- United States

- /

- Energy Services

- /

- NYSE:WTTR

Select Water Solutions (WTTR): Assessing Valuation as Lithium Facility Launch Signals New Growth Path

Reviewed by Simply Wall St

Select Water Solutions (WTTR) recently revealed a new step for its business. The company broke ground on a lithium extraction facility with Mariana Minerals, using its existing water infrastructure in the Haynesville shale region.

See our latest analysis for Select Water Solutions.

This lithium facility announcement follows a string of updates, from a Q3 earnings report with softer profits to a recently affirmed dividend. Shares have rebounded strongly in the past quarter with a 35% 90-day share price return, and the 1-year total shareholder return now sits above 7%, reflecting steady long-term gains.

If you’re interested in other companies finding creative ways to grow value, you might want to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading at a considerable discount to analyst price targets despite recent gains, investors must ask: Is Select Water Solutions undervalued at these levels, or is the market already pricing in the company’s next stage of growth?

Most Popular Narrative: 18.5% Undervalued

At $11.68, Select Water Solutions remains well below the most popular narrative’s fair value estimate of $14.33. This gap has caught the eye of market watchers and makes for a compelling setup for what’s next.

Expansion of dedicated water infrastructure contracts and advanced recycling capabilities is driving predictable revenue growth, premium pricing, and stronger customer relationships. Business streamlining, along with adoption of automation and proprietary technologies, is improving margins, operational efficiency, and unlocking new cross-selling opportunities.

What’s really powering this valuation? It is not just about expected profit growth or cash flow improvements. There is a surprising mix of efficiency moves, industry adoption, and a future margin target that most would associate with much larger players. Hungry for the key driver that puts a premium on these numbers? Only a closer look reveals the true engine of this price target.

Result: Fair Value of $14.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in water services revenue or an over-concentration among a few customers could challenge Select Water Solutions' ability to deliver on bullish expectations.

Find out about the key risks to this Select Water Solutions narrative.

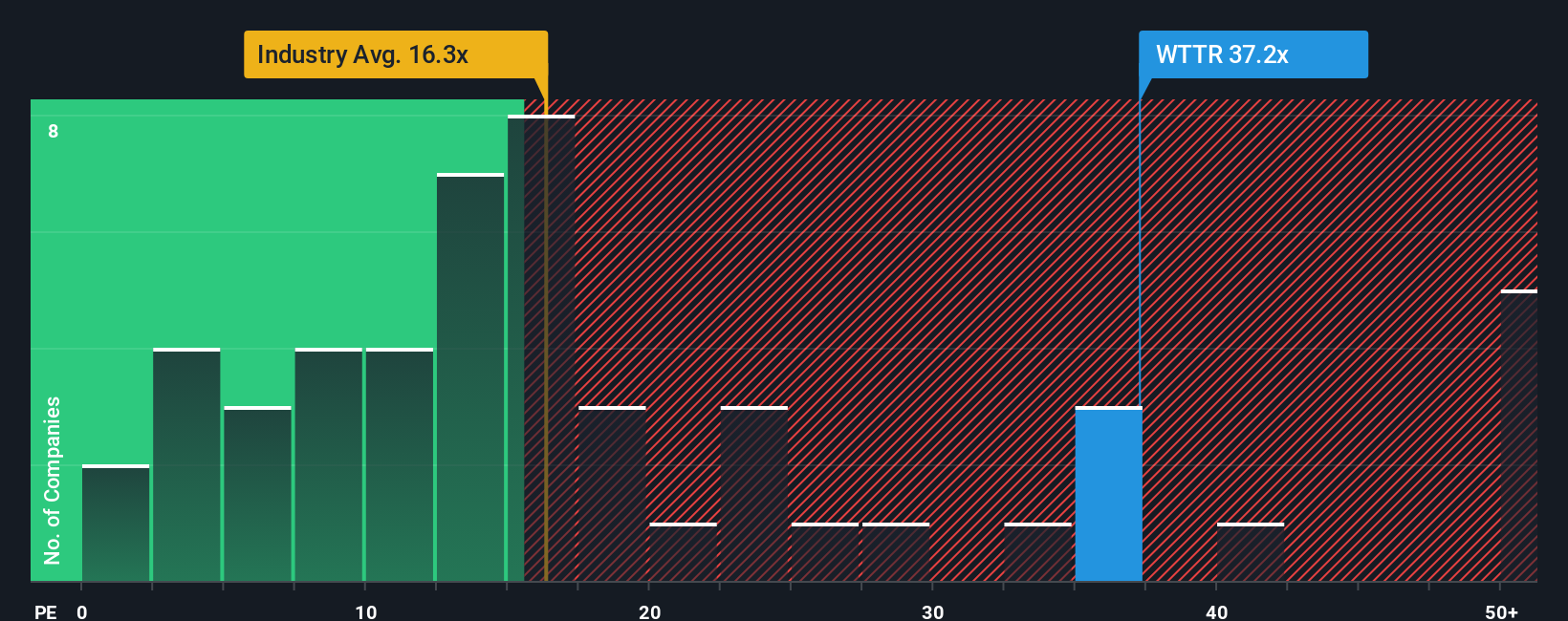

Another View: Multiples Tell a Different Story

While the fair value estimate looks promising, the market’s favored valuation ratio suggests Select Water Solutions is trading at a premium to both its industry and peer group. Its price-to-earnings ratio is 36.8x, which is well above the industry average of 16.9x and a peer average of 8.3x. The price-to-earnings ratio that our model calculates as fair—what the market could reasonably move toward—is just 16x. This sizable gap could indicate a risk that investors are paying too much, or that the market is factoring in future growth that is not yet fully visible. Does this premium signal genuine confidence, or is the stock getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Select Water Solutions Narrative

If you see the story differently or prefer an independent deep dive, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Select Water Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t just stop with Select Water Solutions when dynamic opportunities await. Get ahead of the curve by searching for stocks that align with your goals. There is a world of growth, value, and innovation to capture right now.

- Capture the momentum in artificial intelligence by reviewing these 26 AI penny stocks which are reshaping industries with breakthrough applications and rapid earnings growth.

- Tap into strong, consistent returns by browsing these 20 dividend stocks with yields > 3% to find quality companies offering attractive yields above 3%.

- Ride the wave of digital transformation by reviewing these 81 cryptocurrency and blockchain stocks that champion fresh technologies in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTTR

Select Water Solutions

Provides water management and chemical solutions to the energy industry in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives