- United States

- /

- Oil and Gas

- /

- NYSE:STNG

Scorpio Tankers Jumps 8.5% as Analysts Rethink Its True Value in 2025

Reviewed by Bailey Pemberton

If you’ve ever felt torn over holding or buying Scorpio Tankers stock, you’re not alone. This is one name that keeps investors on their toes, with headline-grabbing gains and just enough volatility to prompt a double take at your portfolio. In just the past week, shares climbed 8.5%, a healthy bounce that stands out against a slightly negative 1.5% return over the last month. But step back a bit, and the year-to-date return is a robust 15.8%, and the longer-term five-year return is an eye-popping 569.4%. Yet even with these impressive numbers, the past year did see a 7.2% dip, reminding us that this stock doesn't always move in a straight line.

What’s been moving the needle lately? Much of the volatility is tied to shifting global demand for refined petroleum products and changes in tanker shipping rates, which have kept the industry in the headlines. Scorpio Tankers has also made moves to modernize its fleet and streamline operations, helping to reinforce its position in a competitive market. Investor mood seems to swing between seizing strong cash flows and weighing global macroeconomic risks, which is exactly what makes its valuation so interesting right now.

By most standard measures, Scorpio Tankers looks undervalued, passing 5 out of 6 key checks, for a value score of 5. Whether you’re looking for a bargain or worried about catching a falling knife, understanding these valuation methods is key. Let’s break down the numbers, then dig into what might be an even smarter way to think about valuation before making your next move.

Why Scorpio Tankers is lagging behind its peers

Approach 1: Scorpio Tankers Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach reflects what those cash flows are worth right now. For Scorpio Tankers, this analysis starts with a solid footing, as the company posted $522.8 million in Free Cash Flow over the last twelve months. Analysts project that cash flows will continue to grow, reaching $687 million in 2027 and, based on extrapolations, moving toward $1.1 billion in 2035. The first five years rely on direct analyst estimates, while Simply Wall St extends these forecasts for the subsequent years.

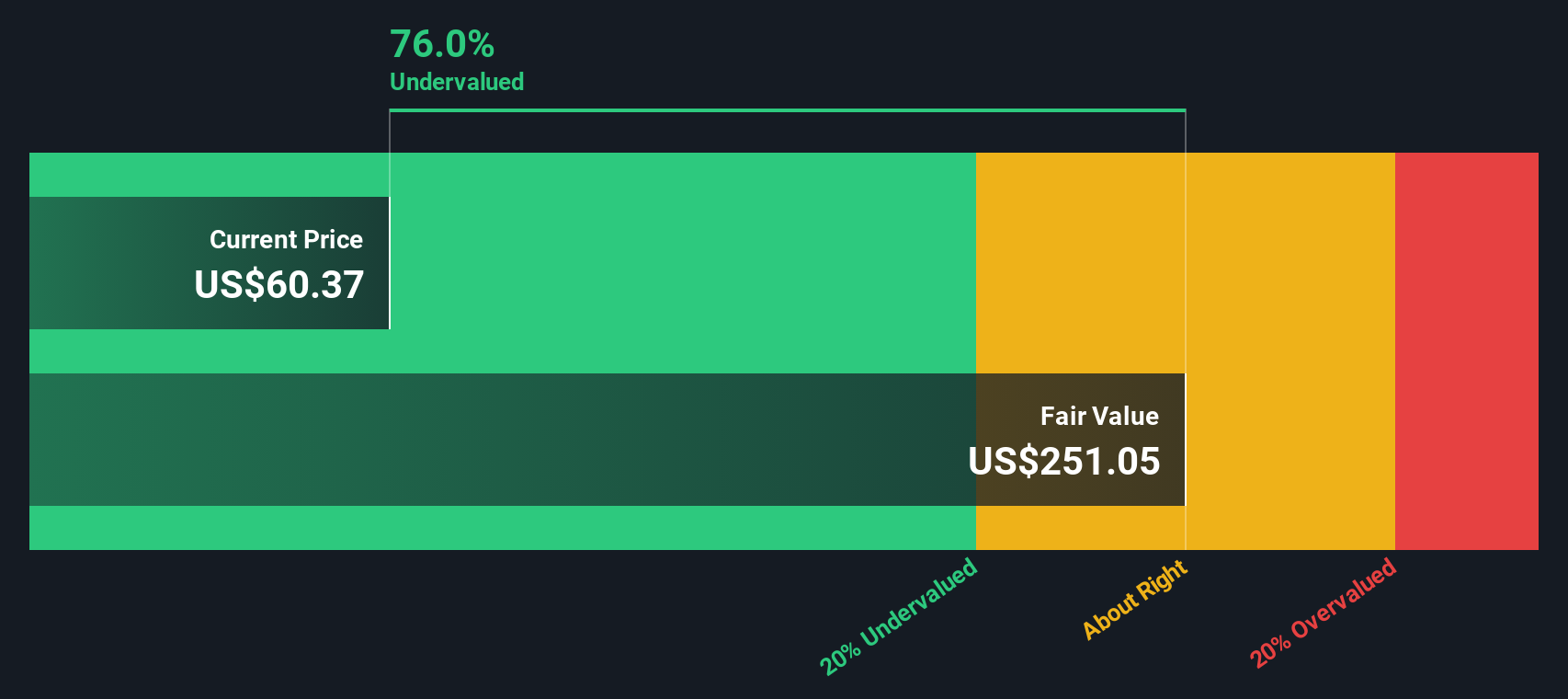

All these numbers are calculated in USD, the reporting currency, to maintain consistency in comparison. Using the DCF method, Scorpio Tankers’ intrinsic value comes to $278.53 per share. With the current share price trading at a steep 79.2% discount to this valuation, the stock appears deeply undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Scorpio Tankers is undervalued by 79.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Scorpio Tankers Price vs Earnings

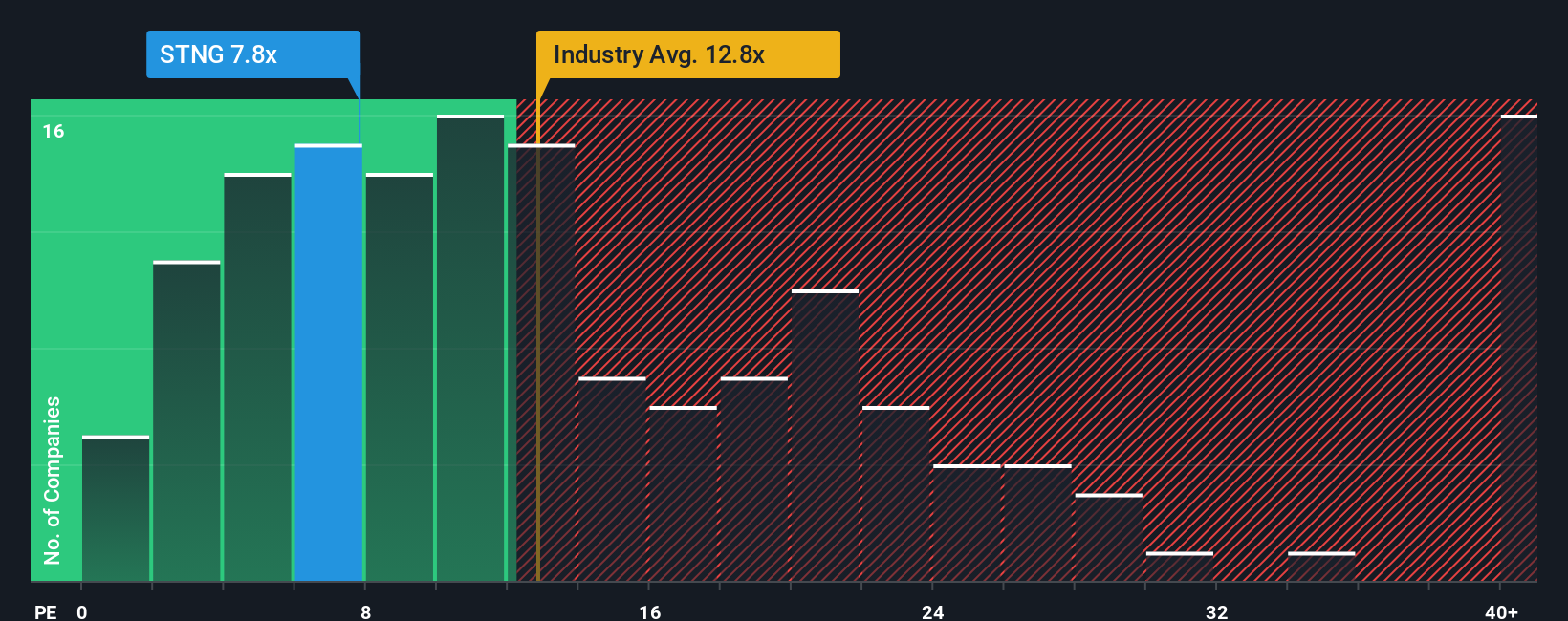

For profitable companies like Scorpio Tankers, the price-to-earnings (PE) ratio is a widely recognized valuation metric. It provides investors with a quick measure of how much they are paying for each dollar of the company’s current earnings. Using PE works best when a company has steady, positive earnings, as it helps capture growth prospects and perceived risk in a single, easy-to-compare figure.

The “right” PE ratio can depend on several factors. Rapidly growing companies, or those with low risk, often command higher PE ratios, while slow-growing or riskier businesses tend to trade lower. Comparing Scorpio Tankers, its PE stands at 7.48x, which is significantly lower than the industry average of 12.77x and its peers at 12.28x. At first glance, this suggests the stock trades at a discount.

However, Simply Wall St’s proprietary Fair Ratio offers a more nuanced perspective. This Fair Ratio, at 14.33x for Scorpio Tankers, reflects specific factors like the company’s projected growth, profitability, industry characteristics, market capitalization, and specific risk profile. Unlike standard industry averages, the Fair Ratio is designed to match a company’s unique profile, allowing for a more accurate sense of value.

With Scorpio Tankers’ actual PE of 7.48x well below its Fair Ratio of 14.33x, the stock appears clearly undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Scorpio Tankers Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an investment tool that goes beyond the numbers to put your perspective and research at the center of the decision.

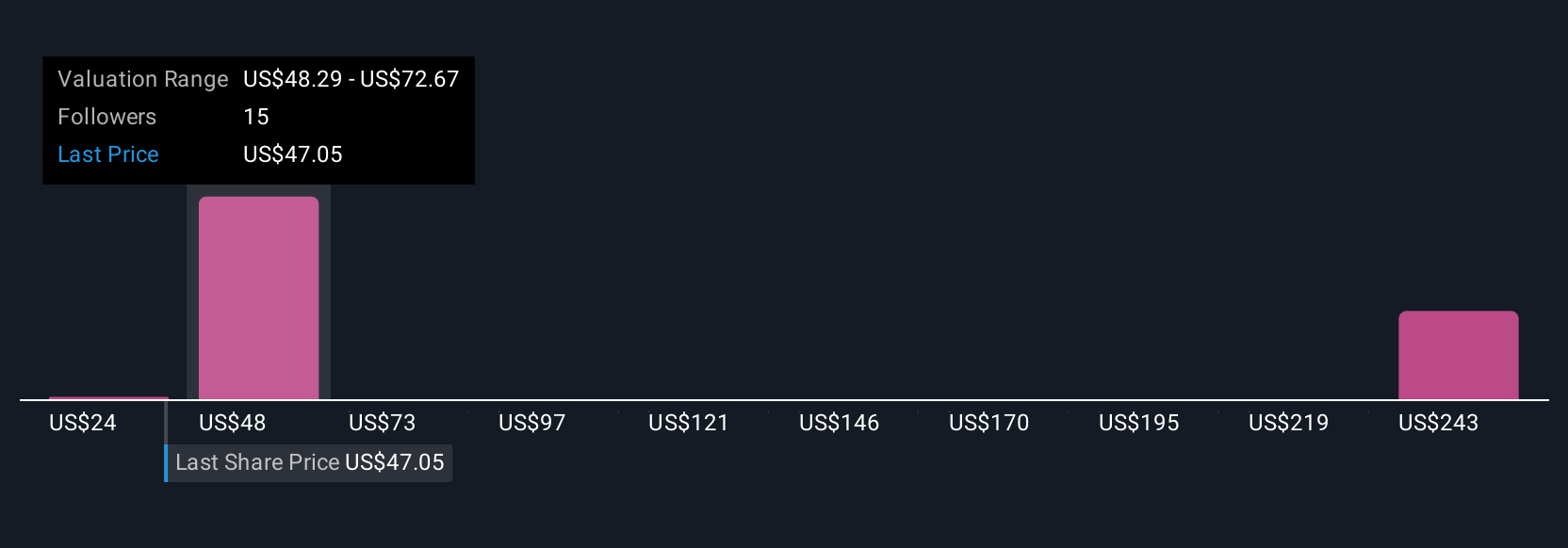

A Narrative is simply the story you create about a company’s future, grounded in your own assumptions about fair value, future revenue, earnings, and margins. Rather than just accepting consensus estimates or static ratios, Narratives link your view of Scorpio Tankers’ business prospects to a financial forecast. This lets you see how your expectations connect to fair value and how that stacks up against today’s share price.

Narratives are easy to create and update yourself within Simply Wall St’s popular Community page, helping millions of investors make more informed, personalized choices. As events unfold, such as new earnings reports or industry news, Narratives update dynamically, keeping your analysis relevant.

By comparing your calculated Fair Value to the latest Price, Narratives help you decide when to buy or sell by showing if the stock is undervalued from your point of view. For example, some investors now see Scorpio Tankers as a future market leader with a fair value of $75, while others, wary of regulatory and industry risks, peg the value closer to $54. Both are valid Narratives reflecting each investor’s story and forecast.

Do you think there's more to the story for Scorpio Tankers? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion