- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Has Valero Energy’s 38% 2025 Price Rally Left Room for Further Gains?

Reviewed by Bailey Pemberton

- Ever wondered if Valero Energy's impressive price run means it's still a smart investment, or if the value story has already played out?

- Valero's shares have delivered a strong 38.2% gain year-to-date and are up 26.7% over the past year. The past week saw a modest 0.3% dip.

- Recent headlines have highlighted ongoing supply chain challenges and fluctuations in oil prices, putting energy companies in the spotlight. For Valero, renewed optimism around refining margins and positive sentiment about infrastructure investments have been fueling recent momentum.

- On the valuation front, Valero currently scores 2 out of 6, suggesting there may still be value gaps to explore. Next, we’ll break down what this means using a range of valuation methods and uncover whether there's a smarter, more up-to-date way to gauge the stock's true worth.

Valero Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Valero Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company's intrinsic value by projecting its expected future cash flows and then discounting those amounts back to today using a risk-adjusted rate. In simple terms, it is a method that aims to translate future profit potential into a current-dollar figure, giving investors a benchmark for comparison to the market price.

For Valero Energy, the latest reported Free Cash Flow stands at $4.0 Billion. According to available analyst estimates and forecasting models, this figure is expected to grow modestly over the coming years. The ten-year projection for free cash flow in 2029 is $4.64 Billion, with further increases extrapolated to about $5.19 Billion in 2035. Analysts provide direct estimates for the next five years, while projections beyond that are based on growth trends modeled by Simply Wall St.

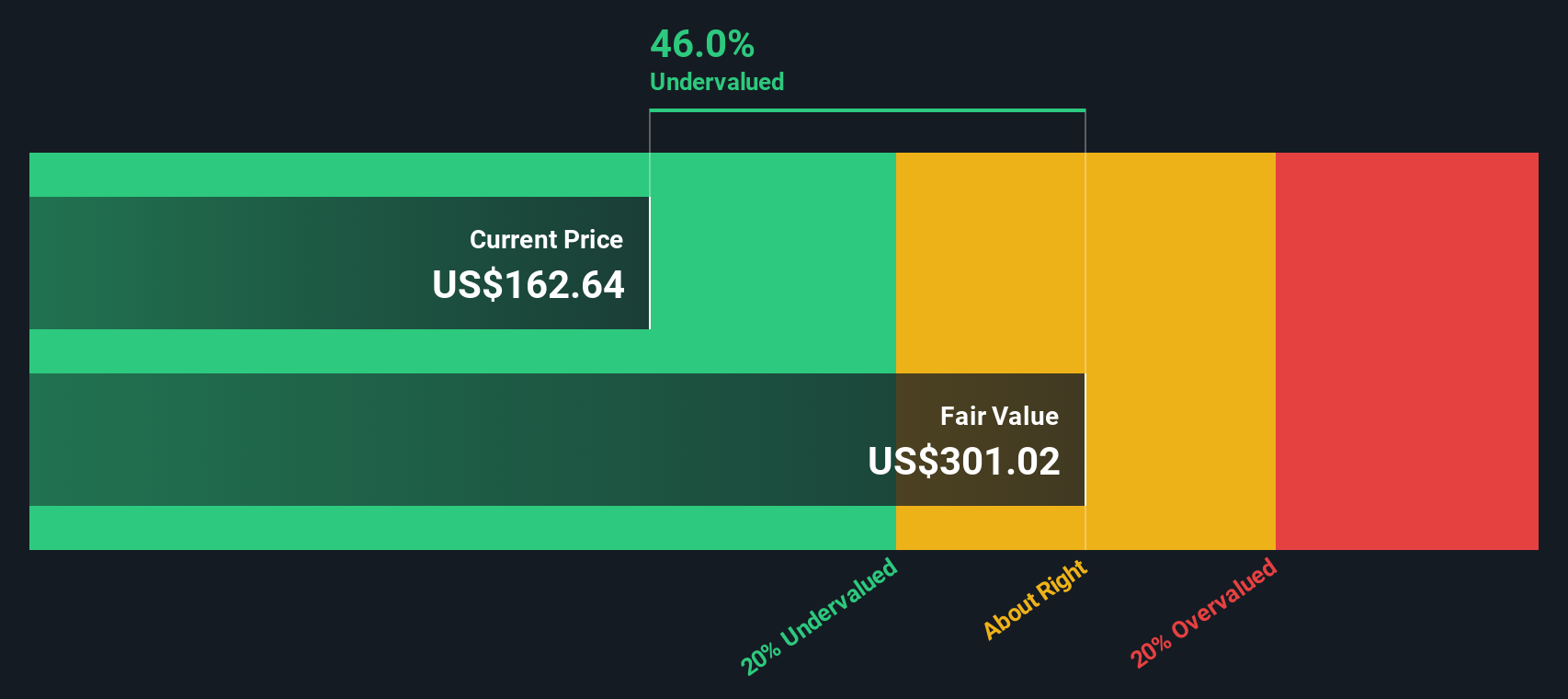

Based on the 2 Stage Free Cash Flow to Equity model, Valero Energy's calculated intrinsic value is $353.50 per share. Given the current market price, this equates to an implied discount of 51.9%, which suggests the stock is significantly undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Valero Energy is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Valero Energy Price vs Earnings

For profitable companies like Valero Energy, the Price-to-Earnings (PE) ratio is a widely used and intuitive valuation metric. It helps investors gauge how much they are paying for each dollar of the company's earnings, offering a direct way to compare value across similar businesses.

The "right" or fair PE ratio is not the same for every company. It often depends on how quickly earnings are expected to grow, the risks involved in the business, and overall market sentiment. Companies with strong growth prospects or lower risks can often justify higher PE ratios, while mature or riskier businesses usually trade at lower multiples.

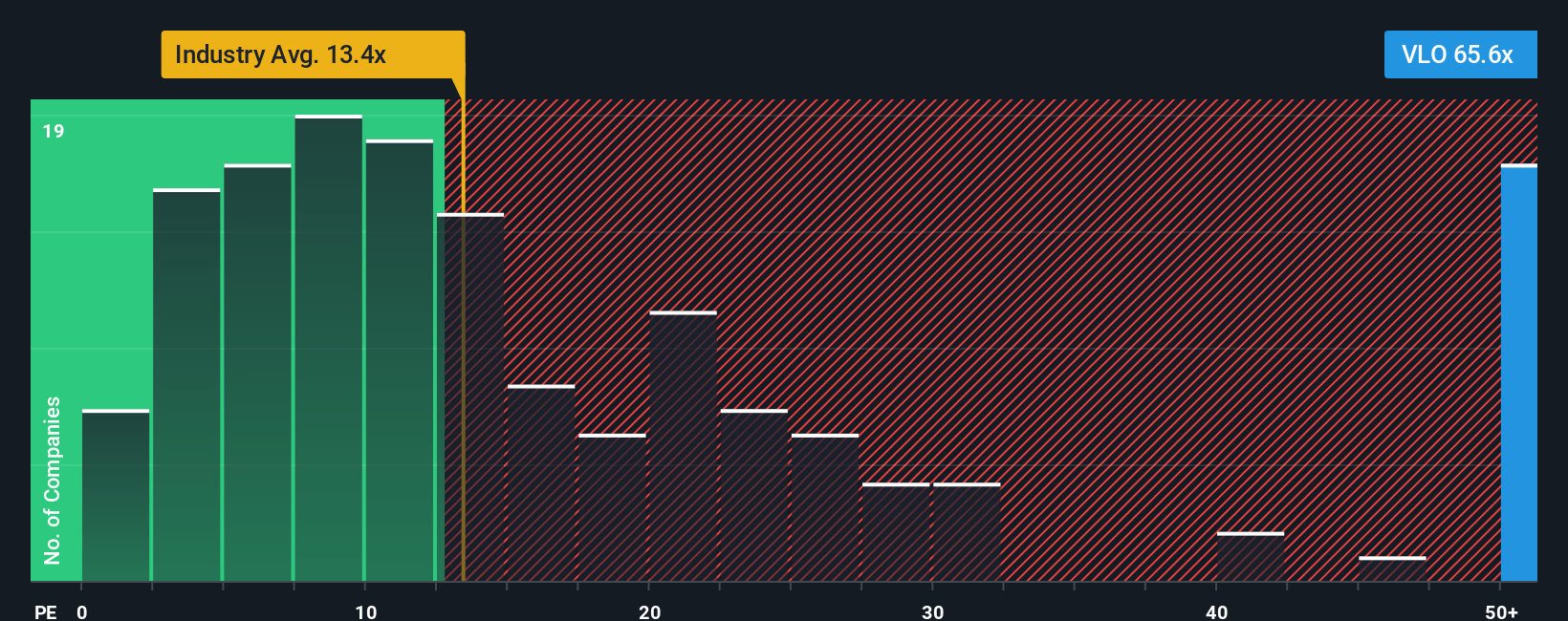

Currently, Valero Energy is trading at a PE ratio of 34.8x. This is notably higher than the Oil and Gas industry average of 12.8x and above the average for its public peers at 26.7x. This might initially suggest Valero is expensive relative to its sector.

However, the proprietary "Fair Ratio" calculated by Simply Wall St for Valero is 22.0x. This metric is based on a more holistic view, factoring in the company’s profit margins, growth trends, industry classification, market cap, and key risks. Unlike simple industry or peer comparisons, the Fair Ratio provides a tailored estimate of what the PE should be for Valero specifically. This helps investors avoid misleading conclusions drawn from blanket averages.

In this case, Valero's actual PE ratio of 34.8x is meaningfully higher than its Fair Ratio of 22.0x. This suggests the stock is overvalued based on earnings potential and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valero Energy Narrative

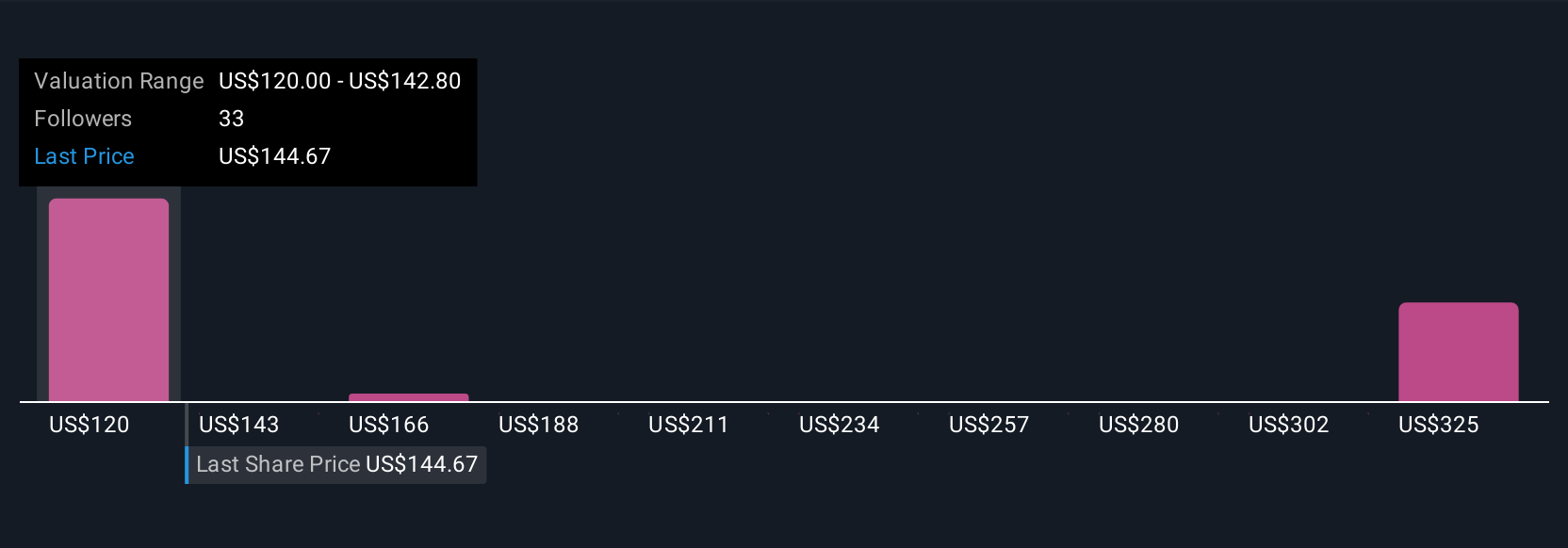

Earlier, we mentioned there is a smarter, more dynamic way to understand valuation, so let's introduce Narratives. A Narrative is simply the story an investor believes about a company’s future, tied directly to their own assumptions about fair value, future revenue, earnings, and profit margins. Rather than looking at stocks only through rigid metrics, Narratives connect what’s happening in the business world to how those events might play out financially. This makes your valuation personal and actionable.

Narratives are an easy-to-use feature available on Simply Wall St’s Community page, where millions of investors share their views and forecasts. These tools bring together your perspective, the latest company developments, and your chosen numbers. They help you decide whether now is the best time to buy or sell by directly comparing your Fair Value with the current stock price. As news or earnings are released, Narratives update automatically so your story stays relevant and up to date.

For example, some Valero Energy investors may be optimistic, predicting a fair value of $181 per share based on anticipated growth in refining margins and dividends. Others remain cautious with a fair value closer to $133 due to regulatory and cost risks. With Narratives, you build your view using your numbers so you can invest with clarity and conviction.

Do you think there's more to the story for Valero Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives