- United States

- /

- Oil and Gas

- /

- NYSE:SM

Imagine Owning SM Energy (NYSE:SM) And Trying To Stomach The 74% Share Price Drop

SM Energy Company (NYSE:SM) shareholders should be happy to see the share price up 20% in the last week. But the last three years have seen a terrible decline. To wit, the share price sky-dived 74% in that time. So it sure is nice to see a big of an improvement. Only time will tell if the company can sustain the turnaround.

Check out our latest analysis for SM Energy

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, SM Energy moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

With a rather small yield of just 1.0% we doubt that the stock's share price is based on its dividend. Revenue is actually up 12% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching SM Energy more closely, as sometimes stocks fall unfairly. This could present an opportunity.

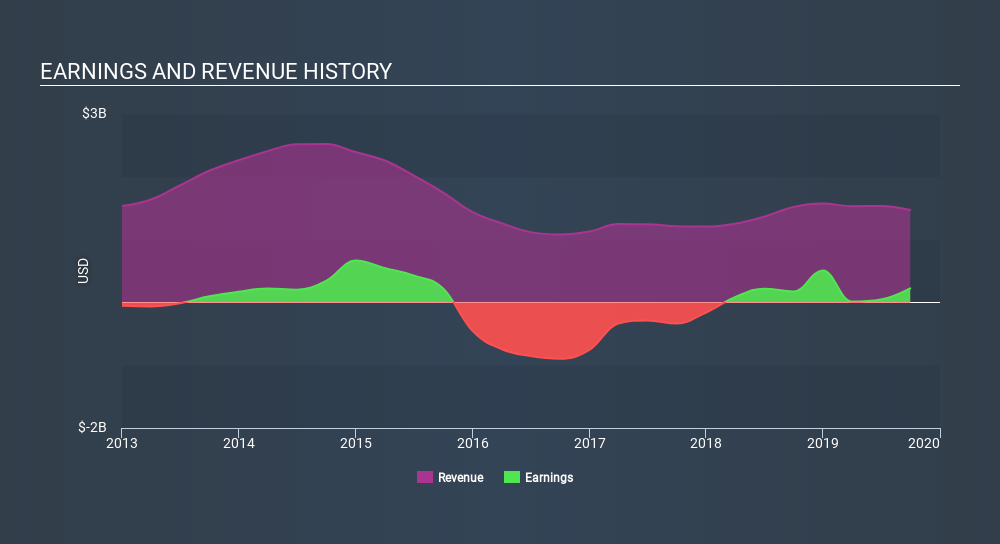

The company's revenue and earnings (over time) are depicted in the image below.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on SM Energy

A Different Perspective

Investors in SM Energy had a tough year, with a total loss of 48% (including dividends) , against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

SM Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026