- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Is Exxon Mobil Still a Bargain Amid Leadership Shake-Up and 2% Weekly Dip?

Reviewed by Bailey Pemberton

- Wondering if Exxon Mobil is still a good deal or becoming pricey? You are not alone, especially as more investors are taking a closer look at its actual value right now.

- The stock recently dipped 2.4% over the past week and slid 1.2% in the past month, but it is still up 6.7% year-to-date and has soared an impressive 250.8% over five years.

- Recent headlines suggest that Exxon Mobil’s leadership shake-up and significant moves in energy transition initiatives are keeping the company in the news, highlighting both excitement and uncertainty. The industry’s ongoing debates around oil prices and renewables are clearly having an impact on investor sentiment and short-term price swings.

- When it comes to valuation, Exxon Mobil lands a score of 4 out of 6 on our key undervalued checks—solid, but not flawless. Next, let us break down what those valuation methods really tell us about the stock, and stick around for an even smarter way to size up its true worth.

Approach 1: Exxon Mobil Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting them back to today’s dollars. This approach is widely used to assess the fundamental value of a stock by focusing on how much cash the business is expected to generate over time.

For Exxon Mobil, analysts estimate the company’s latest twelve-month Free Cash Flow at $28.1 billion. Looking ahead, projections indicate steady cash flow growth, with forecasts rising to $44.7 billion by 2029. While analyst coverage extends about five years forward, further projections are extrapolated by Simply Wall St to provide investors with a longer-term sense of the company’s earnings power.

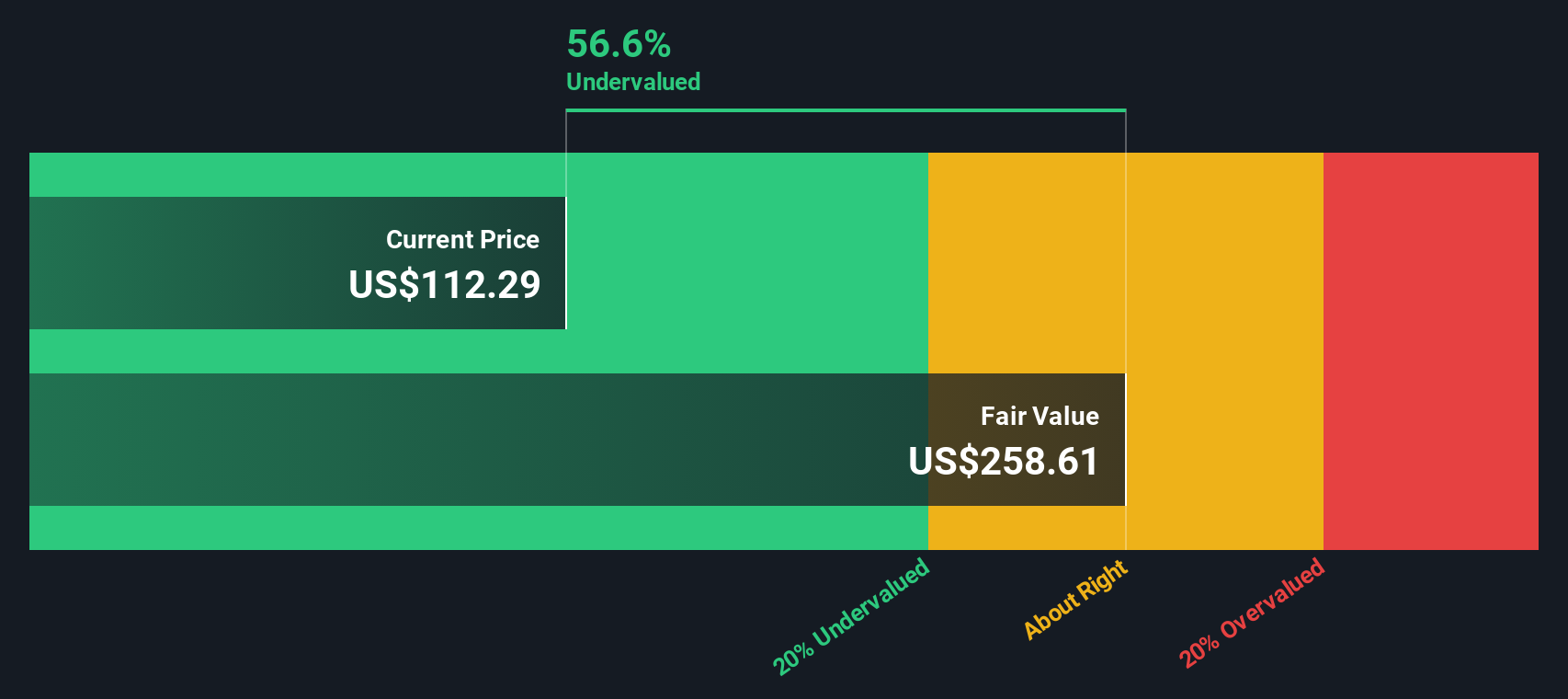

Based on all these cash flows discounted appropriately, the DCF model suggests an intrinsic value of $285.39 per share. Compared to the current share price, this implies the stock is trading at a 59.9% discount to its calculated fair value, which may indicate substantial potential upside for value investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exxon Mobil is undervalued by 59.9%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: Exxon Mobil Price vs Earnings (PE Ratio)

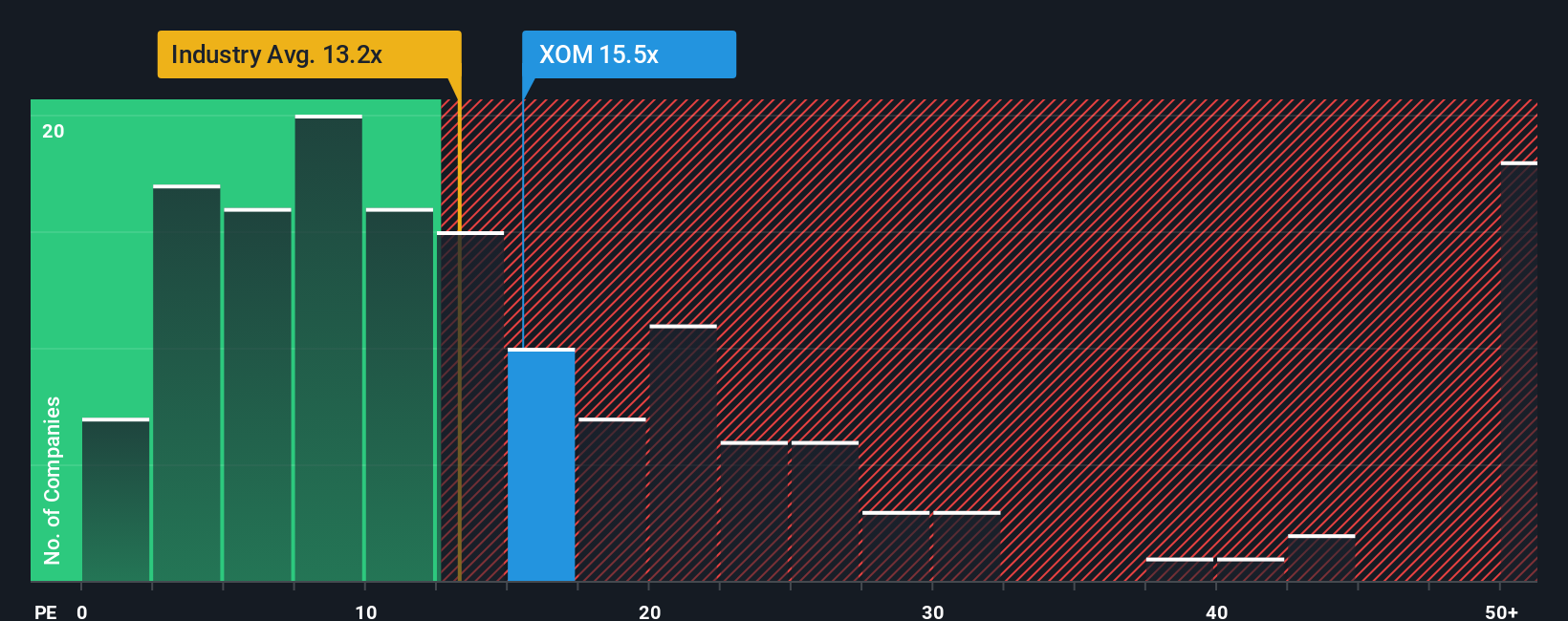

The Price-to-Earnings (PE) ratio is a popular valuation metric for established, profitable companies like Exxon Mobil because it neatly summarizes how much investors are willing to pay for each dollar of earnings. It makes it easy to compare companies within the same industry or across the market, especially when solid profits are being generated year after year.

Deciding what counts as a "normal" or "fair" PE ratio is not always straightforward. Factors like a company's future growth outlook, its risk profile, and even broader market sentiment all impact what investors consider reasonable. In essence, faster-growing or lower-risk companies tend to justify higher PE ratios, while those facing slower growth or greater uncertainties often trade at lower multiples.

At the moment, Exxon Mobil’s PE ratio sits at 16.1x. Compared to the Oil and Gas industry average of 13.1x and the average of direct peers at 23.5x, Exxon seems to be valued somewhere between industry norms and its closest competitors.

However, Simply Wall St's "Fair Ratio" provides an alternative comparison. This proprietary metric calculates what Exxon Mobil’s PE ratio should be by considering its unique blend of growth expectations, profit margins, industry characteristics, risk, and market cap. Exxon's Fair Ratio stands at 22.7x. This means that based on these tailored factors, Exxon's current valuation appears to be trading below its fair value.

Because Exxon Mobil’s actual PE ratio is meaningfully lower than its Fair Ratio, this suggests potential undervaluation, rather than just keeping pace with the industry average.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1435 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exxon Mobil Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, an intuitive approach that puts investors in control of their own viewpoint on a company’s future.

A Narrative is the story, or perspective, that you build around Exxon Mobil, bringing together your beliefs about where the business is headed, your estimates for growth, and what you think the stock is truly worth. Rather than relying solely on static numbers, Narratives allow you to connect the company's strategy and industry context to a financial forecast and then to your own fair value outcome.

On Simply Wall St's Community page, millions of investors use Narratives to share their outlook, whether they see Exxon as a value play fueled by operational efficiency or a stock facing significant risks from inflation, oil price volatility, or energy transition trends. Narratives update dynamically when new information, like company news or earnings, comes in, so your investment view stays current and relevant.

This approach helps users quickly gauge whether it may be time to buy or sell, by comparing their own fair value estimate with the market price and seeing how their story lines up with others. For example, recent Narratives for Exxon Mobil range from a bullish fair value of $174 per share, arguing for substantial upside due to Guyana growth, to a more cautious low of $95 per share, reflecting concerns about inflation and energy transition risks.

Do you think there's more to the story for Exxon Mobil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success