- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO): Examining Valuation Following CFO Transition and Renewed Shareholder Confidence

Reviewed by Simply Wall St

Valero Energy (NYSE:VLO) is making headlines after announcing that Homer Bhullar will step into the Chief Financial Officer role starting January 2026, as Jason Fraser prepares to retire. Investors are watching the move closely, given Valero’s track record of shareholder returns and steady dividends.

See our latest analysis for Valero Energy.

Shares of Valero Energy have surged, with a 90-day share price return of 27.3% pushing the stock to $169.56, and the 1-year total shareholder return sitting just under 37%. Momentum is clearly building, supported by steady dividends, ongoing buybacks, and robust quarterly earnings, helping Valero stand out even as sector peers consolidate.

If you’re interested in other companies showing both resilience and insider confidence, now’s the perfect moment to explore fast growing stocks with high insider ownership.

With such standout performance and executive changes in view, the key question is whether Valero Energy’s current valuation offers a real bargain, or if the market has already priced in all of its future growth potential.

Most Popular Narrative: 3.5% Undervalued

Valero Energy’s latest widely followed narrative puts its fair value estimate at $175.63 per share, just above the recent close of $169.56. This narrows the gap and has investors watching closely for what could move the stock next.

The SEC unit optimization project at St. Charles, expected to start up in 2026, is projected to increase the yield of high-value products, potentially boosting future revenues and earnings. Anticipated tight product supply and demand balances, with low product inventories, are expected to support refining fundamentals during the driving season, possibly enhancing refining margins and revenues.

Wondering what’s really behind this valuation uptick? The narrative is driven by bold, forward-looking shifts such as game-changing operational upgrades and ambitious profit assumptions. Click to uncover the exact projections that have analysts recalibrating their fair value for Valero.

Result: Fair Value of $175.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook could quickly change if regulatory hurdles or unexpected operational issues put pressure on Valero’s profit margins and earnings momentum.

Find out about the key risks to this Valero Energy narrative.

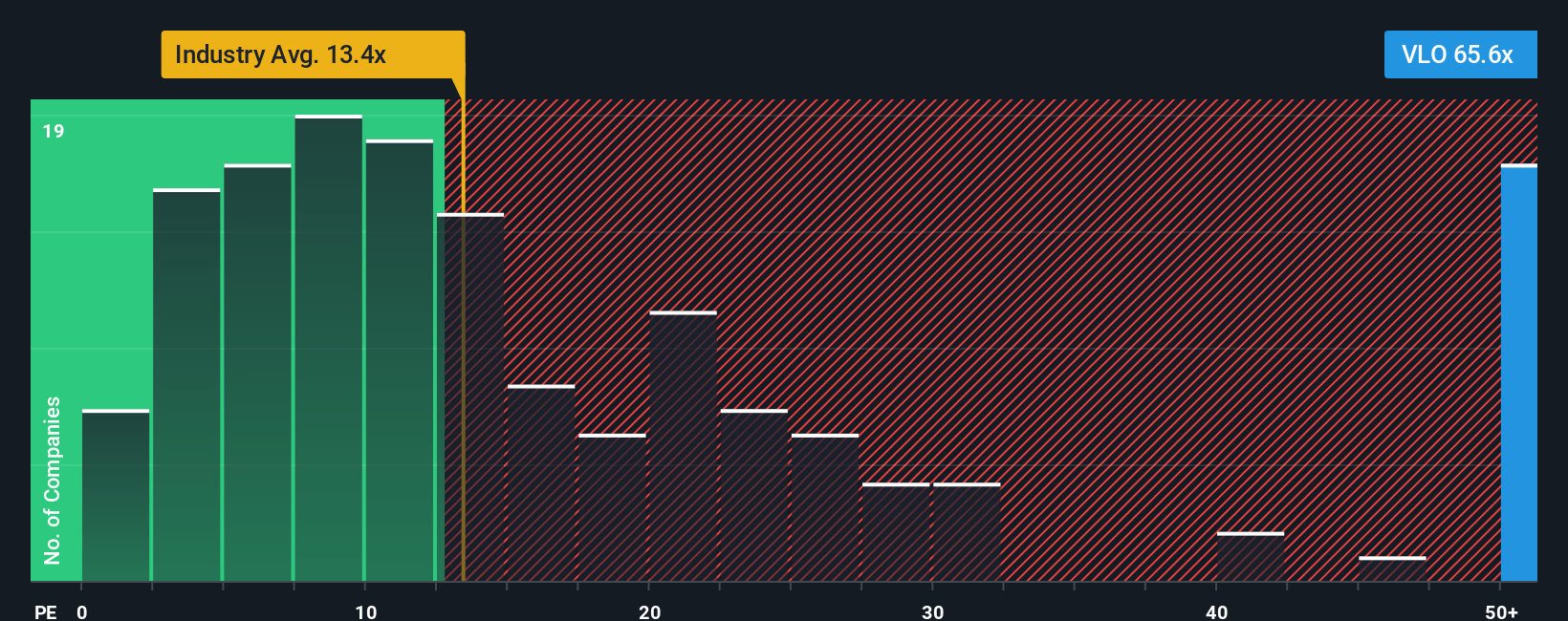

Another View: Price Ratios Tell a Different Story

While fair value estimates point to Valero being undervalued, a closer look at its current price-to-earnings ratio of 34.7x shows the stock trading well above both the industry average (12.6x) and its fair ratio (21.6x). This sizeable gap suggests investors might be paying a premium, raising real questions about near-term upside or downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valero Energy Narrative

If you see things differently or enjoy digging into the numbers yourself, you can quickly build your own view based on the latest data. Give it a try with Do it your way.

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Miss a chance, miss an opportunity. If you want to stay ahead, now is the moment to unlock powerful stock ideas built on real market insights.

- Uncover rising potential in the digital currency space with these 81 cryptocurrency and blockchain stocks. Companies are fueling the next phase of blockchain innovation and financial transformation.

- Accelerate your search for reliable yields by checking out these 22 dividend stocks with yields > 3%. These companies offer attractive dividends above 3% for steady income and growth.

- Jump on the AI trend and target future leaders through these 26 AI penny stocks. This screener spotlights promising businesses advancing artificial intelligence and machine learning breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives