- United States

- /

- Energy Services

- /

- NYSE:SMHI

SEACOR Marine Holdings (SMHI) Losses Worsen, Undermining Hopes for Profitability Turnaround

Reviewed by Simply Wall St

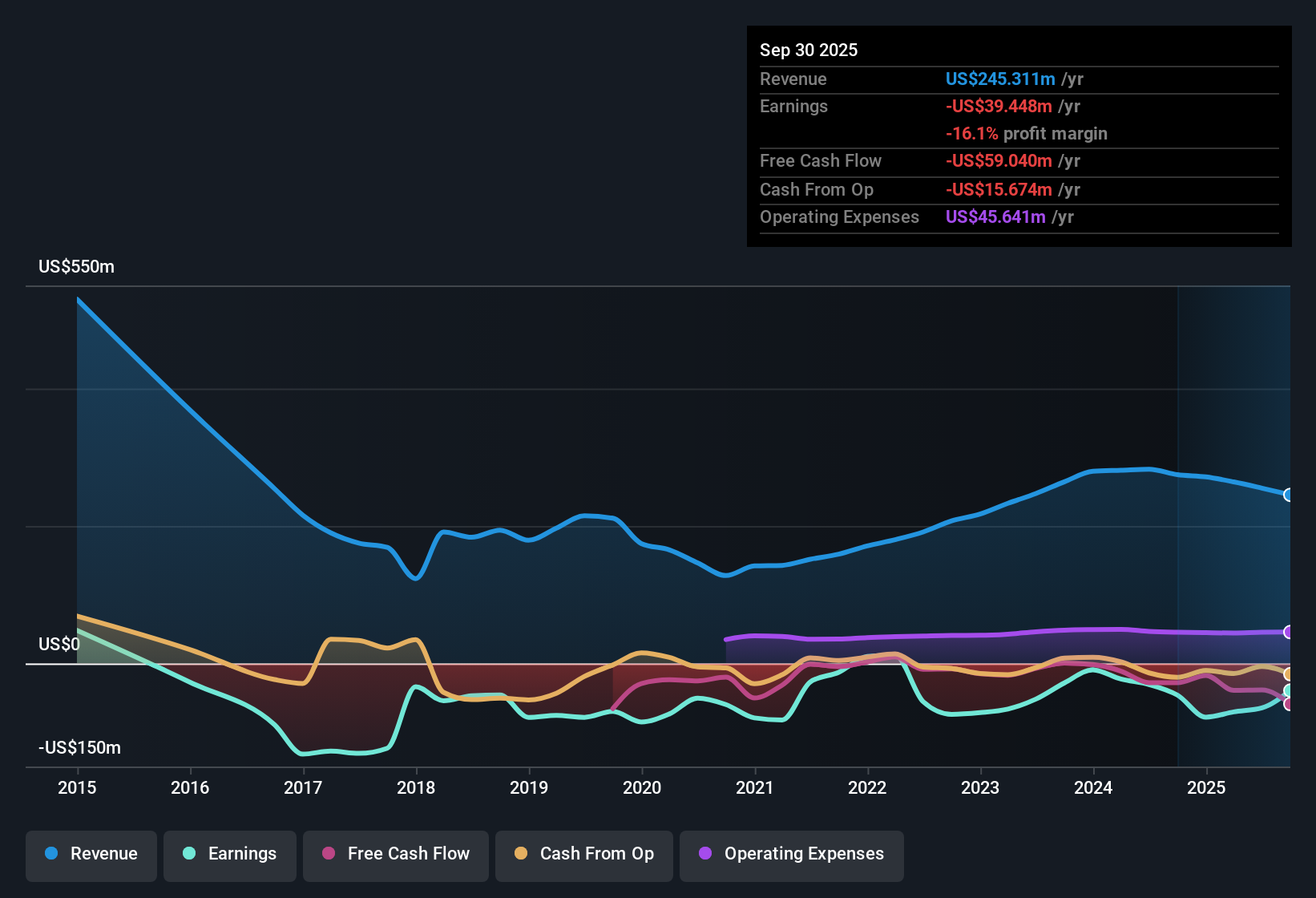

SEACOR Marine Holdings (SMHI) is currently unprofitable, with losses increasing over the past five years at a compound annual rate of 3.6%. Over the last year, the company’s profitability has not improved, and investors should note there is no concrete evidence of high-quality past earnings in the current results. With no reward factors identified in the latest data, the continued trend of mounting losses and lack of growth momentum highlights why risks remain at the forefront for anyone tracking the stock this earnings season.

See our full analysis for SEACOR Marine Holdings.Now, let’s see how these headline results hold up against the wider market narratives. In the next section, we will line up the numbers with the stories analysts and the community are following.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Multiple Below Industry, But Above Peers

- SEACOR Marine trades at a Price-to-Sales (P/S) ratio of 0.7x, which is lower than the US Energy Services industry average of 1x and above the peer average of 0.5x. This highlights how investors are pricing in both sector-wide headwinds and company-specific concerns relative to direct competitors.

- This supports the view that ongoing sector stress and company risks are being partially balanced by potential for improved contract visibility.

- The industry discount reflects bears’ focus on lack of profitability and growth, while the premium to peers supports those watching for operational resilience or market recovery tailwinds.

- Bears continue to cite stagnant profitability and the company’s financial position as reasons for trading below broader sector multiples, while the ratio implies some hope that conditions could shift favorably if effective fleet or contract moves materialize.

No Evidence of Growth or High-Quality Earnings

- There is not sufficient data to assess SEACOR Marine’s expected revenue or earnings growth, and filings offer no evidence of high-quality past earnings. This leaves little for bulls to point to as an upside driver at this time.

- Bears highlight the absence of growth catalysts and the company’s inability to demonstrate sustained profitability.

- Unlike some industry peers showing clear revenue growth or forecast visibility, SEACOR Marine’s filings suggest that both top-line and bottom-line momentum are lacking.

- This ongoing growth gap underlines the bearish view that the company’s current trajectory fails to convince markets of any near-term turnaround, intensified by the lack of reward factors in the data.

Financial Position Limits Upside Potential

- SEACOR Marine is not regarded as being in a strong financial position, with continued unprofitability and no evidence of improved profitability over the last year. This makes it especially vulnerable to sector swings.

- Bears argue that risks around financial stability will persist unless the company can show tangible steps towards breaking the loss trend.

- With revenue and earnings not expected to grow, the justification for an improved valuation or sustained share price remains weak compared to steady or recovering peers.

- The company’s discounted P/S ratio, while partially reflecting sector caution, increases investor sensitivity to any setback in operational performance or industry outlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SEACOR Marine Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SEACOR Marine’s persistent losses, lack of growth momentum, and ongoing financial vulnerability leave investors exposed to further downside if conditions worsen.

Want companies that can weather uncertainty? Use solid balance sheet and fundamentals stocks screener (1984 results) to focus on businesses with stronger financial footing and resilience against the ups and downs SEACOR currently faces.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives