- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

What Targa Resources (TRGP)'s Earnings Surge and $1B Buyback Mean for Shareholders

Reviewed by Simply Wall St

- Targa Resources reported strong second quarter 2025 results, with revenue rising to US$4.26 billion and net income reaching US$629.1 million, while also announcing a new US$1 billion share repurchase program authorized by its board of directors.

- The company’s combination of significant income growth and a major buyback reflects management’s confidence in its ongoing financial performance and outlook.

- We'll examine how the robust earnings results and fresh buyback authorization shape Targa Resources' investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Targa Resources Investment Narrative Recap

If you’re considering Targa Resources, the story hinges on confidence in the long-term growth of US energy infrastructure and pipeline capacity, bolstered by consistent customer activity and planned expansions. The recent surge in earnings and new US$1 billion buyback program reflects strong execution, yet neither changes sensitivity to oil price volatility, the single most important short-term catalyst and risk for Targa. For now, this news supports the upbeat narrative but does not fundamentally alter the risk-reward profile.

Among all recent developments, Targa’s announcement of its latest share repurchase program is most relevant in shaping near-term sentiment. The buyback complements the company’s capital return strategy and aligns with the robust earnings; however, its impact is largely associated with enhancing shareholder returns rather than changing operational catalysts, such as project completions or volume growth outlook.

However, investors should also recognize that, despite recent momentum, the company’s exposure to commodity price swings remains a critical factor to watch...

Read the full narrative on Targa Resources (it's free!)

Targa Resources' outlook anticipates $24.2 billion in revenue and $2.4 billion in earnings by 2028. This is based on a 14.0% annual revenue growth rate and a $1.2 billion increase in earnings from current earnings of $1.2 billion.

Uncover how Targa Resources' forecasts yield a $205.16 fair value, a 23% upside to its current price.

Exploring Other Perspectives

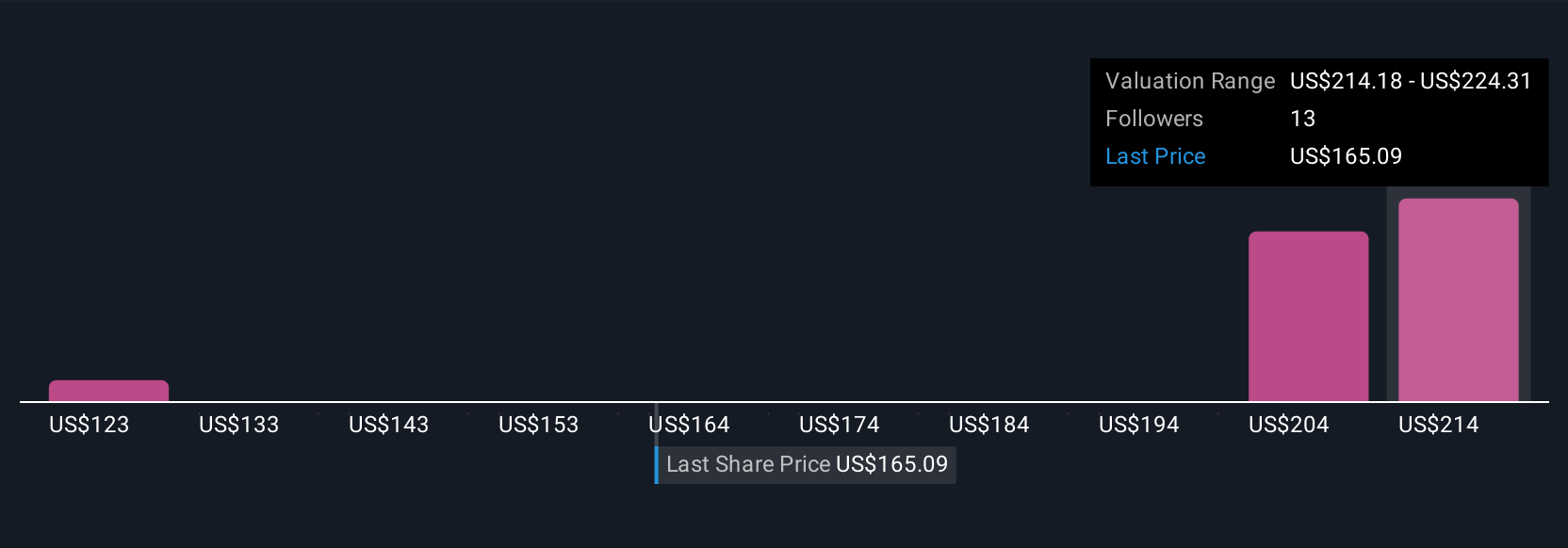

Fair value estimates from 5 Simply Wall St Community members range widely from US$123 to US$229, reflecting sharply different views on Targa’s growth outlook. With oil price volatility as a key risk, many possible futures for Targa Resources are represented, explore these varied perspectives to see which align most with your own expectations.

Explore 5 other fair value estimates on Targa Resources - why the stock might be worth as much as 38% more than the current price!

Build Your Own Targa Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Targa Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Targa Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives