- United States

- /

- Oil and Gas

- /

- NYSE:SOC

How Class Action Lawsuits Over Production Claims at Sable Offshore (SOC) Have Changed Its Investment Story

Reviewed by Simply Wall St

- Over the past week, multiple law firms have filed class action lawsuits against Sable Offshore Corp. alleging the company and its executives made false or misleading statements about the restart of oil production off the California coast and its business outlook during a secondary public offering earlier this year.

- This wave of legal action highlights rising concerns around corporate disclosures and regulatory scrutiny within the offshore oil sector.

- We'll explore how the legal uncertainties surrounding Sable Offshore's production restart claims impact the company's broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sable Offshore's Investment Narrative?

To be a shareholder in Sable Offshore right now, you really need to believe in the company’s ability to deliver on ambitious production growth while managing heavy losses and regulatory hurdles. The draw for many has been new guidance for a sizable ramp-up in oil production, which, if realized, could translate into rapid revenue growth and possibly move the company closer to profitability. However, the recent flood of class action lawsuits after the secondary offering adds a new layer of risk that is hard to ignore. These legal actions, focused on alleged misstatements around production restart and business outlook, create uncertainty around the timing and credibility of upcoming catalysts like the Las Flores restart. With Sable’s share price recently showing resilience and even a modest uptick, initial market reaction hints that investors may not see the court challenges as immediately material. Still, fresh legal scrutiny shifts attention back to disclosure practices and strengthens the case for viewing legal and regulatory risk as the most pressing concern in the short term.

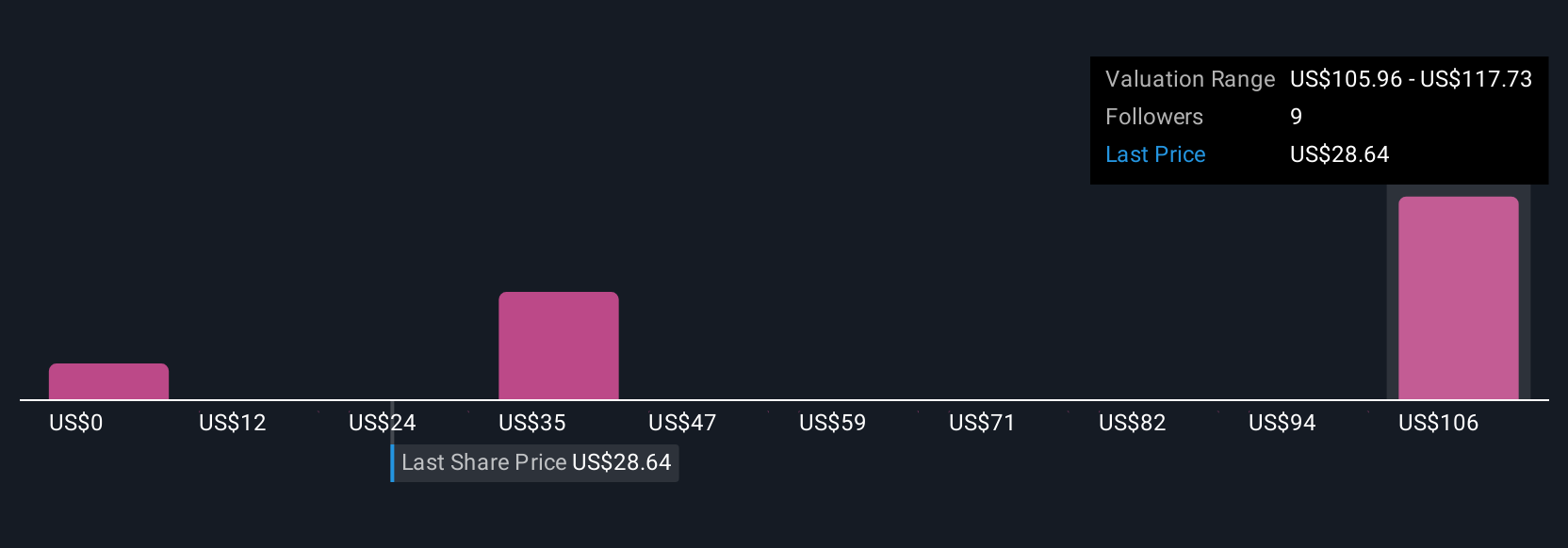

But, amid optimism about future oil production, legal and regulatory risks deserve close attention. Sable Offshore's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Sable Offshore - why the stock might be worth less than half the current price!

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives