- United States

- /

- Oil and Gas

- /

- NYSE:VTLE

Three Undervalued Small Caps With Insider Buying In None Region

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks face a mixed environment with geopolitical tensions and economic indicators creating both challenges and opportunities. The S&P 600, representing small-cap stocks, has experienced fluctuations amid rising oil prices due to Middle East tensions and unexpected job gains in the U.S., highlighting the importance of careful stock selection. In such a dynamic setting, identifying companies with strong fundamentals and potential for growth can be key to navigating these uncertain times.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.2x | 2.1x | 49.65% | ★★★★★☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.27% | ★★★★☆☆ |

| Studsvik | 19.3x | 1.2x | 44.82% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 48.38% | ★★★★☆☆ |

| Genus | 172.2x | 2.0x | -2.94% | ★★★★☆☆ |

| MYR Group | 36.1x | 0.5x | 39.20% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -114.88% | ★★★☆☆☆ |

| HighPeak Energy | 12.9x | 1.6x | 31.28% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -205.89% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of $2.12 billion.

Operations: The company generates revenue primarily from oil and natural gas development, exploration, and production activities, reaching $1.21 billion recently. Its cost of goods sold (COGS) amounted to $204.47 million for the same period. The gross profit margin has shown variability over time, with a recent figure of 83.10%. Operating expenses include significant allocations to depreciation and amortization, which were $508.83 million in the latest report.

PE: 12.9x

HighPeak Energy, a smaller company in the energy sector, recently reported revenue of US$275.27 million for Q2 2024, up from US$240.76 million the previous year. Despite this growth, net income decreased to US$29.72 million from US$31.83 million due to lower profit margins of 12.6%. Insider confidence is evident with recent share repurchases totaling 978,989 shares for US$14.55 million by June 2024 under their buyback plan announced in February 2024.

- Click here to discover the nuances of HighPeak Energy with our detailed analytical valuation report.

Gain insights into HighPeak Energy's past trends and performance with our Past report.

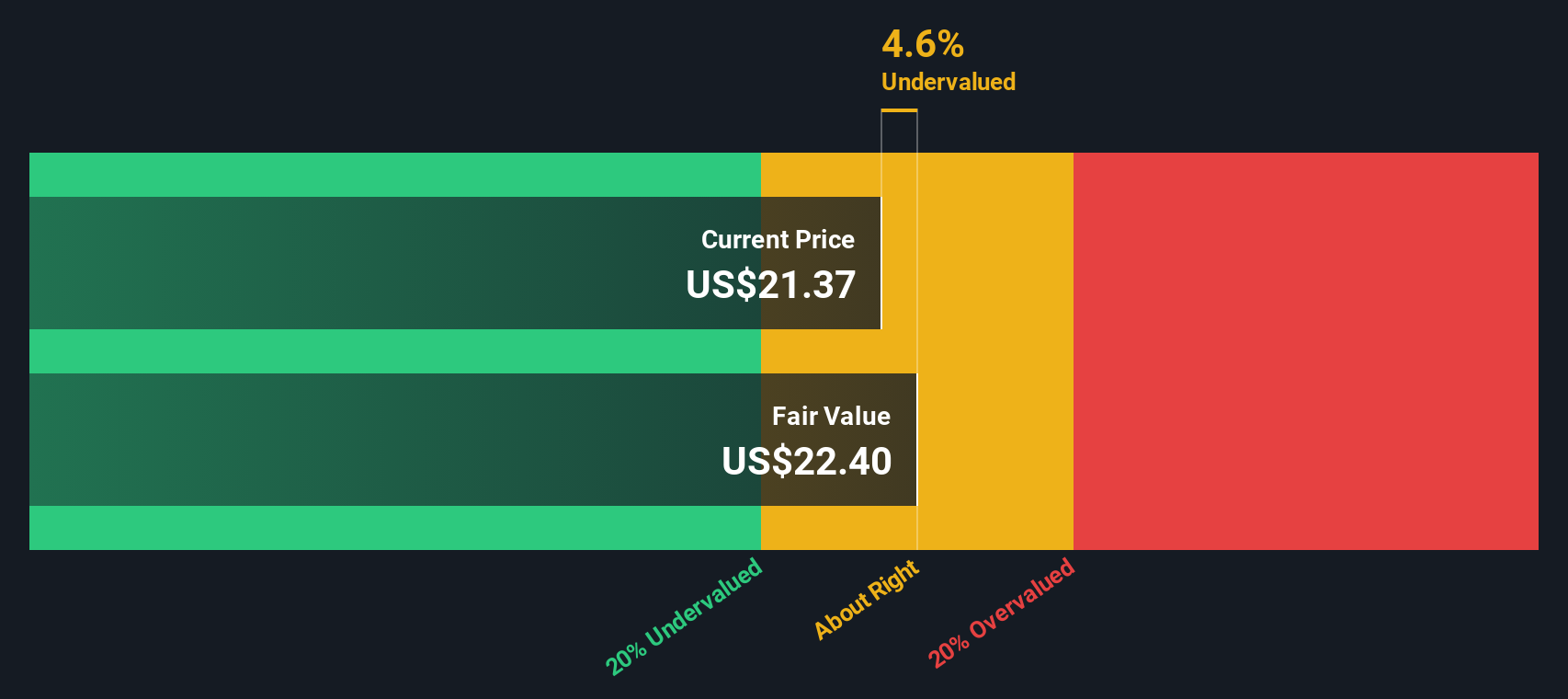

Vital Energy (NYSE:VTLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vital Energy is engaged in the exploration and production of oil and natural gas, with operations that include midstream and marketing activities, boasting a market capitalization of approximately $1.27 billion.

Operations: Vital Energy's revenue primarily stems from its exploration and production activities, including midstream and marketing operations, totaling $1.84 billion. The company's cost of goods sold (COGS) is $532.99 million, contributing to a gross profit margin of 71.01%.

PE: 4.5x

Vital Energy, a smaller player in the energy sector, has seen insider confidence with recent share purchases. Despite a challenging year with diluted earnings per share dropping from US$16.3 to US$0.98 and net income falling significantly, the company is increasing production guidance for 2024, expecting up to 140 MBOE/d in Q4. Revenue grew to US$476 million in Q2 from US$335 million last year, indicating potential for recovery amidst high debt levels and reliance on external funding.

- Click to explore a detailed breakdown of our findings in Vital Energy's valuation report.

Explore historical data to track Vital Energy's performance over time in our Past section.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading industrial group in China specializing in the production and distribution of building materials and interior decoration products, with a market cap of CN¥19.84 billion.

Operations: Revenue primarily stems from the Plastics & Rubber segment, with gross profit margin showing fluctuations, reaching 29.80% in December 2020 before settling at 26.04% by June 2024. Operating expenses have varied over time, impacting net income margins which peaked at 13.36% in March 2021 but decreased to approximately 6.58% by June 2024.

PE: 6.5x

China Lesso Group Holdings, a smaller company in its sector, recently reported a decline in half-year sales to CNY 13.56 billion from CNY 15.30 billion the previous year, while net income fell to CNY 1.04 billion from CNY 1.49 billion. Despite these challenges, insider confidence is evident as Founder and Executive Chairman Luen Hei Wong purchased 4 million shares for about US$10 million, indicating faith in future growth prospects despite high debt levels and reliance on external borrowing for funding. Earnings are projected to grow annually by over 10%, suggesting potential for recovery and value realization over time.

- Get an in-depth perspective on China Lesso Group Holdings' performance by reading our valuation report here.

Learn about China Lesso Group Holdings' historical performance.

Make It Happen

- Navigate through the entire inventory of 192 Undervalued Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTLE

Vital Energy

An independent energy company, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026