- United States

- /

- Oil and Gas

- /

- NYSE:WKC

Does World Kinect’s (WKC) Executive Overhaul Signal a Strategic Shift for the Company’s Future?

Reviewed by Sasha Jovanovic

- World Kinect Corporation has announced a series of major leadership changes, including the appointment of Ira M. Birns as Chief Executive Officer effective January 1, 2026, with Michael J. Kasbar transitioning to Executive Chairman, and Andrea B. Smith joining the Board of Directors as of October 24, 2025.

- This broad reshaping of the company's senior management and board may influence corporate strategy and operational direction at a pivotal period for the business.

- We'll examine how the planned CEO transition and board expansion could influence World Kinect's outlook and ongoing transformation.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

World Kinect Investment Narrative Recap

To be a World Kinect shareholder right now, you need to believe that the company's ongoing portfolio transformation and leadership overhaul will help unlock stronger, more recurring earnings, even as the business faces persistent headwinds in demand for traditional fuels and margin pressure from declining land and marine segments. The recent wave of executive changes, including the upcoming CEO handoff and board expansion, does not appear to materially change the biggest short-term catalyst: successful execution in scaling sustainable energy offerings, or the core risk: continued revenue and margin contraction in legacy businesses.

The appointment of Jose-Miguel (Mike) Tejada as Chief Financial Officer stands out as particularly relevant, given that near-term financial discipline and operational oversight will be key as World Kinect attempts to offset ongoing declines in top-line revenue and margin from land and marine. This highlights the importance of effective financial leadership as the company transitions and invests in higher-growth, renewable-focused segments.

In contrast, investors should be aware that secular declines in the land segment, and resulting revenue headwinds, could pose a structural challenge if...

Read the full narrative on World Kinect (it's free!)

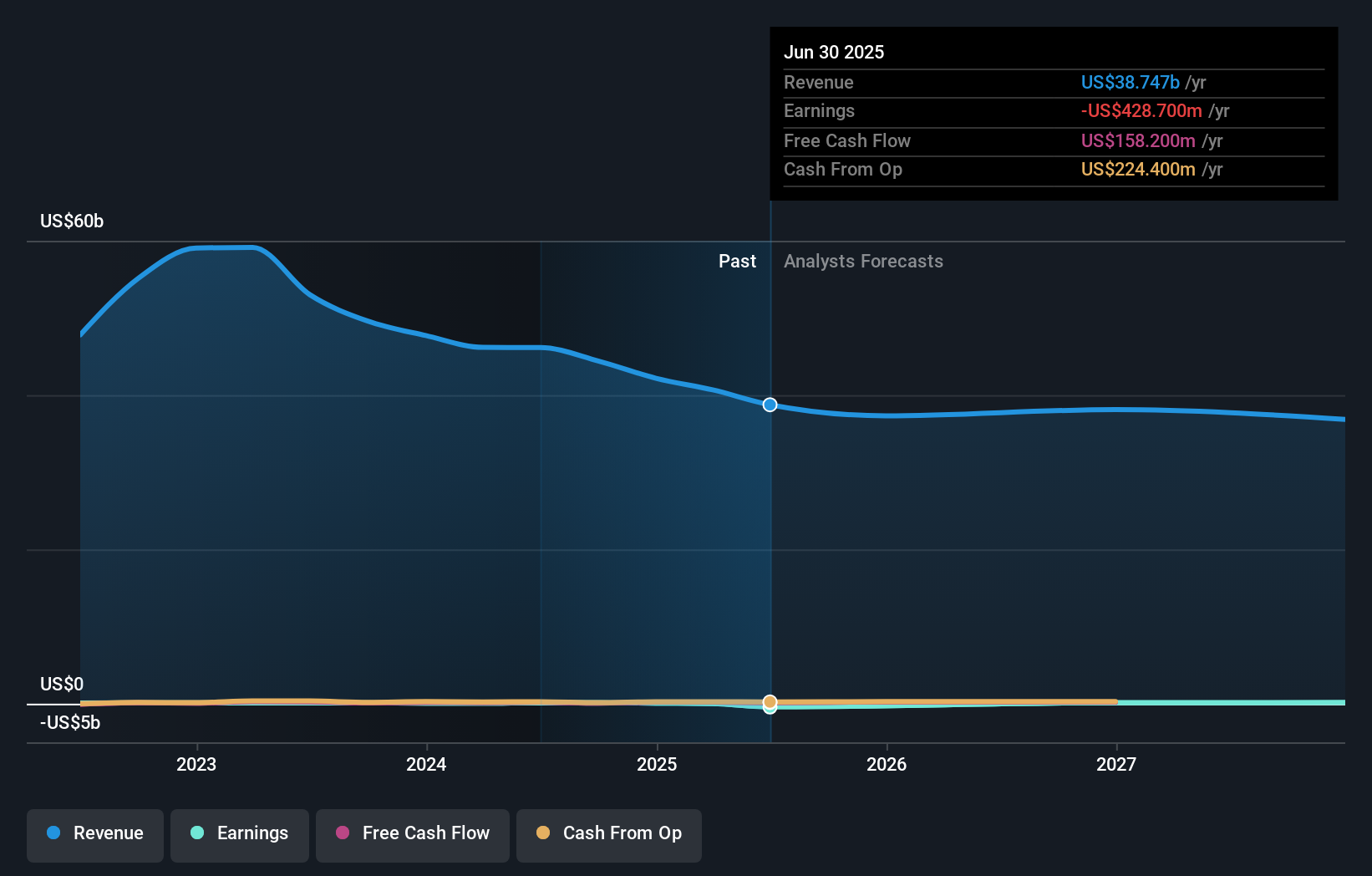

World Kinect's outlook anticipates $37.1 billion in revenue and $330.9 million in earnings by 2028. This scenario is based on an annual revenue decline of 1.5% and an earnings turnaround of $759.6 million from current earnings of -$428.7 million.

Uncover how World Kinect's forecasts yield a $28.33 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for World Kinect range from US$28.33 to US$37.08, based on 2 diverse perspectives. With earnings volatility and a shrinking core fuels market still a material risk, it is worth considering how your own view compares to the wider Simply Wall St Community's analysis.

Explore 2 other fair value estimates on World Kinect - why the stock might be worth just $28.33!

Build Your Own World Kinect Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your World Kinect research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free World Kinect research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate World Kinect's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives