI penny stocks, a tool built to highlight companies leading today’s tech wave.

- Fuel your portfolio with reliable income. Launch your search for yield above 3% by checking out these 19 dividend stocks with yields > 3% right now.

- Seize the moment to identify undervalued gems often flying under the radar by using these 901 undervalued stocks based on cash flows to spot attractive entry points before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives