- United States

- /

- Oil and Gas

- /

- NYSE:VG

Venture Global (VG): Evaluating Valuation Following Q3 Profit and New Long-Term LNG Export Deals

Reviewed by Simply Wall St

Venture Global (NYSE:VG) has caught investor attention after swinging to a third-quarter profit and reporting record revenues from surging liquefied natural gas exports. New long-term supply deals with Mitsui and Atlantic-SEE are also expanding the company’s growth pipeline.

See our latest analysis for Venture Global.

After a turbulent stretch in 2025, Venture Global's recent third-quarter profit and a wave of new long-term LNG contracts have brought renewed optimism. However, it is clear the market is still weighing risks. Despite upbeat earnings and international deals, the company’s share price return year-to-date sits at -67.25%, reflecting the impact of earlier legal disputes and lingering caution even as growth momentum builds around LNG exports and major project milestones.

If Venture Global’s turnaround has you thinking bigger, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at less than half of analyst price targets, is Venture Global's transformation still misunderstood by the market, or has Wall Street already factored in all of the company’s newly won long-term contracts and momentum?

Price-to-Earnings of 9.3x: Is it justified?

Venture Global’s shares currently trade at a price-to-earnings (P/E) ratio of 9.3x, which signals the market is valuing its earnings at a notable discount. With the last close price at $7.86, this P/E is well below what is commonly seen for its US oil and gas peers and the broader industry.

The price-to-earnings ratio tells investors how much they are paying for each dollar of current earnings, making it a popular tool for evaluating companies with consistent profit generation. For an established LNG exporter like Venture Global, a low P/E often prompts questions about the sustainability of earnings and market sentiment toward future growth.

In this case, Venture Global’s 9.3x multiple is well below the US oil and gas industry average of 14.3x and peer average of 25x. Even compared to the estimated fair price-to-earnings ratio of 11.1x, the market is applying a steeper discount than regression-based analysis suggests is warranted. This could signal that investors remain skeptical about the persistence of recent profit gains or expect volatility ahead.

Explore the SWS fair ratio for Venture Global

Result: Price-to-Earnings of 9.3x (UNDERVALUED)

However, continued legal uncertainties and recent annual net income declines could challenge the sustainability of Venture Global’s turnaround story if these issues are not addressed.

Find out about the key risks to this Venture Global narrative.

Another View: What Does a DCF Analysis Reveal?

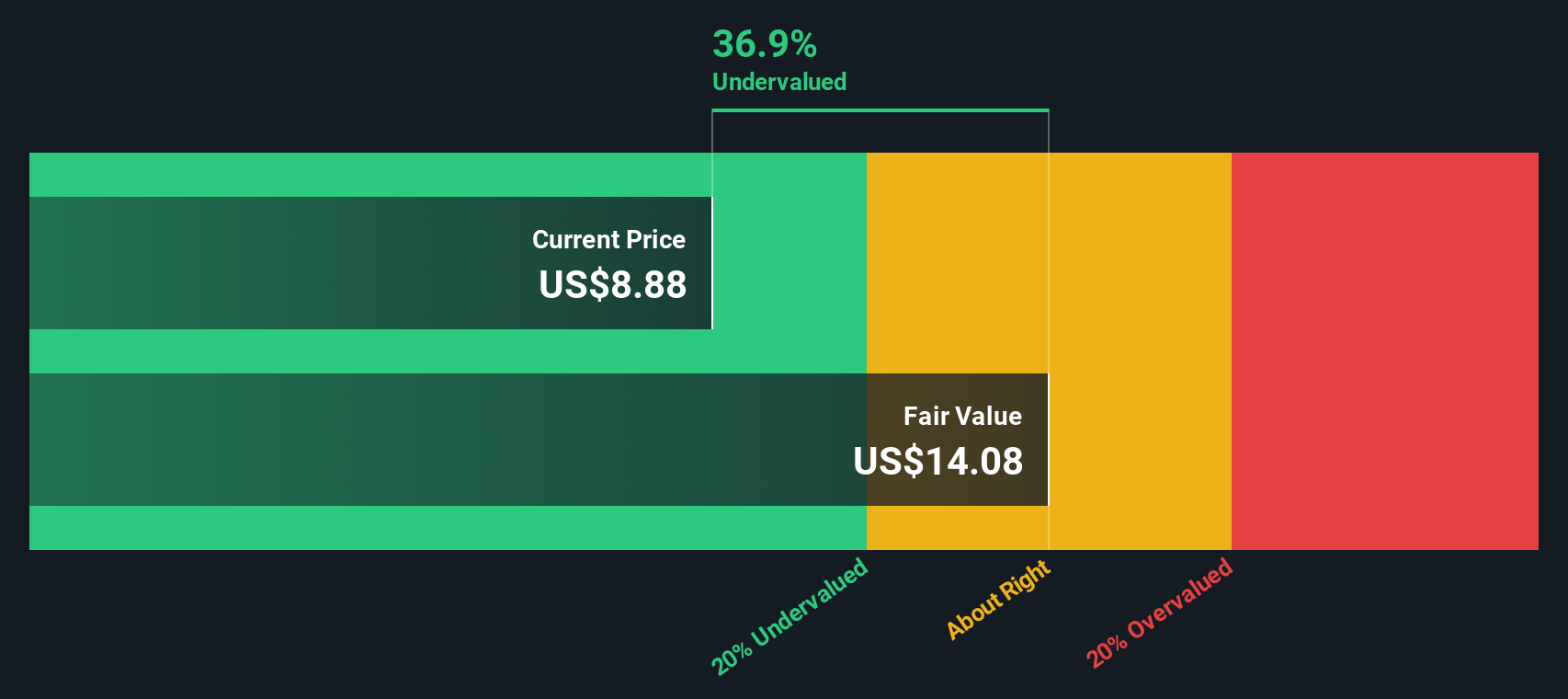

Stepping away from earnings multiples, the SWS DCF model values Venture Global shares at $14.77, which is significantly higher than the current market price of $7.86. This approach suggests the stock is undervalued if future cash flows materialize as expected. However, does the DCF tell the whole story, or are there risks it misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Venture Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Venture Global Narrative

If you see the story differently, or want to dig into the numbers yourself, you can shape your own take in under three minutes, Do it your way

A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always having a few new opportunities on your radar. Don’t let these unique stock picks pass you by. The right screener could lead you to your next big winner.

- Kickstart your search for growth by targeting these 882 undervalued stocks based on cash flows that have the strongest cash flow potential in today’s market.

- Strengthen your portfolio’s future with these 27 AI penny stocks making major strides in artificial intelligence and automation.

- Boost your income stream by selecting these 15 dividend stocks with yields > 3% offering impressive dividend yields and solid financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives