- United States

- /

- Oil and Gas

- /

- NYSE:VTS

Vitesse Energy (VTS): Net Profit Margin Drop Undermines Valuation Narrative

Reviewed by Simply Wall St

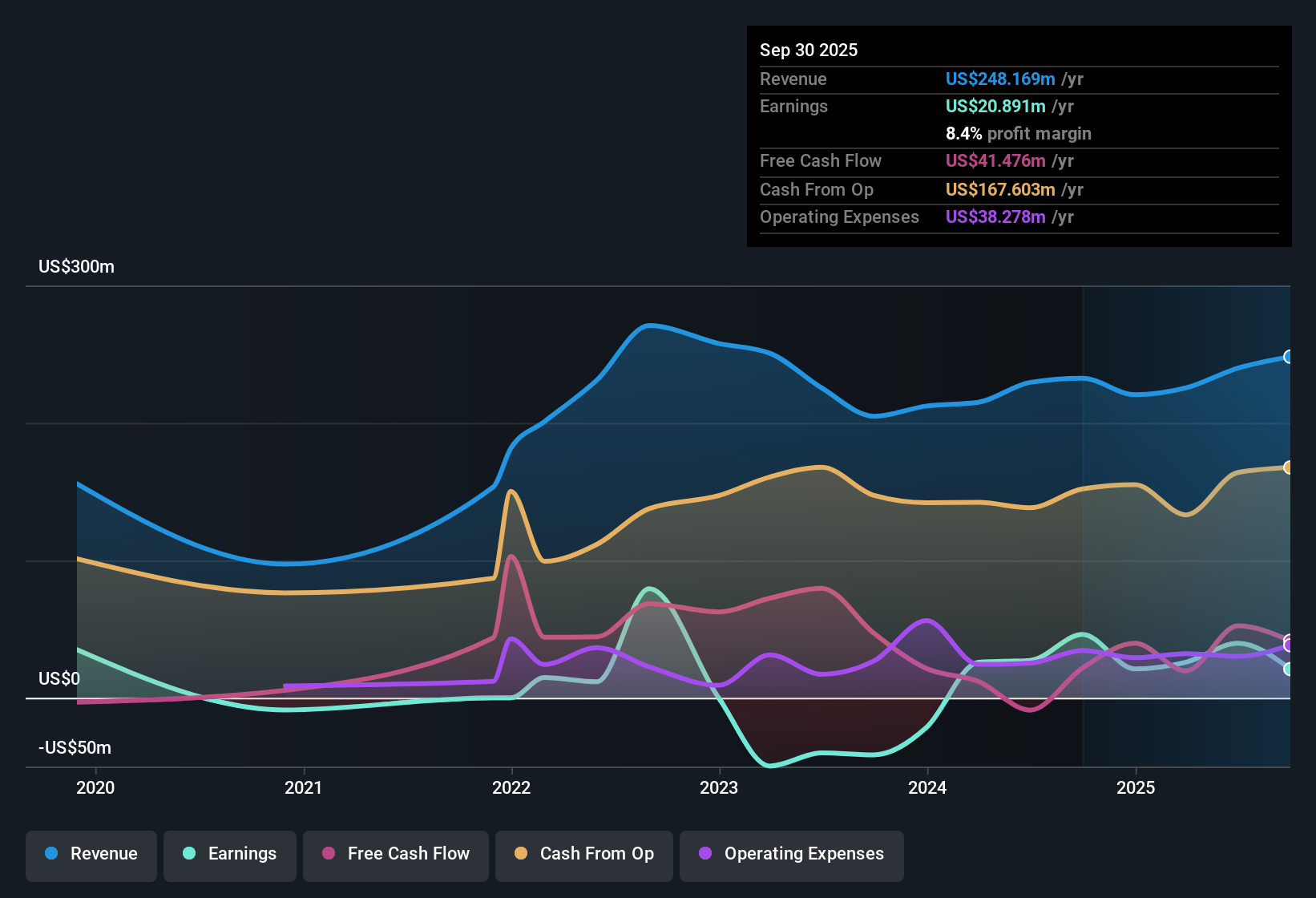

Vitesse Energy (VTS) reported a net profit margin of 8.4%, well below last year’s 19.8%, as the company’s most recent period saw negative earnings growth despite averaging 24.1% annual earnings growth over the past five years. Looking ahead, revenue is projected to grow at just 0.9% per year, lagging the wider US market’s 10.5% average, and earnings are expected to drop sharply by 68.5% per year over the next three years. With shrinking margins and a premium 38.6x price-to-earnings ratio, the earnings release raises questions about whether VTS’s fair value prospects and valuation can overcome slowing momentum and emerging risks.

See our full analysis for Vitesse Energy.Now let's see how these results compare to the broader narratives shaping sentiment around Vitesse. Some angles may strengthen after this update, while others could face new scrutiny.

See what the community is saying about Vitesse Energy

DCF Fair Value Towers Over Share Price

- Vitesse Energy’s DCF fair value stands at $68.68 per share, which is over three times its actual trading price of $20.84. This highlights a significant valuation gap that is much larger than the typical discount seen in the peer group.

- Analysts' consensus view suggests that for shares to close this gap, revenue must reach $369.8 million and earnings $51.9 million by 2028. The company will also need to maintain a PE ratio of 30.1x, higher than the current US Oil and Gas industry average of 11.8x.

- Consensus analysts see room for upside if balance sheet improvements and production from the Lucero acquisition materialize as expected.

- However, the required growth rates are aggressive compared to current forecasts, which anticipate only 0.9% annual revenue growth and a steep earnings decline.

- To see whether the consensus narrative holds up or faces new challenges in light of these valuation gaps, explore the details of how the market weighs risks and rewards in the full consensus narrative: 📊 Read the full Vitesse Energy Consensus Narrative.

Profit Margins Set for a Comeback

- While the most recent net profit margin sits at 8.4%, analysts expect an improvement to 14.0% within three years, in part due to anticipated benefits from the Lucero Energy acquisition.

- Analysts' consensus view highlights that the boost in future margins is tied to expanding well production and strategic hedging. It also notes that reliance on the Lucero assets means execution risk is a key factor in whether these gains are realized.

- This improvement is seen as necessary for the company to justify premium valuation multiples in a market where the average peer margin is generally higher.

- Hedging strategies should help smooth out the volatility from commodity swings but might also cap potential gains if energy prices recover strongly.

Premium Valuation Comes With Risks

- Vitesse trades at a price-to-earnings ratio of 38.6x, well above the US oil and gas average of 12.8x and the peer average of 25.1x. This raises the bar for performance and future growth expectations.

- Analysts' consensus view observes this premium valuation brings extra risk. Management will be under pressure to deliver on accretive acquisitions and efficient capital allocation, as any missteps such as sluggish revenue expansion or margin compression could trigger sharp investor reaction.

- Waivers for unsustainable dividends, share dilution concerns, and insider selling in the recent quarter further increase the challenges for justifying the higher multiple.

- If capital allocation remains flexible without a fixed capex budget, it may enhance agility but also introduce inefficiencies, impacting both earnings consistency and investor confidence.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vitesse Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? You can quickly turn your insight into a personal narrative and make your view count in just a few minutes. Do it your way

A great starting point for your Vitesse Energy research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Vitesse Energy faces premium valuation pressures, thin margins, and lackluster growth expectations. These factors challenge its ability to deliver consistent returns for investors.

If you want to focus on businesses showing reliable progress instead, check out stable growth stocks screener (2077 results) and discover companies posting steady growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTS

Vitesse Energy

Engages in the acquisition, development, and production of non-operated oil and natural gas properties in the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives