- United States

- /

- Energy Services

- /

- NYSE:VTOL

What Bristow Group (VTOL)'s Lowered 2025-2026 Outlook Means For Shareholders

Reviewed by Sasha Jovanovic

- Bristow Group recently reported third quarter results that fell below expectations, citing decreased utilization in its Offshore Energy Services segment and ongoing market challenges, prompting management to lower outlooks for both 2025 and 2026.

- Despite these setbacks, the company still forecasts adjusted EBITDA to increase by more than 25% in the next year, highlighting resilience in some areas of the business.

- To understand the impact of lowered forward guidance, we’ll assess how persistent offshore energy headwinds shape Bristow Group’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bristow Group Investment Narrative Recap

To be a shareholder in Bristow Group, you need confidence in the company’s ability to grow earnings through a mix of offshore energy and stable government contracts, even as it faces sector headwinds. The recent reduction in forward guidance is a meaningful shift, as persistent weakness in offshore energy utilization now weighs on the main short-term catalyst, margin recovery, while amplifying exposure to the business’s biggest risk: sustained pressure on its offshore operations. The impact of this update is material, directly affecting both outlook and near-term expectations.

Among recent announcements, Bristow’s ongoing share repurchase program stands out. Despite profit challenges and a tempered revenue outlook, the company continued buying back shares in Q3 2025, signaling an effort to support shareholder value and confidence during a transitional period. This move is especially relevant against lowered guidance, as it may buffer near-term downside but does not address operational challenges in its key markets.

In contrast, investors should be aware that persistent margin pressures linked to offshore energy demand could still...

Read the full narrative on Bristow Group (it's free!)

Bristow Group's narrative projects $1.9 billion revenue and $129.4 million earnings by 2028. This requires 9.0% yearly revenue growth and a $10.3 million earnings increase from $119.1 million today.

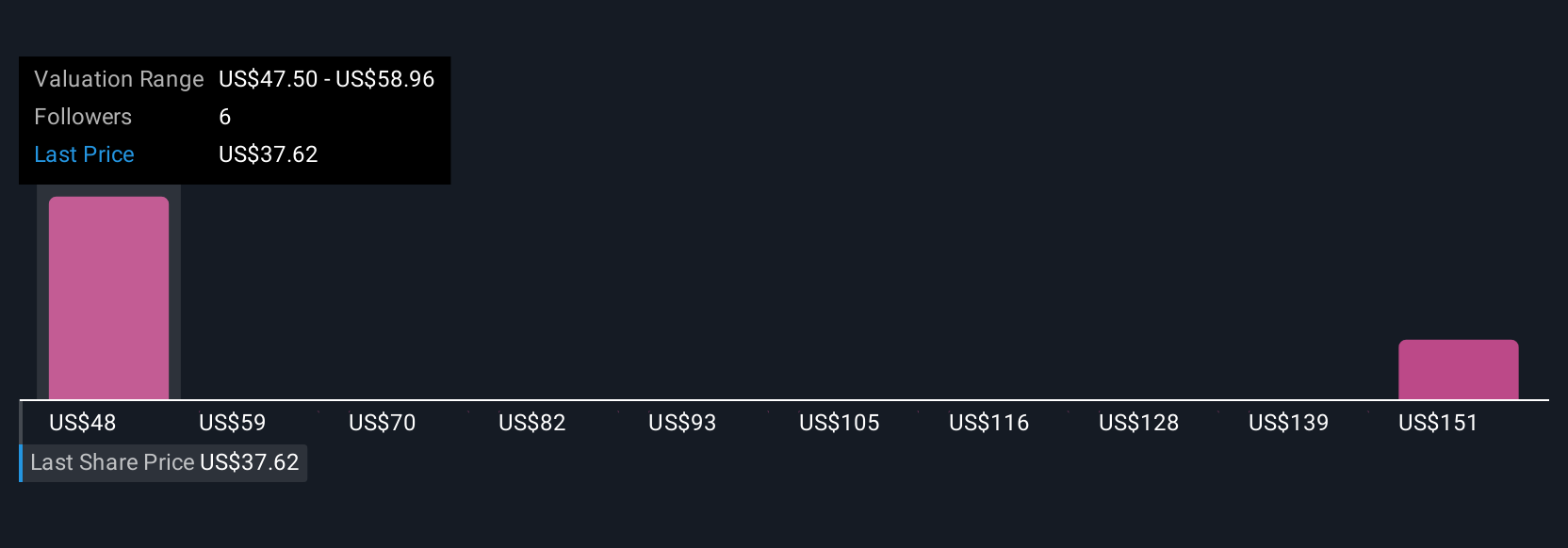

Uncover how Bristow Group's forecasts yield a $47.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Bristow, ranging widely from US$6.62 to US$47.50. While these diverse perspectives point to uncertainty around future valuation, the company’s lowered 2025 and 2026 financial guidance raises important questions about how much of Bristow’s recovery potential is already reflected in these views, make sure to compare several different opinions before deciding where you stand.

Explore 2 other fair value estimates on Bristow Group - why the stock might be worth as much as 27% more than the current price!

Build Your Own Bristow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristow Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristow Group's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTOL

Bristow Group

Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success