- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Why Targa Resources (TRGP) Is Up 8.6% After Earnings Beat and Planned Dividend Hike

Reviewed by Sasha Jovanovic

- Targa Resources Corp. recently reported third quarter 2025 results, posting year-over-year gains in both revenue and net income, and announced plans to recommend a higher common dividend for 2026, subject to board approval.

- This combination of continued earnings growth and anticipated dividend increase reflects the company’s confidence in its financial position and future cash generation.

- We’ll explore how Targa’s strong earnings and proposed dividend raise influence the investment narrative for shareholders and the broader market.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Targa Resources Investment Narrative Recap

To be a Targa Resources shareholder, you generally need to believe in ongoing demand for midstream infrastructure, consistent downstream volumes, and effective capital deployment in the Permian and Gulf Coast. The third quarter results and proposed higher dividend support the current narrative, but do not fundamentally shift the main short-term catalyst, sustained volume growth in core markets, or the established risk of increased competition from new regional entrants, which could impact margins. The near-term business outlook remains largely unchanged in light of the recent news.

Among recent announcements, the share repurchase update stands out; nearly 3.54 million shares have been repurchased for US$604.86 million under the 2024 program. This action directly benefits per-share earnings and return metrics, supporting investor confidence even as Targa faces ongoing competitive and margin pressures highlighted in the baseline risk factors.

By contrast, increased Permian pipeline competition could still complicate the company’s growth plans if pricing power deteriorates, which investors should be aware of as...

Read the full narrative on Targa Resources (it's free!)

Targa Resources' outlook anticipates $23.6 billion in revenue and $2.4 billion in earnings by 2028. This scenario depends on annual revenue growth of 11.4% and a $0.9 billion increase in earnings from the current level of $1.5 billion.

Uncover how Targa Resources' forecasts yield a $205.30 fair value, a 21% upside to its current price.

Exploring Other Perspectives

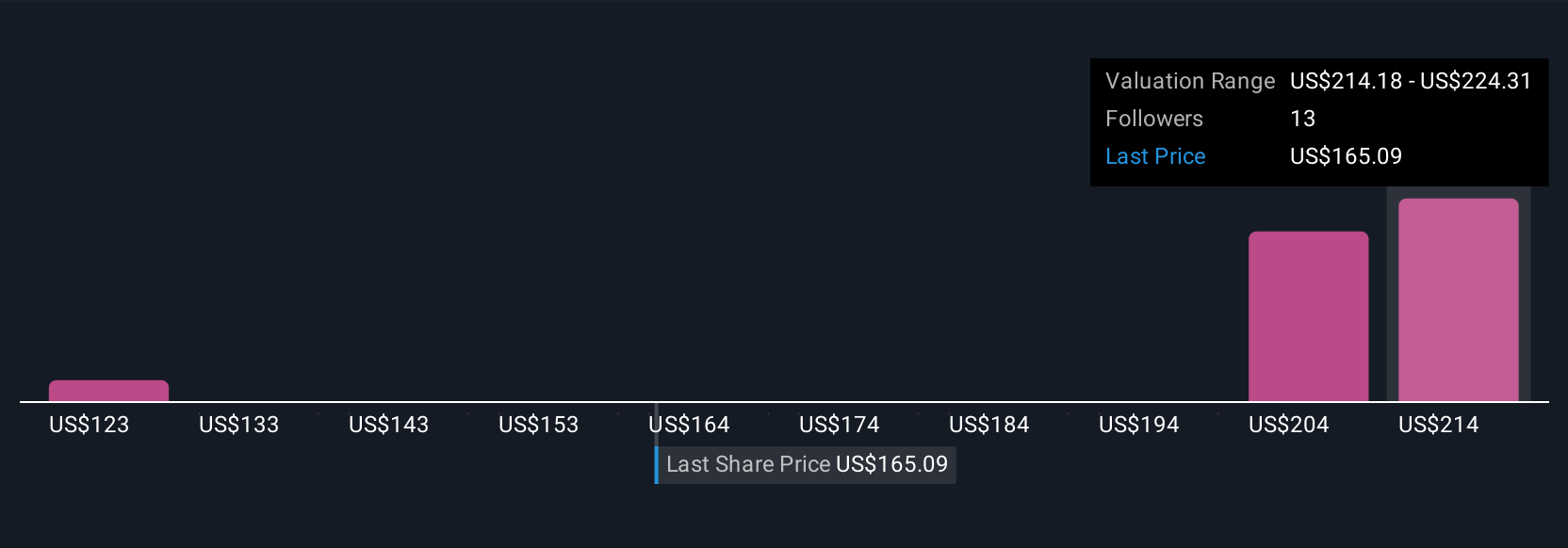

Fair value opinions from five Simply Wall St Community members range from US$128.57 to US$321.46 per share. While many see large potential undervaluation, competition in the Permian region could weigh on long-term profit growth and shape outcomes very differently for each perspective.

Explore 5 other fair value estimates on Targa Resources - why the stock might be worth 24% less than the current price!

Build Your Own Targa Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Targa Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Targa Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives