- United States

- /

- Energy Services

- /

- NYSE:USAC

A Look at USA Compression Partners's Valuation Following Strong Q3 Earnings and Upward Forecasts

Reviewed by Simply Wall St

USA Compression Partners (USAC) just released its third quarter results, showing a sharp jump in both revenue and net income compared to last year. The quarter delivered performance that outpaced expectations and points to positive momentum moving into year end.

See our latest analysis for USA Compression Partners.

Shares of USA Compression Partners have shown pockets of strong momentum lately, with a 2.94% pop in the last trading day and an impressive 8.99% gain over the past week. While the year-to-date share price return sits near 1%, it is the longer-term picture that stands out. Total shareholder return has reached 13.73% over the past year and 285% over the past five years, highlighting how operational improvements and rising estimates are being recognized by the market.

If you're interested in finding more companies on a growth upswing, it’s worth taking the next step to discover fast growing stocks with high insider ownership

With results beating analyst expectations and shares trading below the latest price targets, the key debate now is whether USA Compression Partners remains undervalued or if the recent surge means the market has already priced in the future growth.

Most Popular Narrative: 8.9% Undervalued

Compared to the latest closing price, the most widely followed narrative calculates a fair value that is materially above where USA Compression Partners shares currently trade. This has sparked renewed attention on what is powering that upside.

Robust growth in natural gas demand fueled by AI, cloud computing, and massive new data center investments is driving a sustained need for reliable, high-horsepower compression solutions. This positions USAC for ongoing contract wins and steady revenue growth. Continued expansion in LNG export capacity and related infrastructure is creating long-term volume growth opportunities for midstream service providers, favoring USAC's specialized fleet and supporting utilization, earnings, and margin strength.

Want to see what is really powering that valuation lift? There is a bold forecast about margins and a future earnings leap that you will not want to miss. Curious how top-line stability, cash flow growth, and high-gear contract wins all blend together for this target? Keep digging to uncover which vital trends tilt the numbers in USAC’s favor.

Result: Fair Value of $26.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on a few large customers and rising costs could quickly change the outlook for USAC’s steady growth and earnings.

Find out about the key risks to this USA Compression Partners narrative.

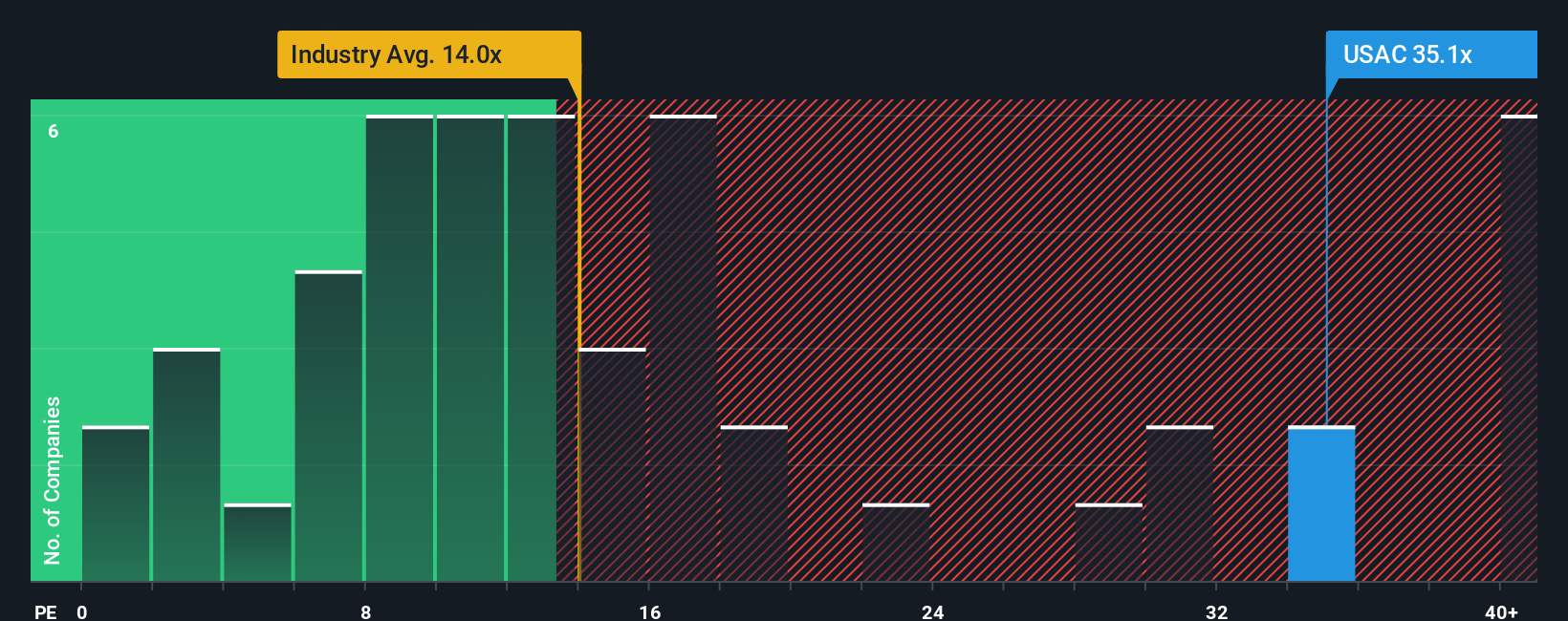

Another View: Market Ratios Tell a Different Story

Looking at valuation through the lens of the price-to-earnings ratio offers a more cautious take. USA Compression Partners trades on a P/E of 30.7x, which is higher than both the US Energy Services industry average of 16.1x and the peer average of 27.6x. Compared to a fair ratio of 19.9x, the market could be signaling elevated expectations or overpricing that might not be sustained if growth slows. Does this gap highlight risk or simply reflect optimism about the company’s future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own USA Compression Partners Narrative

If you see the story differently or want to chart your own course, you can dive into the numbers and piece together your perspective in just a few minutes. Do it your way

A great starting point for your USA Compression Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let smart investing set you apart from the crowd. Use the Simply Wall Street Screener to spot unique opportunities others might overlook and grow your portfolio with confidence.

- Capture consistent income by checking out these 17 dividend stocks with yields > 3% with standout yields surpassing 3% for a powerful dividend strategy.

- Stay ahead of innovation by reviewing these 25 AI penny stocks at the forefront of AI breakthroughs and transformation across industries.

- Capitalize on potential bargains with these 861 undervalued stocks based on cash flows that trade below their true cash flow value, offering opportunities before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USAC

USA Compression Partners

Provides natural gas compression services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives