- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

US Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with major indexes showing both gains and losses, investors are closely monitoring economic indicators and corporate earnings for guidance. In this environment, high insider ownership in growth companies can be a promising signal of confidence from those who know the business best. Understanding which growth companies have significant insider ownership can provide valuable insights into potential long-term investment opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.1% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

Here we highlight a subset of our preferred stocks from the screener.

Canadian Solar (NasdaqGS:CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

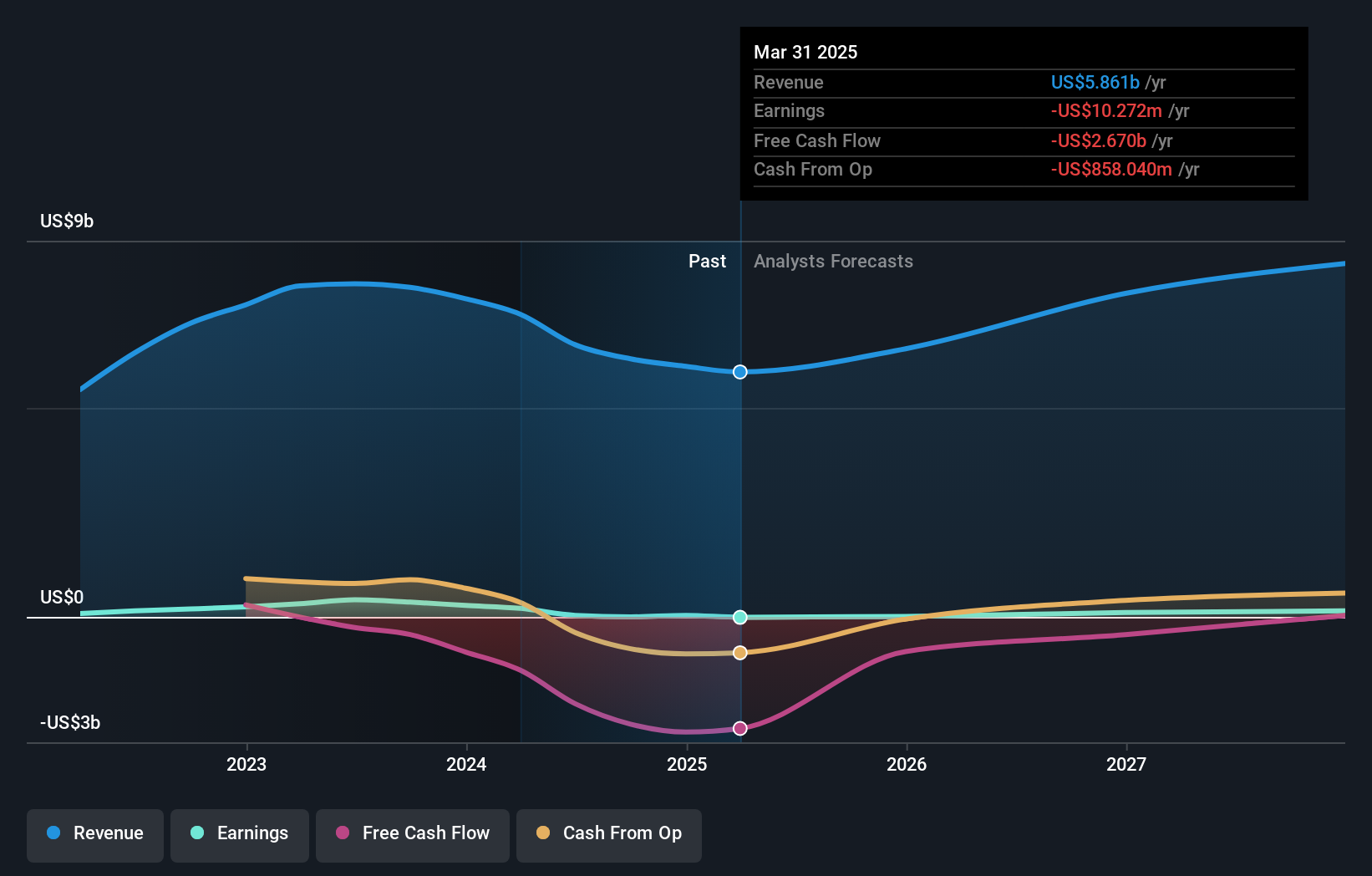

Overview: Canadian Solar Inc., along with its subsidiaries, offers solar energy and battery storage products and solutions globally, with a market cap of $862.77 million.

Operations: Canadian Solar's revenue is primarily derived from its CSI Solar segment, which generated $6.58 billion, and its Recurrent Energy segment, which contributed $207.51 million.

Insider Ownership: 21.2%

Revenue Growth Forecast: 14.2% p.a.

Canadian Solar, a growth company with high insider ownership, faces mixed prospects. Recent earnings showed a significant drop in net income to US$3.82 million for Q2 2024 from US$169.97 million the previous year. Despite this, the company expects strong future earnings growth of 80% annually over the next three years and revenue growth of 14.2% per year. A recent $200 million convertible notes issuance indicates confidence from new investors like PAG, supporting further expansion initiatives such as partnerships and product launches in residential energy storage solutions.

- Click here and access our complete growth analysis report to understand the dynamics of Canadian Solar.

- The analysis detailed in our Canadian Solar valuation report hints at an inflated share price compared to its estimated value.

TETRA Technologies (NYSE:TTI)

Simply Wall St Growth Rating: ★★★★☆☆

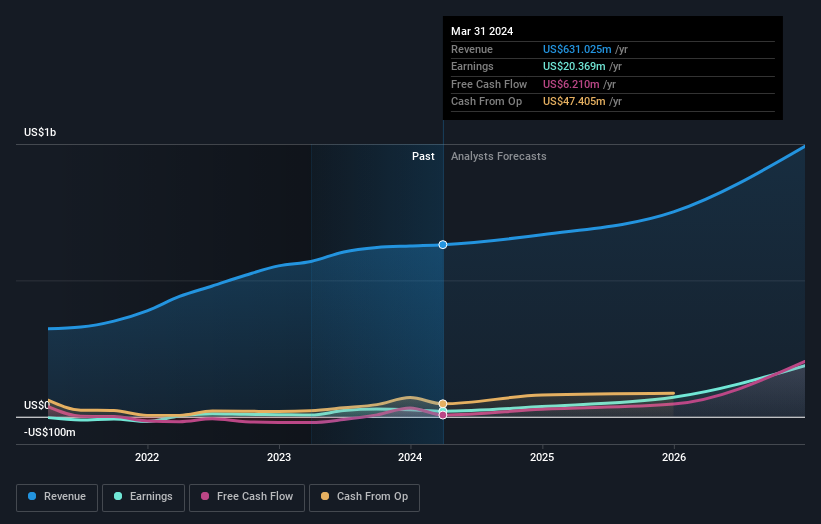

Overview: TETRA Technologies, Inc., along with its subsidiaries, operates as an energy services and solutions company with a market cap of $418.01 million.

Operations: The company's revenue segments include Water & Flowback Services, generating $304.43 million, and Completion Fluids & Products, contributing $323.07 million.

Insider Ownership: 10.2%

Revenue Growth Forecast: 12.6% p.a.

TETRA Technologies shows strong growth potential with earnings expected to grow at 48.2% annually, outpacing the US market's 15.2%. Despite a recent decline in profit margins and net income, the company is trading at a significant discount to its estimated fair value. Revenue is forecasted to grow faster than the market, though not exceeding 20% per year. Insider ownership remains high, indicating confidence in long-term prospects despite mixed recent financial results.

- Dive into the specifics of TETRA Technologies here with our thorough growth forecast report.

- The valuation report we've compiled suggests that TETRA Technologies' current price could be quite moderate.

TXO Partners (NYSE:TXO)

Simply Wall St Growth Rating: ★★★★★☆

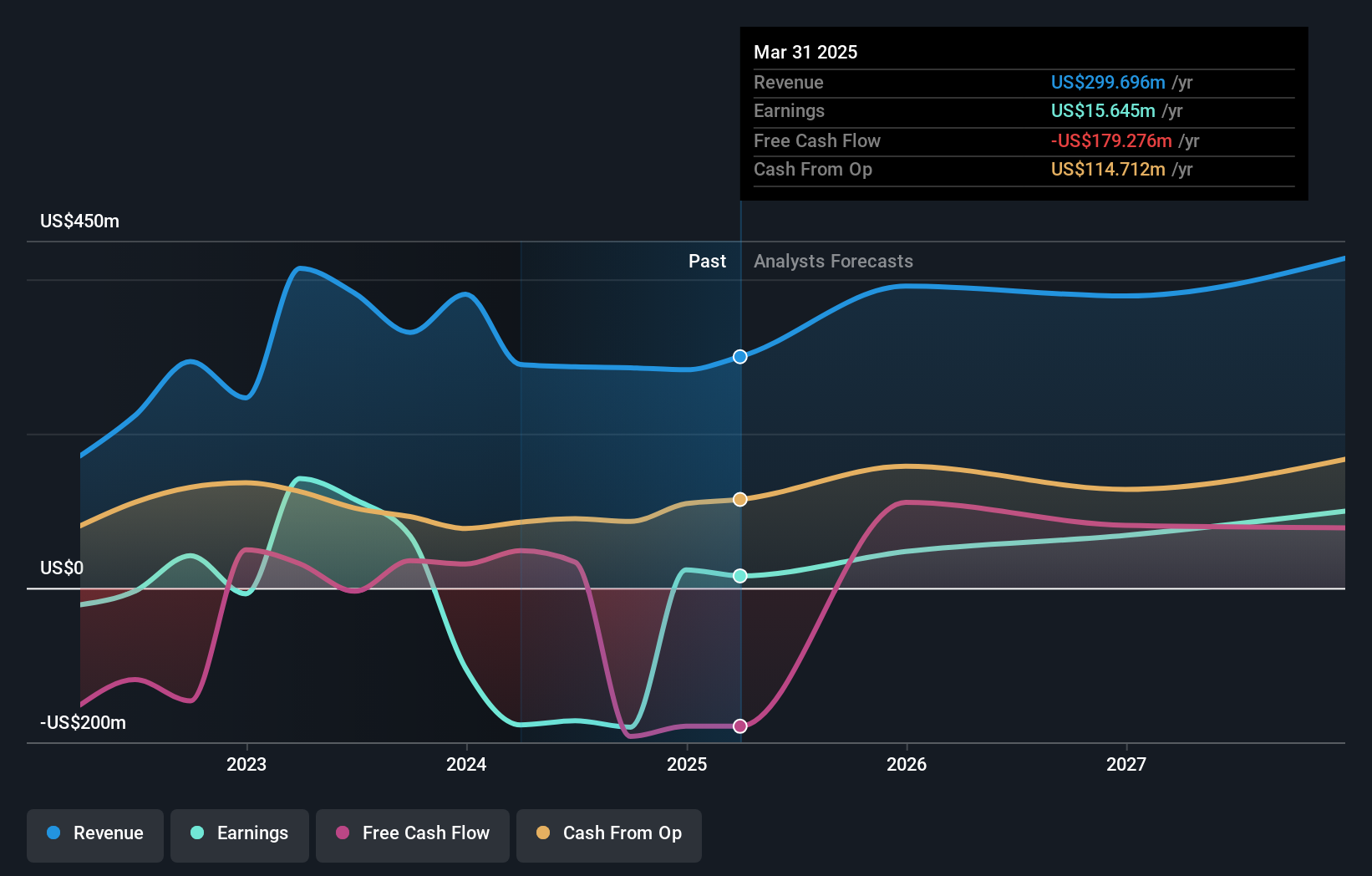

Overview: TXO Partners, L.P. is an oil and natural gas company that focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America with a market cap of $749.06 million.

Operations: Revenue from the exploration and production of oil, natural gas, and natural gas liquids amounts to $286.59 million.

Insider Ownership: 25.2%

Revenue Growth Forecast: 23.4% p.a.

TXO Partners exhibits strong growth potential with revenue forecasted to grow at 23.4% annually, significantly outpacing the US market's 8.8%. Earnings are expected to increase by 147.14% per year, and the company is anticipated to become profitable within three years. Despite a recent follow-on equity offering and dividend decrease, insider buying has been substantial over the past three months, reflecting confidence in its future prospects.

- Get an in-depth perspective on TXO Partners' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report TXO Partners implies its share price may be lower than expected.

Next Steps

- Investigate our full lineup of 175 Fast Growing US Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in in Asia, the Americas, Europe, and internationally.

Moderate with reasonable growth potential.