- United States

- /

- Oil and Gas

- /

- NYSE:TNK

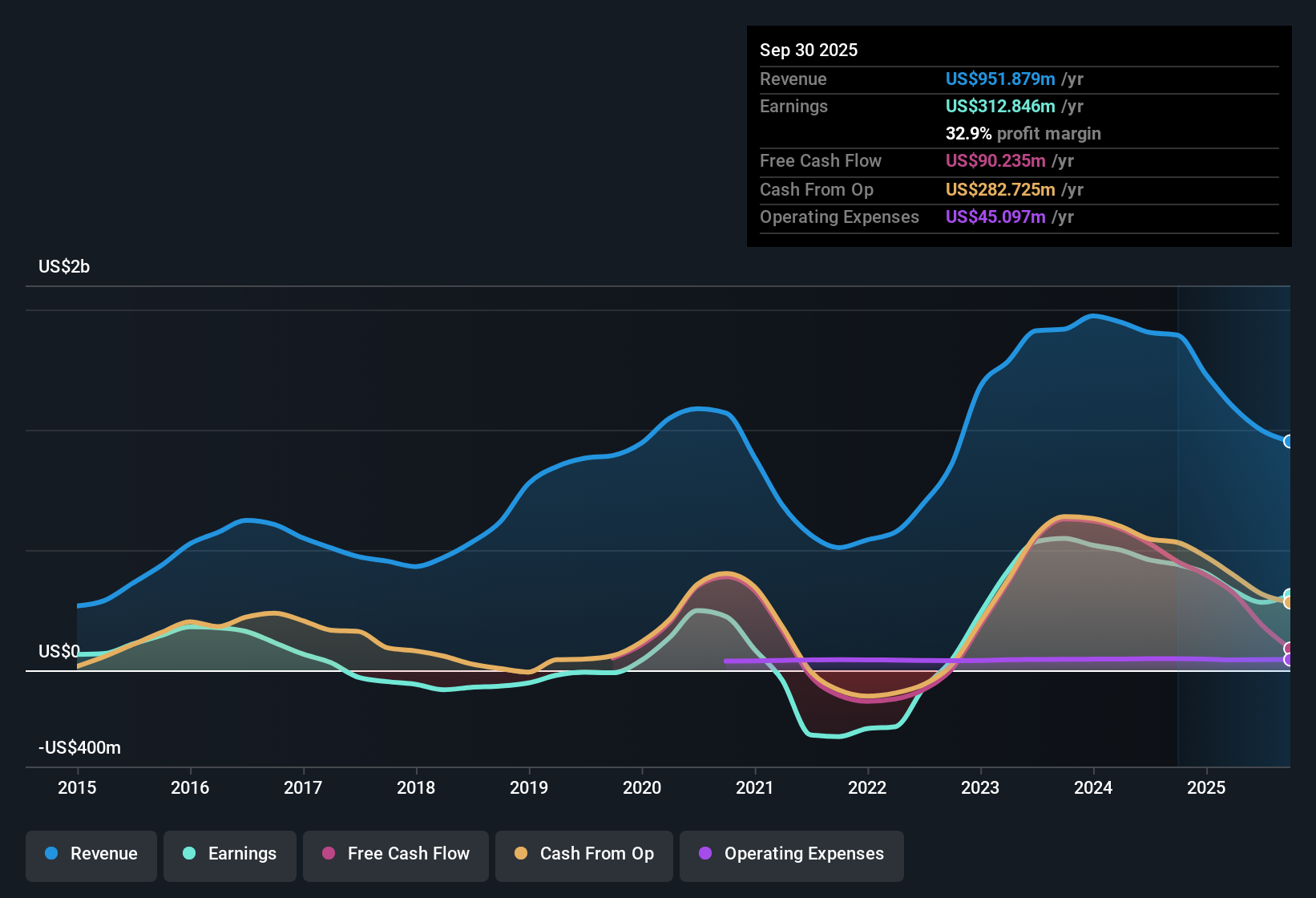

Teekay Tankers (TNK) Net Margin Rises to 32.9%, Challenging Bearish Growth Narratives

Reviewed by Simply Wall St

Teekay Tankers (NYSE:TNK) posted net profit margins of 32.9%, up from 32.1% a year ago, as recent results were lifted by a one-off gain of $100.3 million for the twelve months ending September 30, 2025. Over the past five years, annual earnings surged at a steep 40.7% pace, but this latest period revealed a setback with negative earnings growth year over year. As forecasts point toward yearly revenue declines of 16.7% and an expected 12.9% decrease in earnings over the next three years, investors face a tough outlook despite the stock’s discounted valuation against industry peers.

See our full analysis for Teekay Tankers.The next section takes these headline results and puts them up against widely followed market narratives. Some points may stack up as expected, while others could spark a debate.

See what the community is saying about Teekay Tankers

Fleet Modernization Carries Cost and Compliance Risks

- Teekay Tankers’ ongoing strategy of selling older vessels to invest in more fuel-efficient ships is intended to reduce operating expenses. However, the company has actually sold more vessels than it has acquired in the current year. This raises the risk that delays or gaps in fleet replacement could drive up costs or lead to regulatory non-compliance.

- Bears argue that this transition period exposes Teekay Tankers to heightened operational and market risk,

- persistent volatility in the tanker market, including shifting global oil trade patterns and decarbonization regulations, could cause greater cash flow variability;

- if fleet renewal is delayed or insufficient, the fleet may struggle to meet tightening IMO emissions standards, potentially increasing capital expenditures and putting pressure on margins.

Margin Outlook Defies Revenue Headwinds

- While analysts forecast annual revenue to fall by 22.5% for the next three years, they also expect profit margins to rise from 28.3% to 51.4% over that period, representing a doubling of margins even as the topline declines.

- Analysts' consensus view sees Teekay Tankers’ focus on efficiency and fleet renewal as key drivers behind this margin expansion,

- expanding net margins and strengthening vessel values amid global tightening of fleet supply could improve long-term profitability;

- however, persistent regulatory changes and a slowing pace of global oil demand might limit the potential benefits from these internal improvements.

Discounted Valuation vs. Peers Remains Attractive

- Teekay Tankers currently trades at a price-to-earnings ratio of 6.5x, well below the US Oil and Gas industry average of 12.8x and its peer group’s 13.5x, so shares appear attractively valued relative to rivals despite mixed growth prospects.

- Consensus narrative notes that bears often point to declining earnings forecasts, but the sustained valuation gap and analysts' consensus price target of 61.67 (recent share price: 58.84) suggest that the market may be underestimating the company’s resilience,

- the 5% upside potential built into the current analyst target is supported by stronger margins even if revenues continue to contract;

- ongoing market inefficiency around spot market exposure and vessel age also offers upside for investors willing to tolerate volatility.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teekay Tankers on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique angle on the data? Share your insights and shape your own story in just a few minutes, and Do it your way.

A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite attractive valuation, Teekay Tankers faces pressure from contracting revenues and negative earnings growth expectations over the coming years.

If you seek more consistent growth and less uncertainty, use our stable growth stocks screener (2113 results) to discover companies that reliably expand revenues and earnings across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives