- United States

- /

- Oil and Gas

- /

- NYSE:VLO

How Valero’s Leadership Transition and Capital Returns May Shape the Outlook for Investors (VLO)

Reviewed by Sasha Jovanovic

- Valero Energy recently announced the appointment of Homer Bhullar as Senior Vice President and Chief Financial Officer, effective January 1, 2026, following Jason Fraser's retirement, reaffirmed its US$1.13 per share dividend, and completed a significant share repurchase totaling over US$4.56 billion as of September 30, 2025.

- This combination of executive leadership transition, continued capital returns through dividends and buybacks, and stronger-than-expected quarterly earnings reflects focused capital management and operational momentum for the company.

- We'll examine how Valero's robust earnings and enhanced shareholder returns could influence its investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Valero Energy Investment Narrative Recap

To be a Valero Energy shareholder, you need confidence in the company's ability to balance steady capital returns and operational discipline against market pressures and regulatory uncertainties. The recent announcement of Homer Bhullar as the incoming CFO, along with continued dividend payments and robust share buybacks, does not materially shift the largest short-term catalyst, margin improvements from efficient refining, and the primary risk, which remains regulatory or financial impacts from California operations and renewable diesel challenges.

Of the recent announcements, Valero’s completed share buyback totaling over US$4.56 billion stands out in the context of catalysts supporting shareholder returns. This significant repurchase effort, alongside stable dividends, highlights an ongoing commitment to returning excess capital, even as earnings remain sensitive to profitability shifts linked to operational and regulatory headwinds.

By contrast, the full effects of California policy changes and potential plant closures represent information investors should keep in mind…

Read the full narrative on Valero Energy (it's free!)

Valero Energy's outlook anticipates $116.8 billion in revenue and $3.8 billion in earnings by 2028. This is based on a 0.2% annual revenue decline and an increase in earnings of $3.04 billion from the current $760 million.

Uncover how Valero Energy's forecasts yield a $175.63 fair value, a 4% upside to its current price.

Exploring Other Perspectives

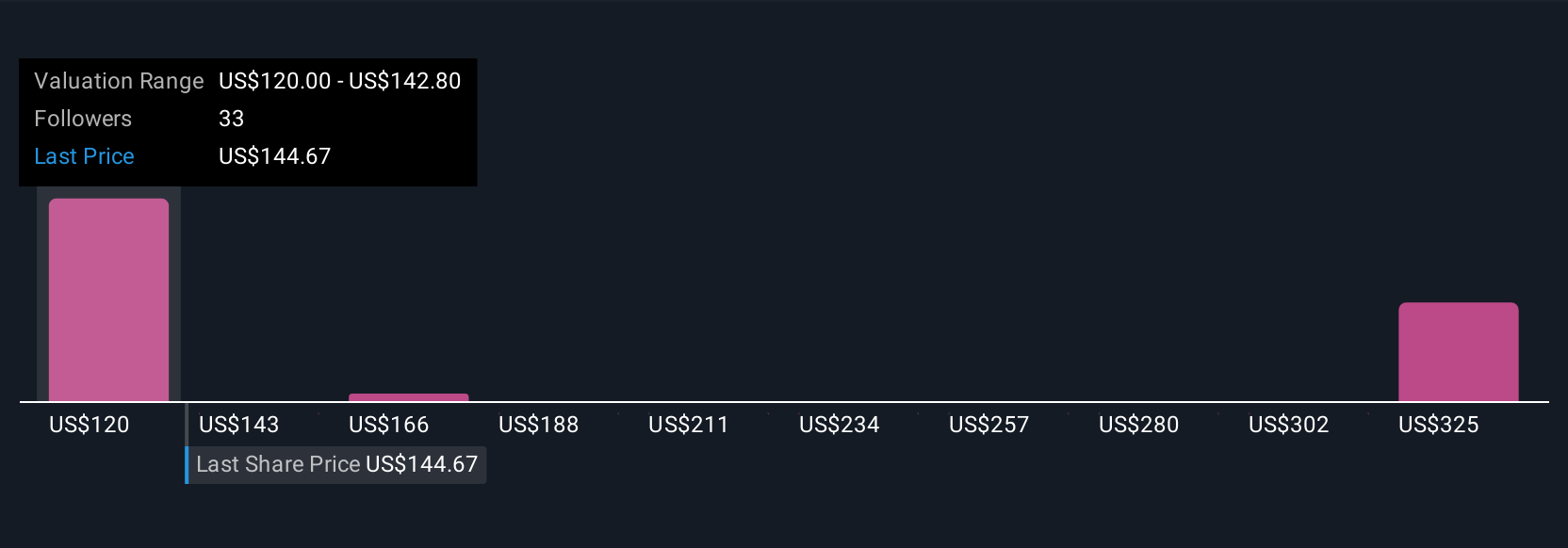

Simply Wall St Community members offered four fair value estimates for Valero Energy, ranging widely from US$128 to US$335 per share. While views differ sharply, many remain focused on the earnings impact of regulatory changes, making it essential to consider several angles when evaluating the company’s potential.

Explore 4 other fair value estimates on Valero Energy - why the stock might be worth as much as 98% more than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives