- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Teekay Tankers (NYSE:TNK) Valuation in Focus After Analyst Upgrades and Better-Than-Expected Revenue

Reviewed by Simply Wall St

Teekay Tankers (NYSE:TNK) is in the spotlight following a flurry of analyst upgrades and raised price targets, prompted by the company’s latest quarterly report. Revenue came in well above expectations, even as earnings per share lagged forecasts.

See our latest analysis for Teekay Tankers.

Investors have clearly taken notice of Teekay Tankers, with the stock climbing sharply following its earnings beat and a series of upbeat analyst reviews. The current momentum is hard to ignore. The share price has delivered an impressive year-to-date return of nearly 45%, while the total shareholder return over one year stands at just above 28%. Steady gains over the past quarter suggest that confidence in the company’s longer-term prospects is building alongside improving fundamentals.

If this kind of market momentum has you wondering what other opportunities might be out there, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

But with Teekay Tankers now trading just above its analyst price targets after a strong run, the key question is whether shares remain undervalued or if the market is already pricing in all the company’s future growth.

Most Popular Narrative: 6.9% Overvalued

Teekay Tankers' most-followed narrative estimates a fair value of $55.83, which is about 6.9% below the last close price of $59.71. The story behind this gap lies in shifting profit dynamics and a moderating revenue decline.

Fleet modernization and strong financial discipline position the company to capitalize on regulatory changes and enhance long-term profitability. Slowing oil demand, regulatory changes, and fleet renewal challenges expose Teekay Tankers to volatile earnings, operational risks, and increased sensitivity to market downturns.

Think you've seen all the drivers behind Teekay's stock price? Wait until you see what this narrative assumes about future profits, margins, and that headline fair value. There is a key set of optimistic financial forecasts that may surprise even veteran tanker-watchers. Are you curious about what numbers are secretly powering this fair value thesis?

Result: Fair Value of $55.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory shifts or a sudden decline in global oil demand could quickly change the assumptions driving current optimism and valuations.

Find out about the key risks to this Teekay Tankers narrative.

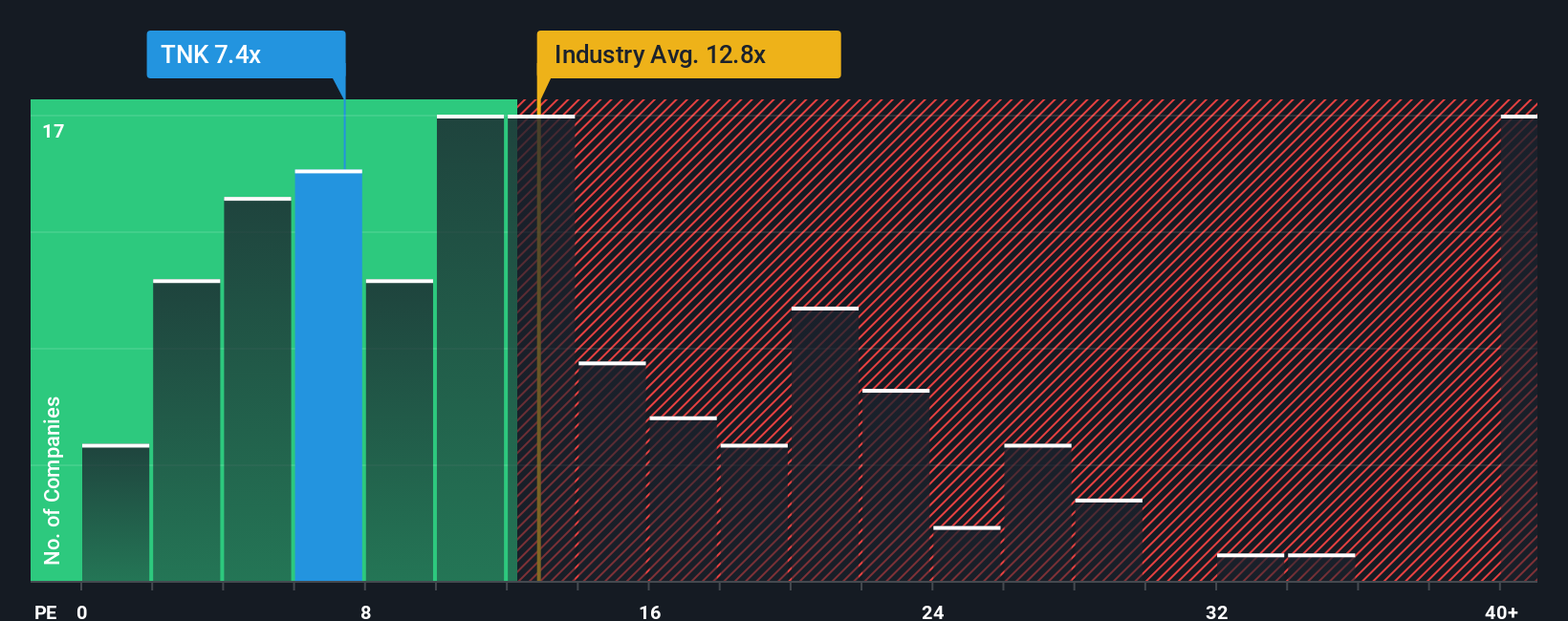

Another View: Looking at Earnings Multiples

There's a different story when you compare Teekay Tankers' price-to-earnings ratio to its peers and the wider industry. TNK trades at just 7.3x, well below peer and industry averages of 13.7x and 13.1x respectively, and under the fair ratio of 12.5x. This significant gap means investors may be viewing Teekay with extra caution, or spotting a potential bargain. Is the market underestimating the company’s future, or are risks still lurking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teekay Tankers Narrative

If you have a different perspective or want to dig into the numbers on your own, you can craft a personalized narrative in just a few minutes, right here: Do it your way

A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one strategy. The next market winner could be hiding in plain sight, and our powerful screeners can help you spot it first.

- Spot innovation at its earliest stages when you check out these 3575 penny stocks with strong financials, which are poised to disrupt entire sectors with bold new business models.

- Boost your passive income potential and glimpse tomorrow’s biggest payouts by browsing these 21 dividend stocks with yields > 3%, featuring yields above 3%.

- Take advantage of ground-breaking tech shifts and turbocharge your portfolio with these 26 AI penny stocks, currently making headlines in artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives