- United States

- /

- Energy Services

- /

- NYSE:VTOL

Can Bristow Group’s (VTOL) Share Buybacks and Revenue Guidance Shift Its Long-Term Value Proposition?

Reviewed by Sasha Jovanovic

- Bristow Group reported third quarter 2025 results on November 4, 2025, including revenues of US$386.29 million and net income of US$51.54 million, while also providing new revenue guidance for fiscal 2025 and 2026.

- An additional update was provided on the company’s ongoing share repurchase program, with 123,966 shares bought back for US$3.95 million as of September 30, 2025.

- We'll explore how Bristow Group's updated revenue outlook for 2025 and 2026 influences its longer-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bristow Group Investment Narrative Recap

To be a Bristow Group shareholder, you really need to believe in the company’s ability to capture stable, recurring revenue from government contracts while expanding its presence in global offshore energy logistics. The updated 2025 and 2026 revenue guidance confirms ongoing contract activity, which supports the most important near-term catalyst, successful execution on long-term government search and rescue agreements. However, the recent announcement does not materially reduce the biggest current risk: ongoing supply chain constraints for new aircraft and aircraft parts.

Among the recent news, the company's share buyback update is particularly relevant. Bristow has repurchased a modest total of 123,966 shares for US$3.95 million since February, a move that could signal confidence in its longer-term strategy even as supply chain risks remain the key concern for investors focused on execution of high-profile contracts.

Yet, despite encouraging progress, it’s essential for investors to also consider how persistent issues sourcing helicopters and parts could limit Bristow’s...

Read the full narrative on Bristow Group (it's free!)

Bristow Group's narrative projects $1.9 billion revenue and $129.4 million earnings by 2028. This requires 9.0% yearly revenue growth and an $10.3 million increase in earnings from $119.1 million today.

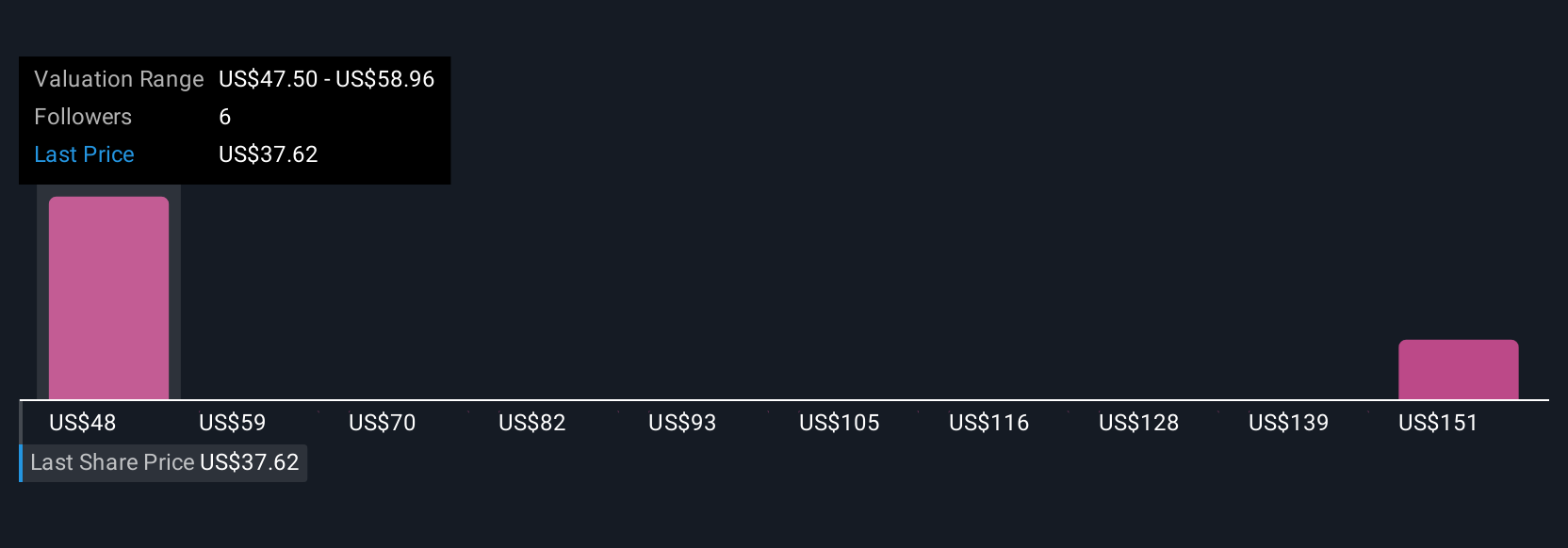

Uncover how Bristow Group's forecasts yield a $47.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Private fair value estimates from the Simply Wall St Community span from just US$6.69 to US$47.50, across 2 distinct perspectives. This diversity underscores how the company’s updated revenue guidance could be interpreted very differently, inviting you to compare multiple views on Bristow’s future performance.

Explore 2 other fair value estimates on Bristow Group - why the stock might be worth as much as 28% more than the current price!

Build Your Own Bristow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristow Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristow Group's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTOL

Bristow Group

Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives