- United States

- /

- Energy Services

- /

- NYSE:VAL

Valaris (VAL): Assessing Valuation After Q3 Profit Jump and Share Buyback Completion

Reviewed by Simply Wall St

Valaris (VAL) just released its third quarter earnings, with net income rising to $188 million from $65 million last year even though revenue slipped. The company also completed a major share buyback.

See our latest analysis for Valaris.

Valaris has been gaining momentum, with a 19% share price return over the last 90 days and a strong 9% gain in the past month. This suggests that investors are reacting positively to improving profitability and shareholder-friendly moves like the recent buyback. Over the long run, the one-year total shareholder return is up 15%, but shares remain below where they were three years ago. This reflects a recovery that has taken time to build, but appears to be picking up steam in 2024.

If the company’s renewed strength in earnings and buybacks has you rethinking your approach, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares delivering double-digit gains over the last quarter and now trading close to consensus analyst targets, is Valaris still undervalued, or has the recent rally already priced in the company’s recovery and future growth?

Most Popular Narrative: 6% Overvalued

The current most-followed valuation narrative sees Valaris near its fair value, with the narrative's fair value of $53.70 sitting slightly below the last close at $56.99. The narrative signals momentum from new contracts and aggressive buybacks, but hints that the recent share price rally may have gone a touch too far.

The company's $4.7 billion contract backlog, its highest of the decade, reflects continued success in winning attractive, multi-year contracts for its high-specification fleet, supported by robust global offshore activity and rising demand for deepwater projects. This strong backlog visibility points to increasing future revenue and earnings stability.

Want to know what keeps Valaris trading above its fair value target? Find out which forward-looking numbers and industry shifts are the backbone of this narrative. Are analysts counting on profit spikes, tighter rig supply, or just betting on long-term contracts? Get the inside story that shapes these projections. There could be a surprise in how the market is pricing growth versus risk.

Result: Fair Value of $53.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry overcapacity or sudden regulatory changes could threaten Valaris’s earnings outlook. This may challenge the current consensus narrative.

Find out about the key risks to this Valaris narrative.

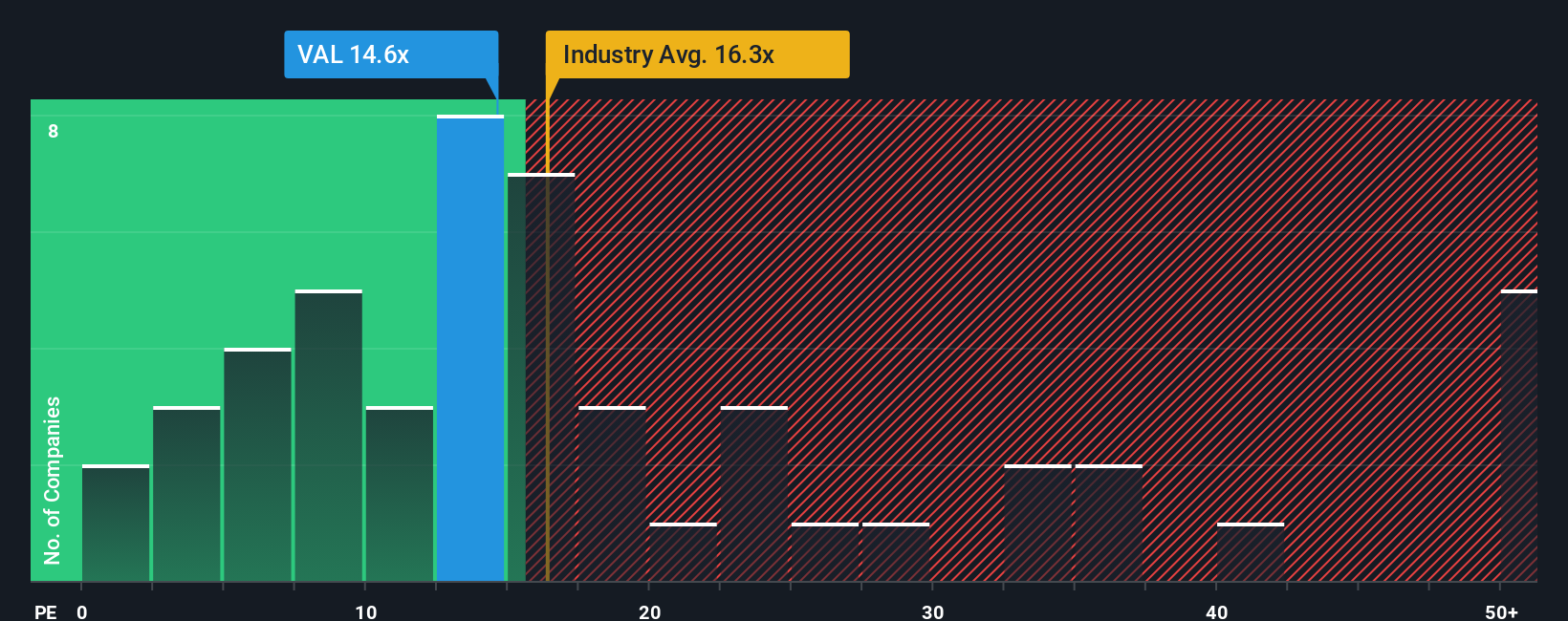

Another View: What Does the Market Multiple Say?

While the analyst narrative sees Valaris as a touch overvalued, the market’s go-to metric, the price-to-earnings ratio, paints a different picture. Valaris trades at just 9.9x earnings, well below the industry average of 16.4x and the fair ratio of 14.8x. This sizable gap suggests the market is still cautious about Valaris’s risks, but it could also signal opportunity if the business truly delivers improved stability and growth. Will investors come around, or does the discount reflect concerns analysts might be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valaris Narrative

If you see things differently or believe your own research could reveal another side of the story, it’s quick and simple to craft your own perspective. Start now and Do it your way

A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t put all your focus on one stock. Broaden your outlook with new opportunities that could add strength, growth, and resilience to your portfolio.

- Tap into high-tech breakthroughs by checking out these 26 AI penny stocks. Ambitious companies are transforming industries through artificial intelligence advancements.

- Boost your income potential with these 18 dividend stocks with yields > 3%. These companies deliver attractive yields exceeding 3% to reward consistent investors.

- Get ahead of the curve by exploring these 82 cryptocurrency and blockchain stocks. Discover businesses shaping the next era of decentralized finance and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives