- United States

- /

- Energy Services

- /

- NYSE:TDW

With EPS Growth And More, Tidewater (NYSE:TDW) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Tidewater (NYSE:TDW). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Tidewater

Tidewater's Improving Profits

Tidewater has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Tidewater's EPS catapulted from US$1.39 to US$3.47, over the last year. Year on year growth of 150% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

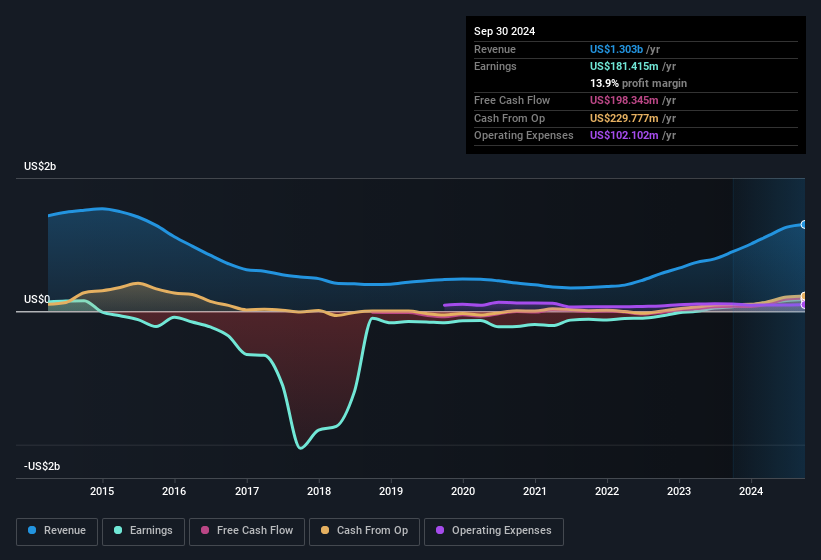

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Tidewater shareholders is that EBIT margins have grown from 12% to 21% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Tidewater's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Tidewater Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Tidewater insiders have a significant amount of capital invested in the stock. Indeed, they hold US$36m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 1.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between US$2.0b and US$6.4b, like Tidewater, the median CEO pay is around US$6.7m.

Tidewater's CEO took home a total compensation package worth US$4.2m in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Tidewater Worth Keeping An Eye On?

Tidewater's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Tidewater is certainly doing some things right and is well worth investigating. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Tidewater is trading on a high P/E or a low P/E, relative to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDW

Tidewater

Provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of offshore marine service vessels worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives