- United States

- /

- Oil and Gas

- /

- NYSE:WMB

A Fresh Look at Williams Companies (WMB) Valuation Following Key Regulatory Approval for NESE Project

Reviewed by Simply Wall St

Williams Companies (WMB) just cleared a major regulatory hurdle for its Northeast Supply Enhancement project, as it won critical permits from both New Jersey and New York agencies. This development paves the way for new investment in energy infrastructure serving New York City.

See our latest analysis for Williams Companies.

With the regulatory win backing the NESE project, optimism is showing up in the numbers. Williams’ share price has climbed 6.1% over the past 90 days, while its one-year total shareholder return stands at an impressive 11.6%. This momentum hints at renewed investor confidence and the company's ability to deliver long-term value.

If this kind of steady progress has you watching the broader energy sector, now’s the perfect moment to discover fast growing stocks with high insider ownership.

But with shares already gaining momentum and trading just over 10% below analyst targets, investors may ask whether Williams Companies is still undervalued or if the market has already factored in its future growth, leaving little room for upside.

Most Popular Narrative: 9.3% Undervalued

Williams Companies' most widely followed valuation narrative suggests its fair value sits above the current market price, indicating there may be potential upside based on fundamental drivers. The company’s investments and contracted assets are positioned to contribute in the coming years.

Williams' investment and leadership in decarbonization, including methane reduction and renewable natural gas projects, are fostering regulatory goodwill, accelerating project permitting, and attracting new, resilient long-term contracts. These developments are expected to provide sustainable margin expansion and lower risk premiums.

Curious about the conviction behind this bullish calculation? The numbers behind this valuation rely on notable assumptions for margin expansion and future growth. What financial expectations are analysts factoring in? Explore now to learn more about the projections and the analysis that places Williams' fair value well above the current price.

Result: Fair Value of $67.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, decarbonization trends, regulatory shifts, or project delays could impact Williams Companies' growth outlook and challenge the bullish valuation narrative.

Find out about the key risks to this Williams Companies narrative.

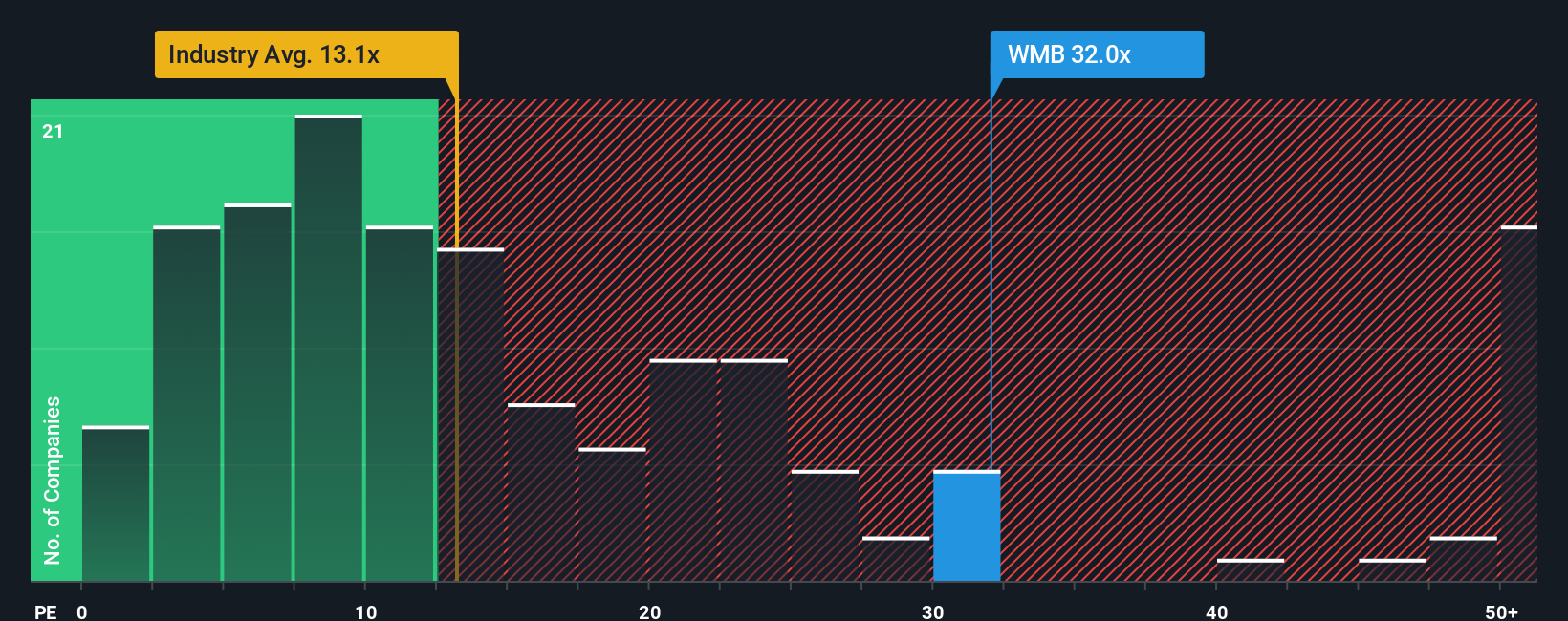

Another View: Price-To-Earnings Signals a Caution

On the flip side, Williams Companies’ price-to-earnings ratio stands at 31.5x. This is well above the industry average of 14.3x and also exceeds what would be considered its fair ratio of 21.5x. This implies the stock is expensive relative to both peers and broader sector expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If you’d rather dig into the numbers on your own and see a different story, you can shape your own view in just a few minutes, so why not Do it your way.

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Uncover fresh opportunities and avoid missing out on tomorrow’s winners by putting the Simply Wall Street Screener to work. Your next smart investment could be just a click away.

- Capture reliable passive income streams by checking out these 17 dividend stocks with yields > 3%, which reward shareholders with higher yields and steady growth.

- Tap into market inefficiencies and access value with these 874 undervalued stocks based on cash flows, which may be poised for a rebound based on strong fundamentals.

- Ride the wave of technological innovation and stay ahead of the curve with these 26 AI penny stocks, as these harness artificial intelligence to disrupt entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives