- United States

- /

- Oil and Gas

- /

- NYSE:SM

Did SM Energy's (SM) Credit Facility Update Just Signal a Shift in Financial Flexibility?

Reviewed by Sasha Jovanovic

- Earlier this month, SM Energy announced a key amendment to its revolving credit facility, eliminating a prior springing maturity provision and replacing it with more flexible terms based on short-term debt levels and borrowing availability, while its lender group reaffirmed a US$3.0 billion borrowing base and kept the committed amount at US$2.0 billion.

- This adjustment may offer the company greater financial flexibility to manage its debt maturities and borrowing needs amid evolving market conditions and operational headwinds.

- We'll examine how the revised debt agreement and related flexibility affect SM Energy's investment narrative and future growth considerations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SM Energy Investment Narrative Recap

To be a shareholder in SM Energy, you need to believe the company can manage operational complexity, drive production efficiency, and sustain reserves growth in several US shale basins, despite exposure to the volatile oil and gas market. The recent amendment to SM Energy’s revolving credit facility improves near-term financial flexibility but does not materially shift the biggest catalyst, core asset performance and reserve replacement, or the most pressing risk, which remains exposure to Uinta Basin oil pricing and logistics.

Among recent announcements, ongoing merger talks with Civitas Resources stand out as most relevant, suggesting potential changes in scale, asset mix, and long-term strategy. However, with no confirmed transaction, short-term investment drivers stay tied to production results and the company’s ability to offset high decline rates in existing wells.

In contrast, investors should be aware of how even flexible credit terms may not fully shield against periods of weaker Uinta oil prices and capacity constraints in ...

Read the full narrative on SM Energy (it's free!)

SM Energy's outlook anticipates $3.5 billion in revenue and $550.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.7%, but earnings are actually expected to decrease by $262.4 million from current earnings of $812.7 million.

Uncover how SM Energy's forecasts yield a $38.62 fair value, a 86% upside to its current price.

Exploring Other Perspectives

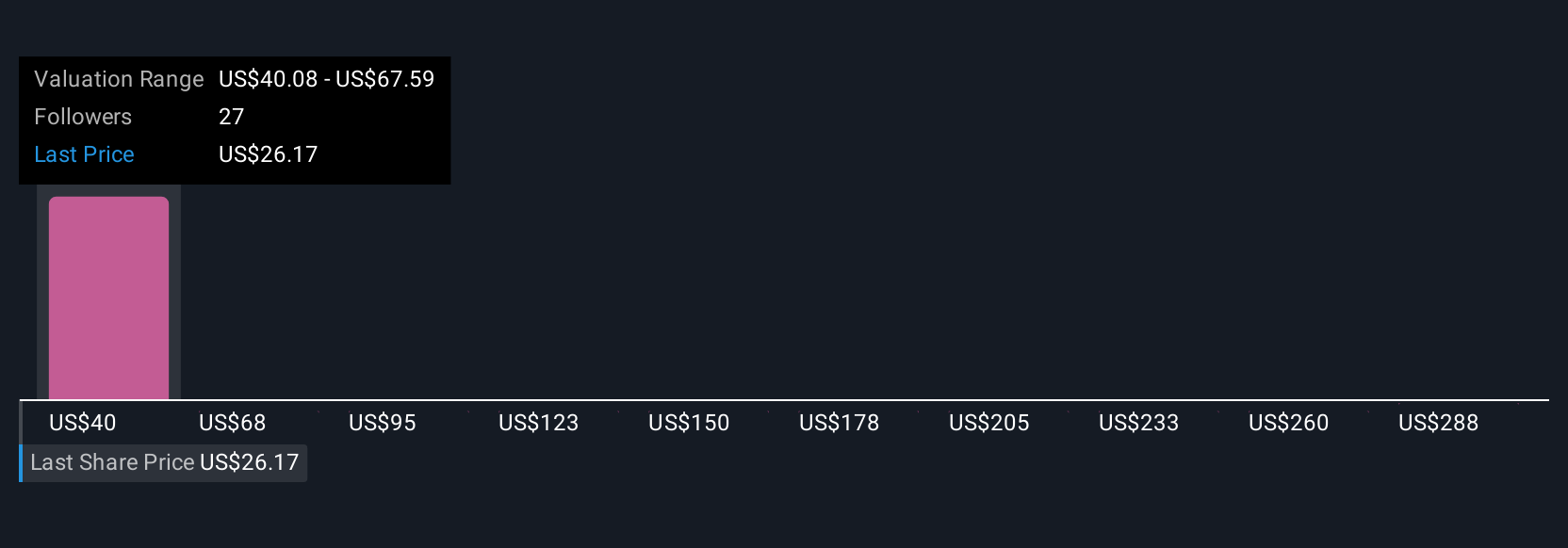

Simply Wall St Community members generated four fair value estimates for SM Energy ranging from US$37.69 to US$315.24 per share. While these opinions highlight wide differences among investors, persistent uncertainty about Uinta Basin logistics and pricing dynamics may continue to shape the outlook and merits further scrutiny from all sides.

Explore 4 other fair value estimates on SM Energy - why the stock might be a potential multi-bagger!

Build Your Own SM Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SM Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free SM Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SM Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives