- United States

- /

- Energy Services

- /

- NYSE:VTOL

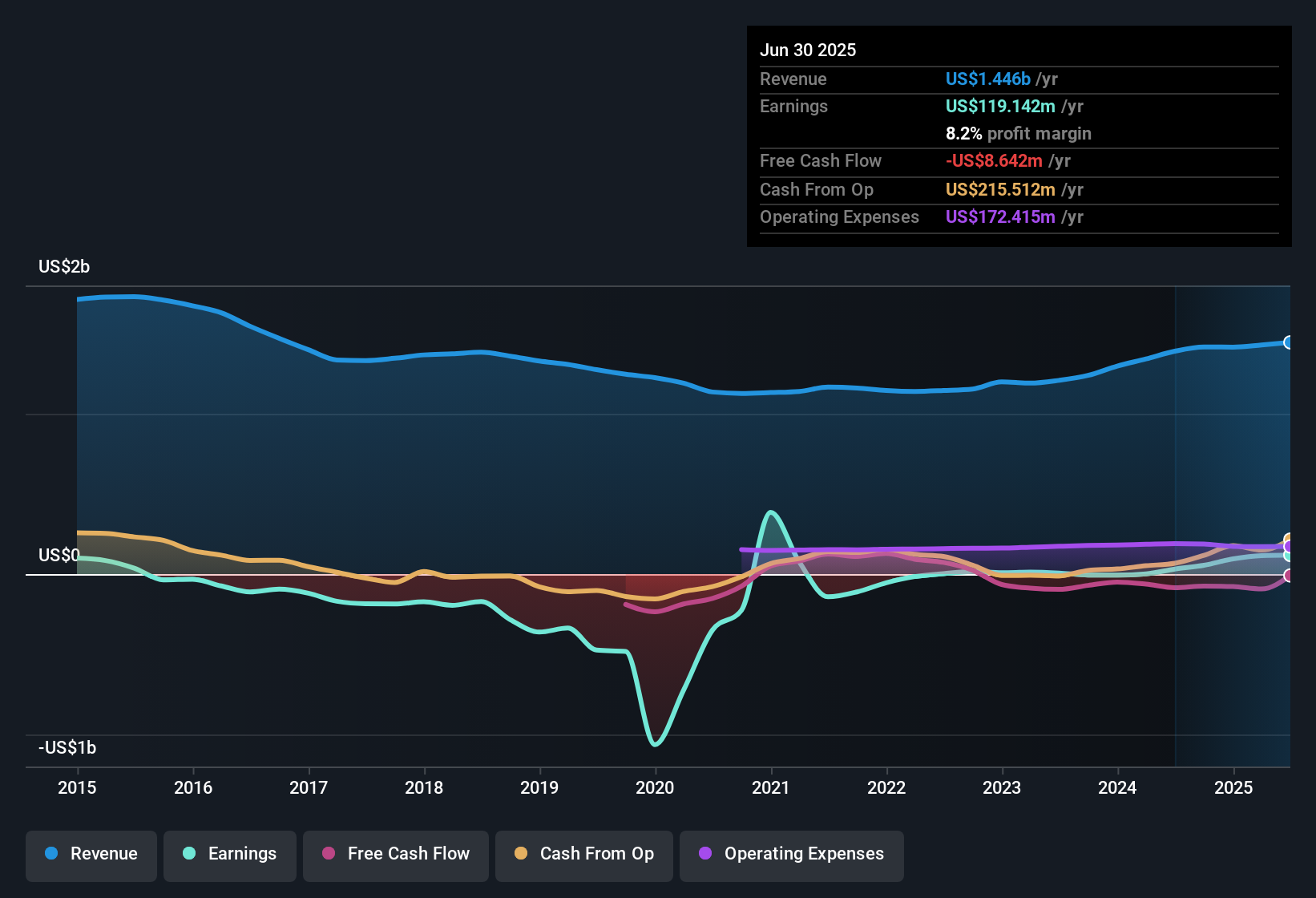

Bristow Group (VTOL) Margin Expansion Challenges Cautious Narratives as Net Profit Jumps to 8.2%

Reviewed by Simply Wall St

Bristow Group (VTOL) posted a standout earnings update, transitioning to profitability with earnings growing at 27.7% per year over the past five years. Its latest net profit margin surged to 8.2%, far outstripping last year’s 2.2%. The most recent annual earnings jumped an impressive 282.6%, which is well above the five-year trend and supports the view that Bristow is delivering high quality earnings. The stock’s Price-to-Earnings ratio sits at 9.4x, notably below both the US Energy Services industry average of 16.1x and the peer group’s 21x. This flags it as good perceived value, though the current share price of $38.75 is above a discounted cash flow estimate of $35.62. With only limited risks identified, investors are watching whether the company’s margin expansion and operational momentum can drive further gains, even as expected revenue growth trails the broader market.

See our full analysis for Bristow Group.Next up, we’ll see how these headline numbers compare to the stories that investors are telling. Some prevailing narratives may get confirmed, while others will face new questions.

See what the community is saying about Bristow Group

Recurring Revenue Locks In Stability

- The ramp-up of new long-term government search and rescue contracts in Ireland and the UK is expected to materially boost Bristow's earnings from 2026, securing stable, recurring cash flows for at least a decade.

- According to the analysts' consensus view, these multiyear contracts mean Bristow is less exposed to volatile oil cycles. Previously, revenue swings were more pronounced because of these cycles.

- Recurring public sector revenues and a diversified client base can offset dips in offshore energy demand.

- This shift could help ease the earnings volatility that often affects the sector and may provide investors with more predictability moving forward.

- To see how this transition to stable contracts connects with the broader company narrative, check out the full view in the consensus story. 📊 Read the full Bristow Group Consensus Narrative.

Margin Outlook Faces Cost Pressures

- Despite the current net margin of 8.2%, analysts forecast it will narrow to 6.9% over the next three years, even as revenues are set to climb by an estimated 9.0% per year.

- Critics highlight that persistent supply chain delays, rising maintenance costs, and heavy investment needs may erode Bristow's profitability faster than expected.

- Higher spending on training, repair, and fleet upgrades could offset revenue growth from new contracts.

- If cost pressures linger beyond current transition periods, the company's EBITDA margin expansion may stall and could challenge bullish expectations for sustained profit growth.

Discounted Valuation vs. Analyst Target

- Bristow trades at 9.4x earnings, below both the US Energy Services average (16.1x) and its peer group (21x). Its $38.75 share price is above DCF fair value of $35.62 but sits 14.2% below the analyst price target of $45.00.

- The consensus narrative points out that for the stock to meet analyst targets, it would need to grow earnings to $129.4 million and re-rate to a PE of 13.9x by 2028, a multiple still lower than today’s industry benchmark.

- This leaves Bristow potentially undervalued if it meets or beats these forecasts. This depends, however, on whether margin compression and capital demands can be managed as projected.

- The tension for investors is whether the industry discount helps create upside or instead signals caution about slower top-line growth compared to the broader market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bristow Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot fresh angles in Bristow’s recent performance? Share your interpretation and craft a unique narrative view in just minutes. Do it your way

A great starting point for your Bristow Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bristow faces margin pressures from rising costs and may see its earnings growth slow. This increases uncertainty about consistent profitability ahead.

If you’d prefer companies delivering steady expansion even when markets shift, use our stable growth stocks screener (2074 results) to focus on those maintaining reliable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTOL

Bristow Group

Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives