- United States

- /

- Oil and Gas

- /

- NYSE:SOC

Can Sable Offshore’s (SOC) Disclosure Practices Withstand the Scrutiny of Legal and Regulatory Challenges?

Reviewed by Simply Wall St

- In recent weeks, multiple law firms have filed class action lawsuits against Sable Offshore Corp., alleging the company made false and misleading statements about restarting oil production off the coast of California, especially during its May 21 secondary public offering.

- These legal actions highlight concerns about transparency and regulatory compliance, with court orders halting pipeline operations adding to investor uncertainty.

- We'll explore how allegations of misleading disclosures regarding operational status and regulatory setbacks may reshape Sable Offshore's investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

What Is Sable Offshore's Investment Narrative?

For anyone considering Sable Offshore, the investment case often hinges on a future turnaround built around the company’s ability to restart oil production and capitalize on projected growth. Before the recent class action lawsuits, short-term catalysts included production ramp-up guidance and the potential for regulatory progress, both seen as key to narrowing steep financial losses. Now, the legal challenges over allegedly misleading statements on operational status, combined with court-imposed operational restrictions, have quickly shifted the focus toward disclosure practices and regulatory risk. These developments are potentially material, as they directly question management’s credibility at the same moment Sable seeks to accelerate production and stem losses. This puts the timing, and even the achievability, of their near-term catalysts under fresh scrutiny. The situation now looks more complex than the earlier consensus analysis suggested. But the biggest risk now may be whether courts will further restrict operations just as Sable needs momentum.

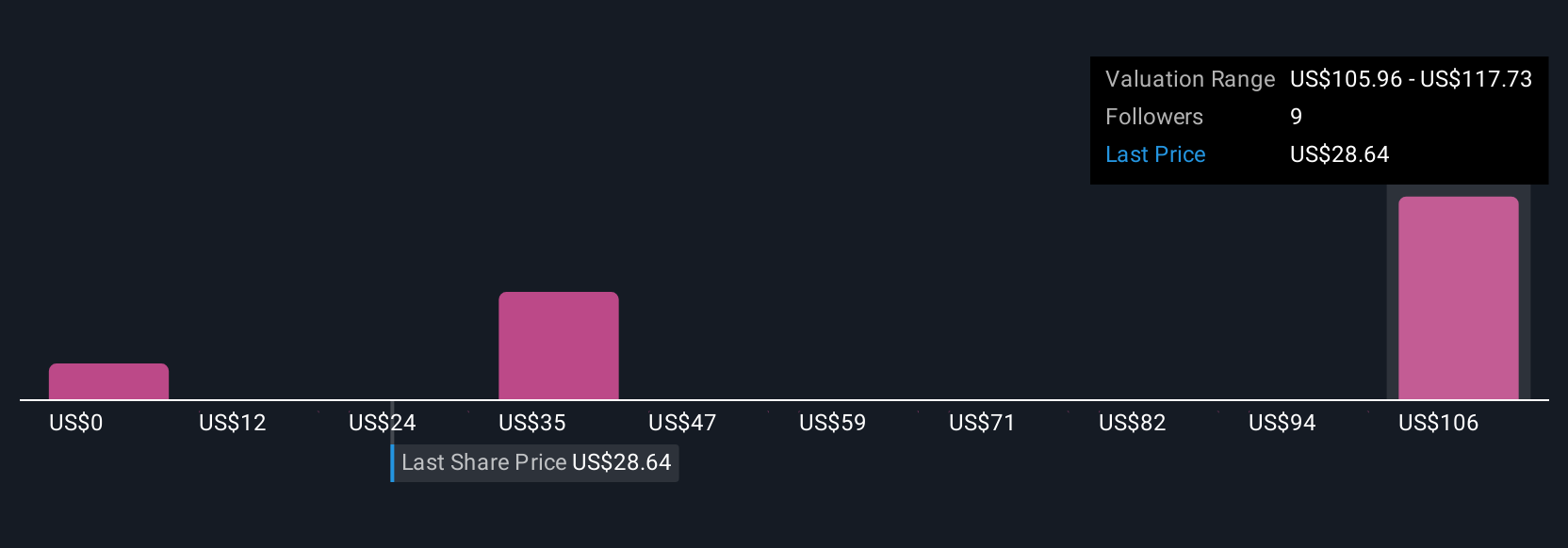

Sable Offshore's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Sable Offshore - why the stock might be worth less than half the current price!

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives