- United States

- /

- Energy Services

- /

- NYSE:SLB

The Bull Case for SLB (SLB) Could Change Following Major BP Offshore Contract Award

Reviewed by Sasha Jovanovic

- BP recently awarded a major contract to SLB's OneSubsea joint venture for a subsea boosting system in the greenfield development of the Tiber project in the deepwater US offshore region, following a similar award for BP's Kaskida project.

- This contract highlights sustained industry demand for advanced high-pressure subsea technology and emphasizes SLB's expanding role as a supplier of standardized offshore solutions for global energy operators.

- We’ll explore how the addition of this large offshore contract strengthens SLB’s investment narrative, particularly in subsea technology.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SLB Investment Narrative Recap

For those considering SLB stock, the core investment thesis revolves around the company’s positioning as a global supplier of advanced energy technology, with a growing focus on subsea solutions, digitalization, and production optimization. While the recent BP contract award reaffirms SLB’s ability to secure major offshore projects, it does not eliminate the most important near-term risk: operator spending pullbacks tied to macro and commodity volatility, which remain a key variable for SLB’s earnings outlook.

The new subsea contract for BP’s Tiber project closely follows an October contract with PTTEP in Malaysia for subsea production systems, underlining the rising demand for SLB’s high-pressure, standardized solutions. This momentum in offshore engineering strengthens SLB’s exposure to longer-cycle projects, providing some insulation from more volatile, short-cycle North American markets.

However, against this backdrop, investors should be aware that despite such contract wins, the biggest risk remains the potential for...

Read the full narrative on SLB (it's free!)

SLB's narrative projects $38.7 billion revenue and $4.9 billion earnings by 2028. This requires 2.9% yearly revenue growth and a $0.8 billion increase in earnings from $4.1 billion today.

Uncover how SLB's forecasts yield a $45.37 fair value, a 25% upside to its current price.

Exploring Other Perspectives

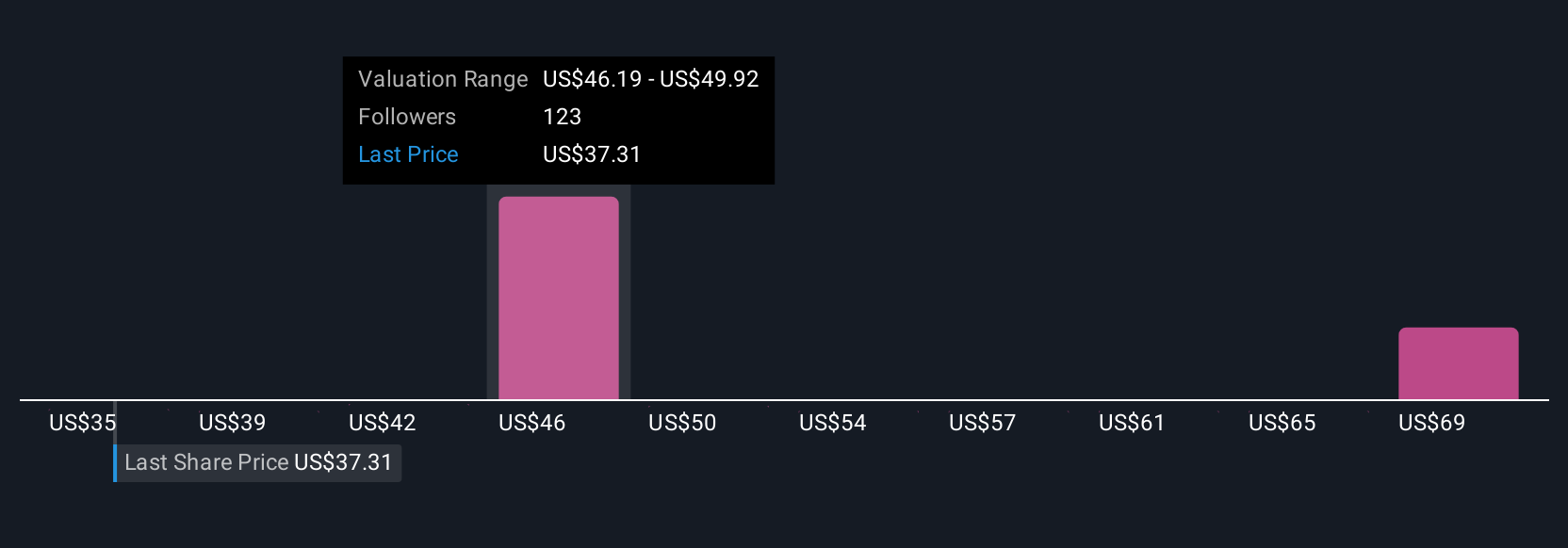

Thirteen community members from Simply Wall St estimate SLB’s fair value between US$36 and US$92, with opinions diverging sharply. As offshore contract momentum builds, keep in mind global upstream spending forecasts could temper upside if operator budgets tighten.

Explore 13 other fair value estimates on SLB - why the stock might be worth over 2x more than the current price!

Build Your Own SLB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SLB research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SLB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SLB's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

SLB

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives